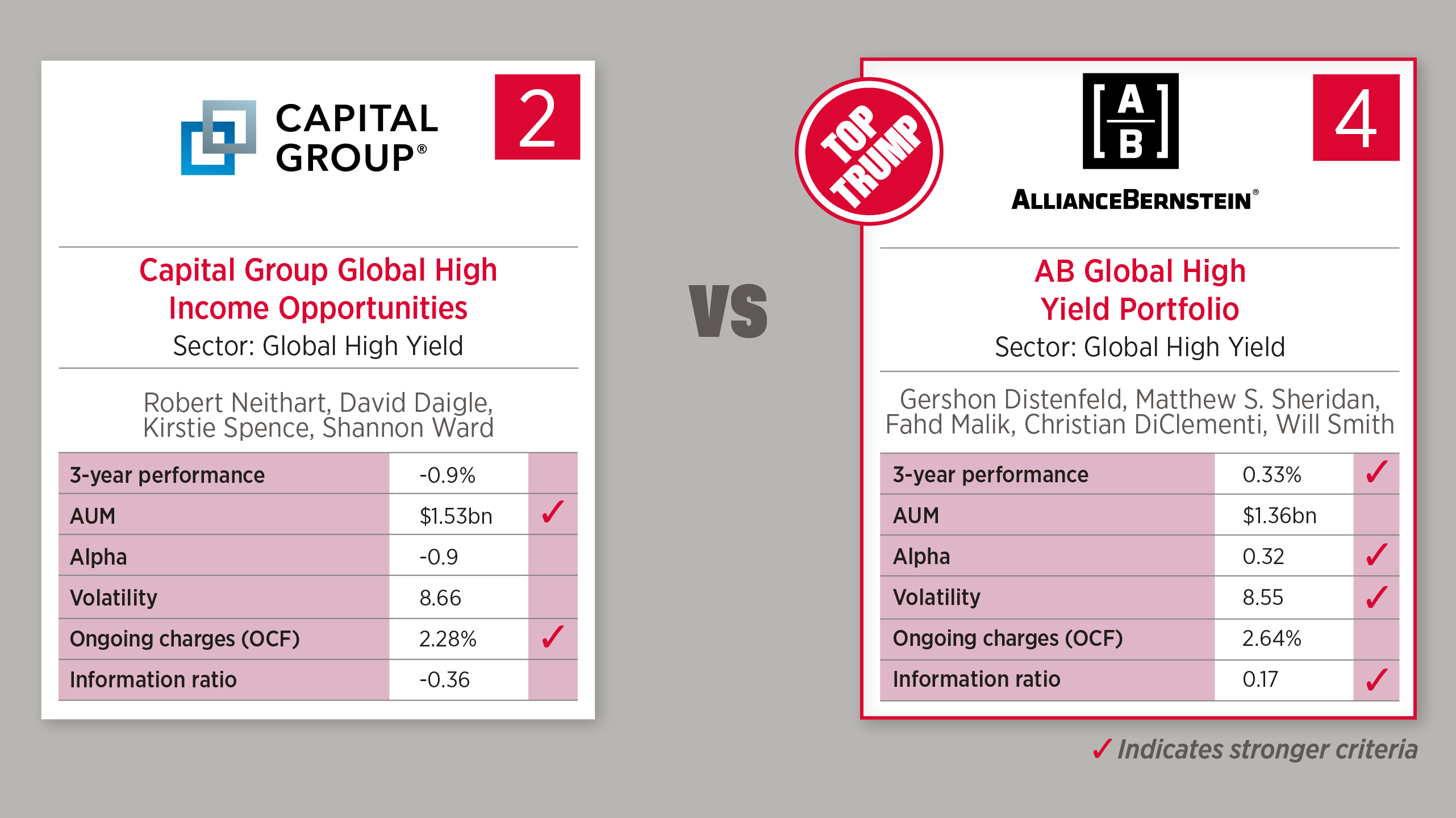

Based on the popular 80s card game, each week we select an asset class and use FE Fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide who is the Top Trump.

This week the the AB Global High Yield Portfolio fund defeats the Capital Group Global High Income Opportunities fund 4-2.

Capital Group Global High Income Opportunities fund

The fund seeks to provide, over the long term, a high level of total return, of which a

large component is current income by investing primarily in emerging market bonds

and corporate high yield bonds from around the world, denominated in US dollars and

various national currencies (including emerging markets currencies).

Top 10 Holdings:

- Mexico government (5%)

- Brazil government (3.6%)

- Indonesia government (3%)

- South Africa government (2.8%)

- Colombia government (2.1%)

- Dominican Republic government (1.7%)

- Malaysia government (1.5%)

- Oman government (1.1%)

- Argentina government (1.1%)

- China government (1%)

AB Global High Yield Portfolio fund

The fund seeks to produce high current income as well as overall total return by applying a global, multi-sector approach to bond investment; investing mainly in higher yielding, lower-rated (below investment grade) securities of issuers located throughout the world, including developed and emerging market countries; and investing in both US dollar and non-US dollar denominated securities.

Top 10 Holdings:

- Aircastle (0.44%)

- Ford Motor Co (0.43%)

- Verscend Escrow Corp (0.42%)

- Altice Financing (0.41%)

- UBS Group (0.4%)

- Republic of South Africa (0.4%)

- Sirius XM Radio (0.4%)

- FNMA (0.39%)

- FNMA (0.38%)

- Prime Security Services Borrower/Prime Finance (0.37%)