The coronavirus shock has heightened the importance of factors that underpin the cause of sustainable finance, according to Mirova, an affiliate of Natixis Investment Managers.

These include the risks of globalisation and the need to control supply chains, the urgency of the fight against biodiversity loss and climate change, and the need for renewed, more sustainable capitalism and business models.

“The demand for ESG and impact investing will accelerate in Asia Pacific in the coming years,” Anne-Laurence Roucher, Mirova’s deputy CEO told a media webinar last week.

Mirova was established in 2014 and manages $18.6bn of assets dedicated to sustainable investment.

It has been awarded B Corp status, which is an international certification that signals a firm’s commitment to corporate responsibility and is a “mission-led company”, which is a French accreditation for a company that has one or more social or environmental objectives beyond profit.

Roucher highlighted several developments in recent years including regulatory initiatives by the Monetary Authority of Singapore (such as its $2bn Green Investment programme launched in 2019), and the Hong Kong Monetary Authority (including its 2019 Sustainable Banking and Green Finance Measures).

Also, the introduction of sustainability reporting guidelines for listed companies on the Hong Kong and Singapore stock exchanges, as well the rise in the number of asset managers in the region signing up for the United Nations Principles for Responsible Investment (PRI) indicate a clear trend towards mainstream acceptance of sustainable investing, according to Roucher.

Indeed, net inflows toward locally-domiciled sustainable funds in Asia saw a record high of $8.7bn during the third quarter of this year, according to data from Morningstar Direct.

This brings total ESG fund assets in the region to $25.1bn, which is 75% higher than in the second quarter.

SUSTAINABILITY THEMES

Mirova identifies and finances companies and projects with a sound business model, which are able to generate positive social and environmental impact as well as financial performance, according to the firm’s CEO Philippe Zaouati.

The objective extends to the firm’s investments in real assets, as well as publicly-traded securities, he told the webinar.

Examples include sustainable land use for Mountain Hazelnut in Bhutan, conservation at Sumatra Merang Peatlang in Indonesia, the circular economy with Plastics for Change India, and sustainable energy for Otago in Cambodia.

In fixed income, prominent sustainability themes include projects related to renewable energy, clean transportation, energy efficiency, sustainable water and wastewater management, which are most evident among Chinese, Indian, Indonesian and South Korean bond issuers, according to Roucher.

In equities, she highlighted environmental transition themes, such as in mobility, buildings,

energy, ICT, and the circular economy, and diversity themes, including the advancement of women to leadership roles.

“These developments are occurring most notably in Australia, Hong Kong, Japan and Singapore,” said Roucher.

EQUITY EXPOSURE

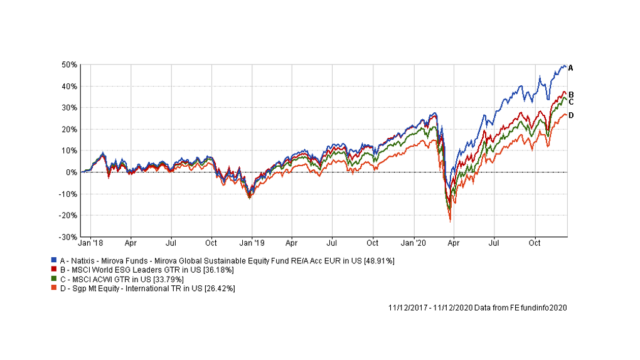

One of the firm’s major products is the Є2.376bn ($2.88bn) Mirova Global Sustainable Equity Fund, which has achieved a three-year cumulative return of 48.9% in US dollar terms, compared with 36.2% by the MSCI World ESG Leaders index (although not the fund’s designated benchmark) and 26.4% by its international equity sector peers, according to FE Fundinfo.

Since December 2017, the fund has generated alpha of 5.5 with a Sharpe ratio of 0.54, double the average risk-adjusted return of its sector, FE Fundinfo data shows.

The largest sector weights in the portfolio are IT, healthcare, industrials and consumer discretionary, and although more the half of the assets are allocated to US stocks (54.6%), there are outsize bets to Denmark (14.5%), Germany (5.5%) and the Netherlands (5.4%) relative to the fund’s benchmark MSCI World Net Total Return EUR index, according to its October factsheet.

Top holdings include US life sciences firm Thermo Fisher Scientific, Danaher, a US science and technology innovator, Microsoft, Danich green energy firm Orsted and Vesta Wind Systems, a Danish wind turbine manufacturer.

The stock selection process combines quantitative and qualitative aspects, said Roucher.

First, a proprietary ESG screening model divides investment prospects into five buckets, with only the top three accepted for review by specialist analysts.

The analysts assess the companies for their compliance with six pillars based on the UN social development goals — three for environmental criteria (biodiversity, climate and natural resources) and three for social criteria (basic needs, education and well-being), according to Roucher.

The carbon footprint of companies which pass muster is also evaluated and additional factors are reviewed for more narrowly-targeted thematic funds.

“We monitor the selected companies’ compliance with these measures through engagement with management and from daily news flow,” said Roucher.

Relative performance of Mirova Global Sustainable Equity Fund