After enduring Covid crash, a once-in-a-generation inflationary battle and a three-year long bear market in Chinese equities, distributors and their clients in Asia are focused on two major themes.

Market volatility, and a potential China comeback are top of the mind for distributors and investors in Asia, according to Manulife’s Asia head of asset allocation Luke Browne.

Browne, told FSA: “Over the past 18 months or so, the conversations we’ve been having with distributors and clients has been fixated on two things: markets are volatile, and when is there going to be a recovery in China equities.”

The prevalence of these themes during discussions is why the firm is launching the Manulife Defined Return fund to address these two concerns for their distributors and clients in Asia.

“The idea is: there are a lot of clients who remain allocated in cash and obviously they’re getting reasonable returns, the likes of which they haven’t seen for the best part of 15 years,” Browne (pictured) said.

“This gives them an opportunity to dip their toes back into the markets for the possibility of enjoying excess returns, but without the downside.”

The proposed fund is to set to have at least 90% of its assets invested in two-year US government bonds, with up to 10% invested in derivatives based on the value of the Hang Seng Index.

To build the portfolio, Browne said he will be targeting the 0.75% 31 March 2026 US Treasury note.

This will be purchased alongside a digital option designed to yield a bonus coupon of around 14% if the Hang Seng Index reaches 108% of the closing value of the Hang Seng on or around 12 March.

The fund’s IPO period started on February 19 and is set to end on 8 March 2024.

However, one risk of putting 90% of the fund’s assets into 2-year US Treasury notes is if the Fed hikes interest rates again, which would cause the value of those bonds to fall.

Browne acknowledged this risk: “Clearly, if two-year interest rates go up, then the NAV falls. But that’s just a mark-to-market. In two years’ time, the clients get back 101%.”

He added: “We certainly don’t anticipate a hike. It’s not impossible, but it is unlikely.”

“What could potentially happen is that the further out, the easing of the monetary cycle becomes for the Fed, probably the more aggressive it will have to be.”

However, Browne emphasised that the product is not designed to take a view on the path of rates.

“The principle here is the fixed investment horizon,” he said. “It’s taking advantage of the elevated rates today and using that to finance the derivative exposure.”

Hang Seng set for a bounce

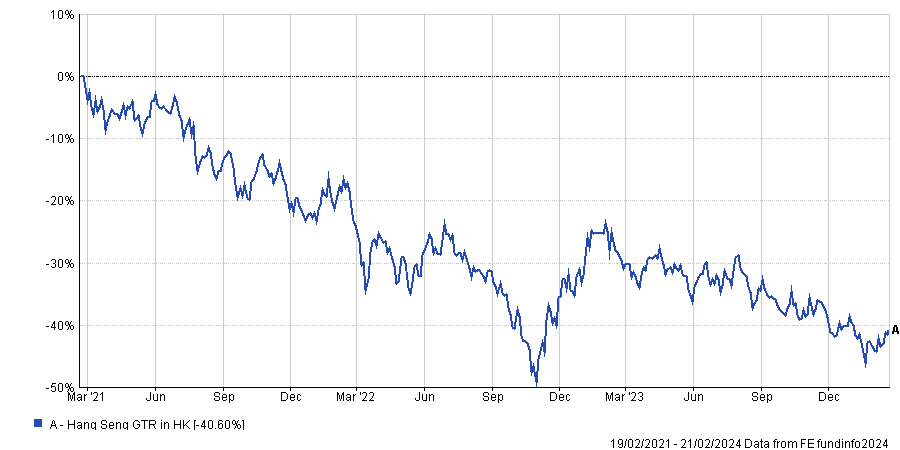

The bet on the Hang Seng Index comes after three-year decline in a stock market that has been dragged down by a tech crackdown, recurring Covid lockdowns and a prolonged property market downturn.

The duration and depth of the bear market in Hong Kong-listed equities have investors starting to wonder if a recovery in China and Hong Kong stocks will ever occur.

“Sentiment is poor. Foreign direct investment into China has collapsed.” Browne said, “But it’s often darkest before dawn”.

“One of the things that we factor into our investment decision-making is the sentiment that investors have – and sentiment is crushed for Hong Kong and Chinese equities.”

“It’s when you get to that low point, you can very quickly get a turnaround in sentiment, flows of money coming in, which tends to be a period of outperformance of those markets.”

He flagged the valuation of the Hang Seng Index, which at the end of 2023 stood at a P/E ratio of 8.8x, compared with the S&P 500 index P/E ratio of roughly 27x.

“Now, obviously, you need to be cautious that it’s not a value trap,” he said. “But with the impact that the People’s Bank of China is likely to continue to have in trying to stabilise markets and return to a path of growth, I think all of these things coming together make a good story for potential recovery in these markets.”

Although the firm has been underweight Chinese equities and the Hang Seng for the past year, it has since adjusted its asset allocation view – citing an opportunity for the “potential near-term tactical upside” for Chinese equities in its latest Q1 2024 outlook.