It is too risky to short or underweight Chinese stocks due to how cheap valuations are, according to Stefan Hofer, chief investment strategist at LGT Bank Asia.

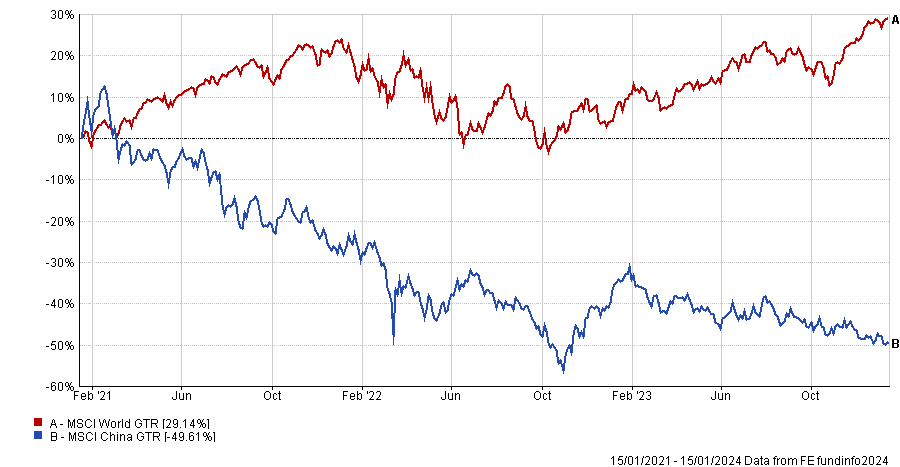

After a multi-year bear market in Chinese stocks with no end in sight, some foreign asset managers have opted to underweight or avoid Chinese stocks entirely.

But there are still very profitable Chinese companies in sectors ranging from technology to tourism that are trading at a “huge discount” relative to global stocks, Hofer told a recent media briefing in Hong Kong.

“It’s actually very risky to be underweight China at this point because we expect a [positive] policy announcement of some kind this year,” said Hofer (pictured).

“It could be quantitative easing, it could be something else. We don’t know. But when that happens, the valuations are so cheap that just a small amount will push the market up massively.”

Markets are on the watch for any policy announcement from the Chinese central government that causes international money to flow back into China, he said.

“The movement will be very sharp,” he added. “You can expect a massive jump in Chinese equities if and when that happens.”

However, currently markets are still grappling with the downturn in China’s property market – which is acting as a drag on consumer sentiment and growth in the nation.

As such, the family-owned Liechtenstein private bank’s positioning remains neutral on Chinese equities.

Hofer said: “The primary challenge facing China is the reordering or the clean-up of the property sector. This always takes time.”

“China is not unique; other countries around the world have had property market challenges in the past as well.”

He pointed to Switzerland in the 1990s, Ireland in the 2000s, and the subprime crisis in the United States in 2007/08 as recent examples.

“This happens from time to time. The issue is that it normally takes two to three years, so we are now at least halfway through that process.”

While Chinese assets have extended their decline in 2023, foreign investors have been flocking to Japan on the back of strong performance of its stock market.

Overweight Japan

Despite a strong year, Hofer said the bank is still overweight Japanese assets and it remains a favourable trade going into 2024.

“What is interesting about Japan is that it has moved from deflation, which lasted for 25 years, to inflation – and that’s very special,” he said.

“If you live in a deflationary economy, what you do as a household is: you store cash, you don’t spend it because every month, every week, every year, you think that the price of goods will go down.”

“Therefore, the economy has been held back by deflation. Now we are moving to inflation and the Japanese are really spending and that is driving earnings growth.”

The bank also has a bullish call on the Japanese yen in 2024, due to the impending divergence between the Bank of Japan and Federal Reserve monetary policy.

Hofer said: “We have a high conviction that in 2024 the Bank of Japan will move in some way or another, whether it’s YCC [Yield curve control] or NIRP [negative interest rate policy], in the direction of monetary tightening.”

“This is because inflation is simply too high not to do that.”