Last year was a record year for healthcare innovation, but the performance of the sector would have left investors thinking otherwise.

2023 proved to be a record year for new drug therapy approvals, where the US Food and Drug Administration approved 55 novel drugs, a 50% jump from the number of approvals in 2022.

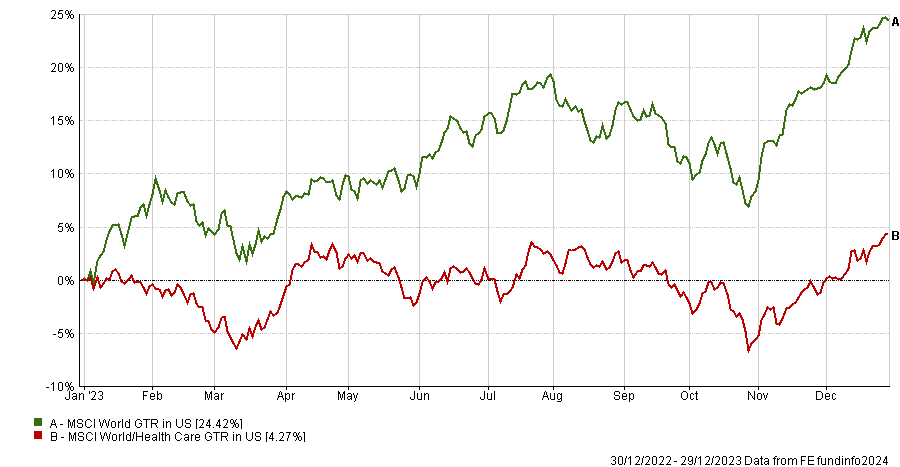

Yet despite this, healthcare stocks in 2023 materially lagged the broader MSCI World index, which was up 24% compared to just 4% from the MSCI World Healthcare index.

One reason for this is because the sector suffered last year from an overhang of the high bar set during the pandemic.

But in 2024 the underlying growth of the healthcare sector will start to become more evident for investors, argues Andy Acker, global life sciences portfolio manager at Janus Henderson.

“The valuations in the sector are at discounts to their history and to the broader market, so coming out of low valuations and low expectations, we think this year will be better,” he said at a recent roundtable.

“You wouldn’t know it by the stock performance last year, but 2023 was a record year for innovation.”

Clear winners

Although the broader healthcare index was down last year, two healthcare companies did emerge as clear winners: Novo Nordisk and Ely Lilly, up 85% and 131% over the past year respectively.

After such a sharp rally, some investors may be tempted to take chips off the table but Acker, who has held both companies in the Janus Henderson healthcare strategy for the past decade, believes the story is still in its early innings.

“Initially, we were excited about their potential for diabetes and now that has expanded to the obesity space,” he said. “Obesity, I believe is the biggest commercial opportunity that we’ve ever seen in the healthcare sector.”

It is estimated that over 100 million people in the US are obese and that figure worldwide is estimated at over 1 billion people, according to the US CDC and WHO.

“10 or 15 years ago, the best therapies for weight loss or obesity would give you maybe 5% of weight loss and many of those therapies had safety or tolerability issues,” Acker said.

“For the first time, we have therapeutics now that can lead to 15% plus weight loss – even 20% plus weight loss – and we believe that that would be sufficient to actually drive an improvement in outcomes.”

Indeed, improved patient outcomes are already being seen and approved by the US FDA.

The US drug authorities recently approved Novo Nordisk’s novel weight loss drug Wegovy for use in lowering the risk of stroke and heart attacks in adults without diabetes.

This came after the Danish firm published data from a large clinical trial that showed the drug reduced the risk of non-fatal heart attack by 28% and heart-related death by 15%.

Acker noted that such an improvement in patient outcomes was previously only available through gastric bypass surgery, which saw doctors removing part of a patient’s stomach to help them lose weight.

“So these therapies are highly effective, like nothing we’ve ever seen before, and the commercial opportunities are enormous,” he said.

Penetration is still tiny

Acker also flagged the fact that in the fourth quarter of 2023 alone, the new weight loss drugs are annualising at $45bn and are growing 80% year-over-year.

“Yet, the penetration is still tiny,” he said. “In the US we’re still mid-single digits penetration, globally we’re about 1% penetration.”

However, there is still a major supply shortfall for the drugs, which is why both companies Novo Nordisk and Eli Lilly are investing heavily to expand their capacity.

Acker said: “The two companies this year will invest about $10bn in capital expenditures to expand capacity – but that’s still not nearly enough.”

“Demand is enormous,” he said. “We’re barely scratching the surface. These products will be expanding for years and maybe even decades. They’re widely projected to grow to over $100bn by the end of the decade – we think it’ll hit that probably well before.”

Although other companies are racing to develop similar weight loss therapies, he believes Ely Lilly and Novo Nordisk will remain the market leaders.

“With the combination of capacity and clinical data, we think that they’ll remain the market leaders for some time,” he said.

Eli Lilly and Novo Nordisk form 5.71% and 4.56% of the $4bn Janus Henderson Global Life Sciences portfolio respectively.