Asian equities lagged their global peers last year, largely due to the outperformance of the S&P 500. The MSCI Asia index rose 11.47% last year compared with a 24.42% jump in the MSCI World index.

Still, there were some bright sparks in the region, notably in Japan, where investor enthusiasm for the country’s corporate governance reforms as well as the prospect of an end to the country’s ultra-low interest rates recently pushed the Nikkei 225 index to an all-time high, surpassing the previous record set in 1989.

Indeed, the Nikkei 225 has even outperformed the S&P 500 so far this year, up 9.52% compared with a 6.7% increase in the S&P 500.

India remains another favourite among asset allocators due to the country’s favourable demographics, pro-business reforms and political stability. The country is also facing a general election this year and historically its equities market has tended to outperform during periods following an election.

The main source of uncertainty at the moment though is China as the country continues to grapple with deflation, problems in its beleaguered property sector and the government’s unwillingness to unleash the kind of massive stimulus that followed previous economic difficulties.

Still, even in China, there are reasons for optimism as valuations remain cheap and some sectors that are aligned with the country’s long-term objectives like renewable energy and EVs have continued to thrive even as the broader index has fallen.

Against this background, Darius McDermott, managing director at Chelsea Financial Services, chose the Invesco Asian fund and the Janus Henderson Horizon Asian Growth fund for this week’s head to head.

| Invesco | Janus Henderson | |

| Size | $2.86bn | $13.7m |

| Inception | 2012 | 2017 |

| Managers | William Lam | Daniel Grana, Matthew Culley |

| Three-year cumulative return | -3.71% | -11.7% |

| Three-year annualised return | -3.29% | -11.07% |

| Three-year annualised alpha | 4.33 | -4.15 |

| Three-year annualised volatility | 16.69 | 16.28 |

| Three-year information ratio | 0.59 | -1.06 |

| FE Crown fund rating | **** | * |

| OCF (retail share class) | 0.9% | 1.27% |

Investment approach

The Invesco fund is a concentrated, value-orientated fund, seeking out companies where the market is underestimating their earnings growth.

To look for companies with prices below fair value, the fund manager William Lam employs a two-step approach.

He starts by calculating expected growth in earnings, which factors in historic growth rates, market trends, a company’s competitive advantage and the quality of their management.

He then looks at a company’s fair value, which considers balance sheet strength, cash flow and future growth.

Using this process, Lam is able to whittle down the number of companies to around 50-70 in addition to a shortlist of 30 companies that can be added should their valuations change.

Meanwhile, the Janus Henderson fund is also a high conviction strategy, although the main difference with the Invesco fund is that the Janus Henderson strategy targets growth as opposed to value.

McDermott notes that despite this difference in style, there is a large degree of overlap in both their top 10 holdings, which include Taiwan Semiconductor Manufacturing, Samsung, HDFC Bank and Tencent in both lists.

The Janus Henderson fund has a larger overweight towards healthcare versus the Invesco fund, while the Invesco portfolio is more concentrated in industrials and communication services.

Sector allocation:

| Invesco | Janus Henderson | ||

| Financials | 24.3% | Financials | 25.9% |

| Information Technology | 22.6% | Information Technology | 23.9% |

| Communication Services | 12.2% | Healthcare | 12.5% |

| Industrials | 11.9% | Communication Services | 9.3% |

| Consumer Discretionary | 11.8% | Consumer Discretionary | 8.6% |

| Materials | 5.6% | Industrials | 6.2% |

| Consumer Staples | 4.1% | Materials | 4.3% |

| Real Estate | 2.9% | Energy | 3.3% |

| Energy | 2.1% | Cash | 2.3% |

| Healthcare | 0.8% | Consumer Staples | 2.3% |

| Utilities | 0.6% | Real Estate | 1.5% |

Top five holdings:

| Invesco | Janus Henderson | ||

| Taiwan Semiconductor Manufacturing Co | 9.1% | Taiwan Semiconductor Manufacturing | 9.5% |

| Samsung Electronics | 7.5% | Samsung Electronics | 9.1% |

| Tencent Holdings | 3.5% | AIA Group | 4.2% |

| HDFC Bank | 3.5% | HDFC Bank | 3.8% |

| United Overseas Bank | 3.4% | CSL | 3.7% |

Performance

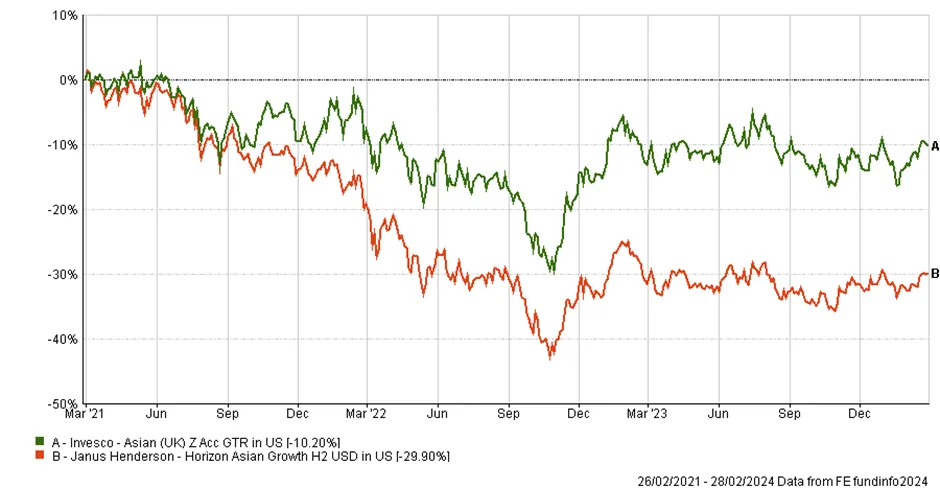

Both funds were largely in line with one another in terms of performance until mid-2021 when value began to reassert itself, McDermott notes.

In 2021, the Invesco fund returned 3.3% while the Janus Henderson fund fell considerably.

McDermott also notes that the Invesco fund has produced smoother returns out of the two, while its strongest performance came in 2017 when it was up 38.1%.

In contrast, the Janus Henderson fund tends to fare less well when growth is out of favour, although paradoxically, its best performance also came in 2017 when it returned 28.8%.

In terms of fees, the Invesco fund is cheaper at 0.9% compared with an ongoing charge of 1.27% for the Janus Henderson fund.

Discrete calendar year performance

| Fund | YTD* | 2022 | 2021 | 2020 | 2019 |

| Invesco | -0.33% | 0.86% | 3.26% | 2.02% | 19.41% |

| Janus Henderson | -0.70% | 5.5% | -22.94% | -9.42% | 26.62% |

Manager review

Both funds benefit from being part of large asset management firms with strong research teams behind them.

The Invesco fund is led by William Lam, who initially co-managed the strategy in 2015 before taking over sole responsibility two years later.

His background is as an accountant before moving into asset management in 2001 when he joined Orbis Investment Management. He joined Invesco in 2006.

Meanwhile, the Janus Henderson fund is led by Daniel Grana and Matthew Culley. Grana serves as a portfolio manager on the emerging market equity team, a position he has held since joining the firm in 2019.

He previously worked at Putnam Investments and also worked in the Latin America investment banking team at Merrill Lynch.

Culley is also a portfolio manager on the emerging market team, while he also serves as a research analyst focused on the communications, technology and consumer sectors.

Before joining Janus Henderson in 2019, he also worked at Putnam Investments.

Conclusion

Overall, McDermott favours the Invesco fund.

“If you were looking for a pure growth fund then the Janus Henderson fund certainly has its plaudits, but overall I think I’d lean towards the Invesco fund as more of a core offering,” he said.

“The behavioural error of mixing up good businesses with good investments can often lead to trouble, but William’s very pragmatic approach and flexible strategy is designed to separate these two elements.”

He notes, however, that the fund can be volatile due to its active management nature, although overall it has proven itself, particularly when value has been in vogue.