As the S&P 500 roared ahead last year, led by the magnificent seven tech stocks, the performance of key indices in Asia Pacific was considerably more muted.

The MSCI AC Asia Pacific ex Japan benchmark was up a mere 5.98%, while the average return of active funds committed to the region, that are available to Hong Kong investors, was a dismal 3.63%, according to FE fundinfo data.

The weakness of Chinese equities, which comprises almost a third of the index and the exclusion of the Japanese market, which last year awoke from its long hibernation, were major factors contributing to the underperformance. The resilience of stock markets in India, Korea and Taiwan could not militate against the presence of China and the absence of Japan.

Nevertheless, chief investment officers and strategists have, in general, sounded a more positive outlook for Asia Pacific equities in 2024.

The consensus that the US will likely avoid a recession and the Federal Reserve will cut interest rates, provides a more supportive backdrop for Asian equities. Earnings momentum in several markets is strong and could also be boosted by a softer dollar. Meanwhile, India is on a structural growth cycle, fuelled by a rising consumer market, a large youth population, and further urbanisation.

Although, low stock valuations and supportive measures by the authorities are tempting some foreign investors into the Chinese market, India as well as the semiconductor manufacturers in Korea and Taiwan are likely to maintain their popularity.

FSA asked Claire Liang (pictured), senior analyst at Morningstar, to consider Asia ex-Japan equity strategies, and she chose the FSSA Asian Growth fund (IE0008368411) and the T Rowe Price Asian Ex Japan Equity fund (LU0266341212).

| FSSA | T Rowe Price | |

| Size | $229m | $492m |

| Inception | 1999 | 2008 |

| Managers | Richard Jones, Rizi Mohanty | Anh Lu |

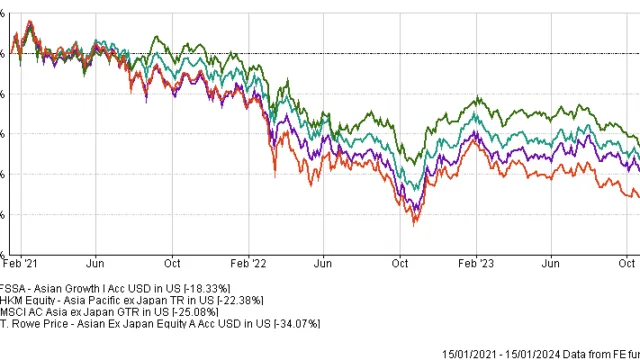

| Three-year cumulative return | -18.33% | -34.07% |

| Three-year annualised return | -6.63% | -12.60% |

| Three-year annualised alpha | 0.42 | -2.98 |

| Three-year annualised volatility | 14.31% | 19.20% |

| Three-year information ratio | 0.26 | -0.70 |

| FE Crown fund rating | **** | * |

| Morningstar rating | ***** (Bronze) | *** (Bronze) |

| OCF (retail share class) | 1.60% | 1.73% |

Investment Approach

The FSSA Asian Growth strategy has a strong focus on quality, aiming to identify companies with strong management teams and dominant franchises that can deliver sustainable and predictable returns over the long term.

Management quality is of upmost important. Lead manager Richard Jones prefers trustworthy and competent management teams that have a long-term vision, demonstrate an ability to effectively allocate capital, and are well-aligned with minority shareholders.

This has resulted in the portfolio’s persistent and notable underweight to the markets that have prevalent corporate governance issues, such as China and South Korea, relative to the MSCI AC Asia ex Japan Index.

In contrast, Jones has been favouring India for years. He also prefers firms with strong franchises, durable cash flows, as well as high earnings visibility, and the portfolio has had a consistent bias towards the consumer staples sector.

Jones invests with an “absolute mindset” and defines risk as permanent loss of capital rather than lagging the index or peers. As such, he adopts a high conviction approach in portfolio construction, and the portfolio’s country and sector exposures often differ substantially from the MSCI AC Asia ex Japan Index, resulting in an active share of over 80% over the years. The end portfolio is compact with 35-45 names in general.

The T Rowe Price Asian ex-Japan Equity strategy follows a quality growth investment approach, seeking companies that can deliver sustainable growth in earnings and cashflows and have reasonable valuations.

While portfolio manager Anh Lu also considers management quality, the durability of companies’ growth prospects is a more important focus here, and she favours growing industries that have rational competitive practices.

Lu diversifies her portfolio across a range of growth companies. Sizable positions in the portfolio tend to be firms that she believes are compound growers with established businesses and stable earnings, such as TSMC and Tencent. That said, she can also invest in some high growth, cyclical growth, and beaten-down names if she believes there are fundamental catalysts to drive future durable growth.

The fund currently has an overweighting to information technology because of Lu’s constructive view of the semiconductor industry’s cyclical recovery as well as future growth fuelled by the growing adoption of AI technology.

Compared with the FSSA fund, Lu runs a more diversified portfolio of 70-100 names. There are no formal restrictions at the sector or country levels, but bets have typically stayed within 10% of the MSCI AC Asia ex Japan Index, resulting in an active share of around 65%.

FUND CHARACTERISTICS

Country allocation:

| FSSA | T Rowe Price | |

| India | 31.3% | 19.8% |

| China | 15.7% | 30.6% |

| Hong Kong | 11.9% | 5.2% |

| Taiwan | 11.5% | 13.6% |

| Singapore | 7.3% | 3.9% |

| Indonesia | 6.2% | 2.0% |

| Japan | 5.7% | |

| South Korea | 3.1% | 13.0% |

| USA | 2.7% | 0.5% |

| Vietnam | 3.0% | |

| Netherlands | 2.3% | |

| Philippines | 1.6% | |

| Malaysia | 1.4% | |

| Thailand | 0.7% | |

| Switzerland | 0.4% | |

| Others | 2.5% |

Sector allocation:

| FSSA | T Rowe Price | |

| Financials | 23.8% | 24.8% |

| Consumer staples | 22.2% | 2.6% |

| IT | 20.6% | 29.2% |

| Industrials | 8.1% | 5.2% |

| Consumer discretionary | 8.0% | 14.5% |

| Communication services | 7.8% | 11.1% |

| Materials | 4.6% | 4.0% |

| Healthcare | 1.7% | 1.1% |

| Real Estate | 1.1% | 3.0% |

| Utilities | – | 1.3% |

Top 10 holdings:

| FSSA | T Rowe Price | ||

| Taiwan Semiconductor Manufacturing Company | 7.12% | Taiwan Semiconductor Manufacturing Company | 9.48% |

| HDFC Bank | 6.60% | Samsung Electronics | 8.13% |

| Colgate-Palmolive (India) | 4.83% | Tencent | 5.81% |

| Mahindra & Mahindra | 4.37% | Alibaba | 3.74% |

| DFI Retail Group | 4.07% | DBS Group | 3.49% |

| Tencent | 4.04% | HDFC Bank | 3.01% |

| OCBC | 4.00% | AIA | 2.73% |

| Kotak Mahindra Bank | 3.84% | ASML Holding | 2.10% |

| Midea Group | 3.80% | ICICI Bank | 2.09% |

| Techtronic Industries | 3.64% | PT. Bank Central Asia | 1.97% |

Performance

Given the manager’s strong focus on capital preservation and management quality, we would expect FSSA Asian Growth to show stronger downside resilience than its peers, which was the case in the falling markets of 2021 and 2022. The fund’s downside capture ratio has also historically been meaningfully lower than its category average. However, due to its conservative growth feature, the fund tends to underperform in strong bull markets, such as in 2019 and 2020.

T Rowe Price Asian ex-Japan Equity has a quality growth emphasis, so the fund tends to do well when growth is in favour, but it could lag the index and peers when value stocks outperform. Unsurprisingly, the fund has struggled since 2021, partly due to the market rotation from growth stocks to value stocks, while its allocation to China as well as stock picks within also weighed on its results.

If we look at absolute terms, the FSSA fund tends to be less volatile as measured by standard deviation. In fact, its volatility was among the lowest in the category over the past 3-, 5-, and 10-years. This is the result of the portfolio manager’s conservative growth approach and capital preservation mindset, which homes in on firms whose revenues are less cyclical, such as its notable overweighting to the consumer staple sector. It is worth noting that the fund’s relative returns against the market index and its category peers, however, can be quite lumpy. This is due to the manager’s benchmark-agnostic and buy-and-hold approach.

The relative performance of T Rowe Price Asian ex-Japan Equity tends to be less jumpy, which can be attributed to its more benchmark-aware approach in portfolio construction. In absolute terms, the fund’s volatility is higher than the FSSA fund, partly owing to the manager’s growth preference that tilts the portfolio towards some of the cyclical sectors, such as information technology, though its volatility is still roughly in line with the average peer.

Discrete calendar year performance

| YTD* | 2023 | 2022 | 2021 | 2020 | 2019 | |

| FSSA | -2.25 | 0.99% | -16.45% | 3.35% | 17.63% | 15.58% |

| T Rowe Price | -5.05 | -0.19% | -23.24% | -4.72% | 27.90% | 25.68% |

| Sector | -2.77% | 3.63% | -19.04% | 0.11% | 21.83% | 18.21% |

| Benchmark | -3.30% | 5.98% | -19.67% | -4.72% | 25.02% | 18.17% |

Manager Review

FSSA Asian Growth is helmed by a veteran lead manager Richard Jones, who has 35 years of experience in Asian equities. He has led this strategy since January 2014 and has consistently shown unwavering commitment to the team’s quality-focused investment approach over the years.

Jones gets close support from comanager Rizi Mohanty, who joined the team in 2016 and has been assisting Jones on this strategy for several years before assuming the comanager role in March 2022.

The duo is part of FSSA’s wider investment team of 22, which averages 13 years of experience. All team members do research and are generalists with no defined coverage responsibilities, though there tends to be some country focus.

We think the team sports a strong investment culture, which includes a compensation structure that encourages long-term investing and an alignment of interest with investors. The team is also mindful of succession planning.

We are keeping an eye on the team’s stability though, as it has seen eight members leave or retire since 2020. That said, the departures were largely among the less-senior ranks, and we take comfort that the team’s generalist approach has helped weather turnover.

T Rowe Price Asian ex-Japan Equity is also led by an experienced and long-tenured portfolio manager Anh Lu. She brings 28 years of experience and has led this strategy since June 2009.

Lu joined T Rowe Price in 2001 as an Asia ex Japan technology analyst and started managing money in 2006 when she was appointed comanager for an international small-cap equity strategy. She relocated from Hong Kong to London in July 2022, but she continues to work closely with the firm’s Asia-based investment team and travel to Asia regularly for company visits.

Lu is supported by a sizable analyst team of 26, which includes eight associate analysts. The team averages nine years of investment experience.

The analysts are organised with sector responsibilities covering the whole Asia region, with some exceptions being made in Greater China, and this allows team members to work closely with their global peers. The team has many experienced regional analysts, but its China analysts are relatively young as the team has been expanding its China resources with junior hires over the past three years.

After seeing an uptick in personnel turnover in the first half of 2022, the team has shown better stability, though the lack of healthcare expertise in the team remains a watchpoint.

Fees

Fee levels are not concerning. FSSA Asian Growth’s retail share class I USD Acc is slightly cheaper (1.60%) than the retail share class, A USD, of T. Rowe Price Asian ex-Japan Equity (1.73%). But both are at the average fee level among its peers.

Conclusion

We think both funds are attractive Asian equity offerings for investors eyeing for the long term, as reflected in the Morningstar Medalist Rating of Bronze for their retail share classes.

Both funds are helmed by experienced Asian equity portfolio managers backed by adequate analytical resources, underpinning their Above Average People ratings.

The FSSA fund’s High Process rating is one notch higher than the T Rowe Price fund, as its quality-focused investment approach is quite differentiated and has been consistently executed to generate robust risk-adjusted returns over market cycles. It has also yielded a performance pattern that is true to its label.