The FSA Spy market buzz – 6 June 2025

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

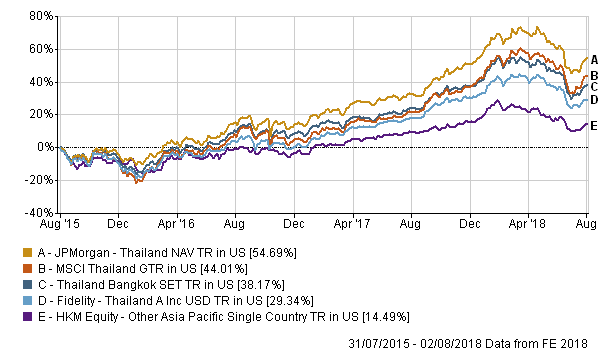

The JP Morgan Fund outperformed its benchmark MSCI Thailand Index and the Fidelity fund on a three-year and five-year basis.

Ng said the major contributor to the outperformance for the fund was the market rally between 2016 and 2017.

“The JP Morgan fund focuses on investing in stocks with higher growth potential. Therefore, the portfolio became a beneficiary during the growth momentum-driven market rally,” he said.

On the flipside, the Fidelity product has slightly underperformed its benchmark Bangkok SET Index.

Ng believes because of the neutral position to the index, the fund’s performance has consistently reflected the index movement and delivered a return that was close to the benchmark.

Exciting opportunities in AI & Robotics outside of traditional tech

Exciting opportunities in AI & Robotics outside of traditional tech

China’s post-pandemic growth gathers pace

China’s post-pandemic growth gathers pace

Federated Hermes SDG Engagement Equity: 2021 H1 Report

Federated Hermes SDG Engagement Equity: 2021 H1 Report

Sustainable Investing in Changing Market Conditions

Sustainable Investing in Changing Market Conditions

Dynamism is the name of the game for this global macro strategy

Dynamism is the name of the game for this global macro strategy

Accessing India’s tech future

Accessing India’s tech future

Your Questions Answered by Federated Hermes Impact Opportunities

Your Questions Answered by Federated Hermes Impact Opportunities

Investors turn to real estate for alternative income

Investors turn to real estate for alternative income

Unmasking the dividend opportunity

Unmasking the dividend opportunity

Driving decarbonisation: how to access new forms of alpha

Driving decarbonisation: how to access new forms of alpha

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

Part of the Mark Allen Group.