The FSA Spy market buzz – 6 June 2025

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

Yuebao is denominated in RMB and the JPM fund is denominated in US dollars.

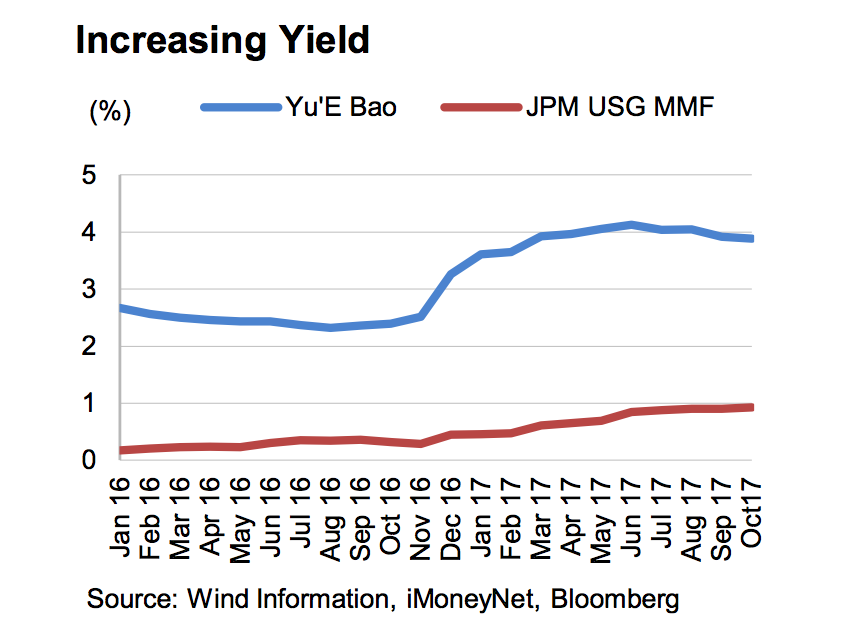

The yield for the Yuebao is significantly higher than the JP Morgan fund, although both are seeing increasing yields.

In October 2017, Yuebao was yielding around 4% while the JPM vehicle yielded 1%.

According to Fitch, bond yields are, in general, structurally higher in China than in the US because of China’s underlying economic growth and central bank rates.

Meanwhile, US money market fund yields have also been increasing as the US Fed has been raising interest rates.

In terms of fees, Yuebao’s are higher compared to JPM, according to Li.

The Yuebao fund’s management fee is 0.3%. It addition, it has a custodian fee of 0.08% and a distribution service fee of 0.25%, she added.

The JPM fund has a management fee of .03%, with a cap on expenses of 0.18%.

Tap into Japan’s post-pandemic growth trends

Tap into Japan’s post-pandemic growth trends

Don’t get left behind in fixed income

Don’t get left behind in fixed income

Fixed income – making ground in ESG as ETFs see rapid growth in AUM

Fixed income – making ground in ESG as ETFs see rapid growth in AUM

Market volatility is creating enticing opportunities for value investors

Market volatility is creating enticing opportunities for value investors

Impact opportunities: investing to limit biodiversity loss

Impact opportunities: investing to limit biodiversity loss

Despite headwinds, ESG continues to perform

Despite headwinds, ESG continues to perform

Unmasking the dividend opportunity

Unmasking the dividend opportunity

The future of mobility

The future of mobility

Step up your portfolio by doubling down on sectors set for long-term growth

Step up your portfolio by doubling down on sectors set for long-term growth

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

Part of the Mark Allen Group.