The most unloved stocks are trading at “extraordinary discounts”, according to the asset allocation team at GMO, the $60bn investment management firm founded by legendary value investor Jeremy Grantham.

“Deep value stocks are currently our highest conviction long-only investment idea,” they said in a recent note.

“In a world where many stocks are being driven ever higher by positive sentiment and investor optimism, many of the ones that have been most unloved and left behind are trading at extraordinary discounts.”

“Of course, to see the full benefit of an investment in these stocks may require some patience, waiting for investor sentiment to unwind and valuations to reassert themselves.”

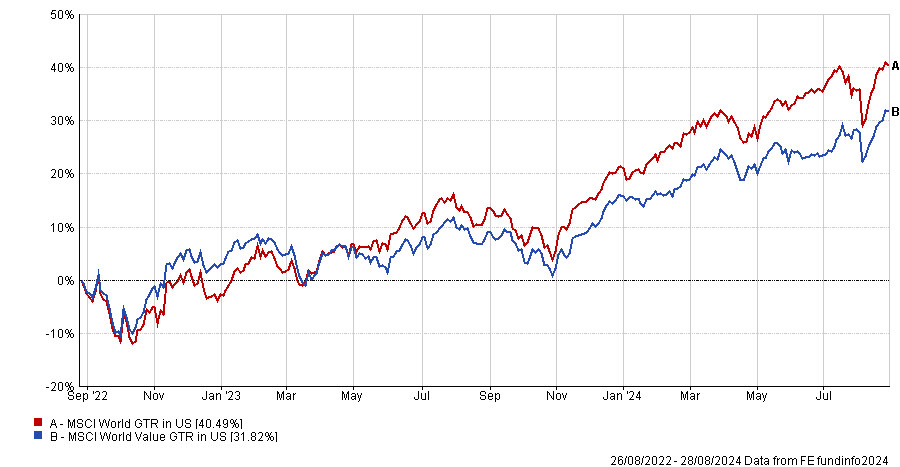

Indeed, despite a period of long-awaited outperformance from value stocks during 2022, the investment style has since lagged the broader market.

Over the past two years, the MSCI World index is up 40.5% versus 31.8% from its value counterpart.

Markets have been driven higher by enthusiasm for artificial intelligence (AI) and outperformance from the world’s largest technology companies, which fall outside the traditional value indices.

This is an example of why in GMO’s view, the growth and value labels assigned by index providers have been done so “sometimes seemingly arbitrarily”.

“Although a low price-to-earnings or other valuation multiple can certainly correlate with cheapness, such characteristics aren’t always present,” they said.

“Some low P/E stocks are worth even less than their prices, while some high P/E stocks warrant even bigger premiums.”

They point to some of the biggest beneficiaries of AI this year, Alphabet and Meta as an example – two stocks they have in their portfolios.

Both US tech giants are considered to be growth stocks by the MSCI index compiles, but GMO said “they are exactly the kind of bargains that we are looking to include in our deep value cohort”.

“Both Alphabet and Meta are highly profitable companies that score strongly on our quality metrics and yet trade at a significantly lower forward P/E ratio than the broad market,” they explained.

“That is why our strategy will continue to focus on valuation and fundamentals when deciding if a stock is cheap or expensive and not be swayed by artificial labels.”

Shares in Meta are up 78% over the past twelve months, more than triple the wider world index which is up 26.1% over the same period.

A valuation gap of historic proportions

As markets across different regions sit close to their all-time highs, GMO’s asset allocation team believes the deep value opportunity can be found globally.

“Deep value stocks are trading extremely cheaply relative to broad markets and their own history,” they said. “In an expensive world, this combination leaves them positioned to deliver strong absolute and relative returns.”

“Outside of the U.S. all value is cheap, but deep value is in the 2nd percentile of its history,” they added.

According to them, value stocks in the U.S. “should largely be ignorable at current valuations” – although what they label as ‘deep value’ are in the 10th percentile of history.

“For the avoidance of any doubt, when we talk about ‘deep value’, we simply mean stocks that are cheap, often screamingly so, relative to our appraisal of their fair value,” they explain.

A full reversion to median historic relative valuations would need value to outperform growth by roughly 60%, according to their estimates.

“Even absent mean reversion, at current valuations, value is positioned to handily outperform,” they said.

“As an aside, it is important to note that the investor exuberance that has fuelled growth stocks in the U.S. has also done a tremendous job of driving valuations across the wider U.S. market (with the exception of deep value) to precarious levels.”

“It is for this reason that our asset allocation strategies favour equities outside the U.S. in expectation of markedly higher medium-term returns.”