Global sustainable fund flows rebounded in the final quarter of 2022, attracting $37bn of net new money, a 50% jump on the previous quarter and a vast contrast to the $200bn withdrawal of cash seen in the wider fund universe.

However, Morningstar’s Global Sustainable Fund Flows: Q4 2022 showed the rebound only occurred in three regions – Europe, Australia and Canada – while the rest of the world, including the US, saw outflows.

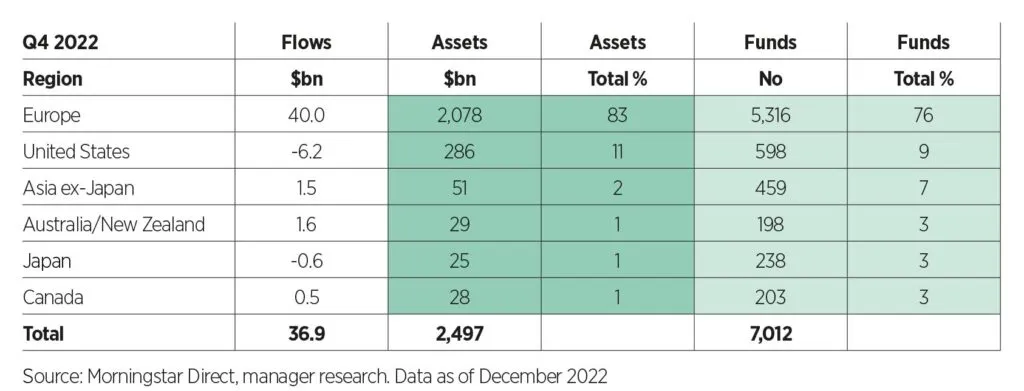

Global sustainable funds’ Q4 2022 statistics

Amid a macroeconomic background of enduring inflationary pressures, rising interest rates and lingering recession fears, the last three months of 2022 saw flows in the global sustainable fund universe climb to $37bn, 50% higher than the $24.5bn (a revised figure) seen in Q3, and 22% higher than Q2 flows. The organic growth rate for global sustainable funds was 1.6% for the period, compared to 1% for Q3. As mentioned, the wider fund market saw $200bn in outflows, up from $198bn in Q3.

Assets under management in global sustainable funds hit nearly $2.5trn at the end of December, an 11.6% increase on the previous quarter and putting an end to three quarters of asset decline, noted Morningstar. In comparison, the overall global fund market grew by 6% in the three months through December 2022.

The firm also said product development continued to rise with an estimated 208 new funds hitting the shelves globally in Q4 – however, this is likely to be revised higher as funds are reported later to Morningstar and it noted the Q3 fund launch figure was restated to 232 from 148.

“It is probably too early to conclude that product development has continued to slow down at the end of last year,” the report said. “Historically, fund launches in the last quarter of each year have been higher than in preceding quarters.”

However, Morningstar commented on a “divided picture” for sustainable funds when looking across the regions.

Quarterly global sustainable fund flows ($)

Asia, Japan and Australasia

Asia reported a mixed bag of flows with Japan and Asia recording net outflows, while Australia and New Zealand saw a bounce back.

Excluding China, the Asia ex-Japan region recorded net outflows of roughly $22m over the fourth quarter. Hong Kong experienced $314m in outflows, while India and Malaysia saw outflows of $38m and $8m, respectively. South Korea also saw investors cash out with net outflows for the third consecutive quarter, reaching $349m in fourth-quarter 2022, driven by bond funds.

However, Thailand experienced inflows of $11m, while Taiwan continued to lead the region with $564m in net inflows. Singapore recorded the second-highest inflows at $110m.

Total assets in Asia ex-Japan sustainable funds were slightly higher at the end of December 2022, at nearly $52bn, registering an increase of 2.9% quarter-over-quarter.

Commenting on fund launches in the region the report said: “Product development slowed from an exceptional third quarter, with 17 launches in the fourth quarter versus 34 in the previous three months. Within the 17 new launches, 11 were in China, five in Taiwan,

and one in South Korea. Equity funds continued to make up the bulk of new launches, accounting for 13, while allocation and fixed-income funds both took up two slots.”

In Japan, sustainable fund market recorded net outflows for the second consecutive quarter amounting to $557m. Morningstar noted a trend in Japan where newly launched funds tend to drive inflows, but within two years, investors take their money out.

“Sustainable funds were no exception to this trend. Seven out of top 10 in terms of inflows were funds incepted in 2022,” the report said.

Meanwhile, inflows into the Australasian (Australia and New Zealand) sustainable funds universe increased fourfold compared with the previous quarter at $1.6bn. Assets in Australasian sustainable funds increased by 30% in fourth-quarter 2022, to an estimated $28.6bn, via a combination of market movements and strong inflows.

Europe

Europe continued to dominate with net new flows of $40bn, an 80% growth on the readjusted figure of $21.3bn in Q3. Passive funds picked up 60% of these new flows. Meanwhile, European conventional funds “continued to bleed assets” with $33.3bn of outflows.

“The resilience of European sustainable fund flows reflects the continued appetite of investors in Europe for investment products that focus on a range of ESG issues from a risk and/or impact perspective, despite greenwashing concerns and the evolving regulatory environment,” the report said. “Asset managers have also continued to adapt their strategies to meet the growing demand.”

Organic growth rates confirmed the end-of-2023 rebound for sustainable funds, calculated as net flows relative to total assets at the start of a period, the European sustainable fund universe saw its organic growth rate surge to 2.2% in the fourth quarter, from 1.2% in the third quarter and 1.5% in the second quarter. However, Morningstar highlighted 2022 organic growth rates were lower than previous years’.

Sustainable assets under management rose 12.7% to $22.1trn in Q4 due to higher inflows, new funds joining the universe and market appreciation, almost regaining the ground lost in Q3 and Q2 – assets at the end of the first quarter stood at $22.2trn.

Overall sustainable funds accounted for 20% of the market share, an increase from 18% the previous quarter. Morningstar said with the Mifid II amendment coming into effect from August 2022, requiring advisers to consider clients’ sustainability preferences, market share could accelerate from here as more retail investors adopt the products, while increased disclosure requirements for companies and asset managers will likely continue to grow investor demand.

Equity funds remained the top asset class for sustainable funds pocketing $21.1bn, however sustainable bonds were extremely popular – they took all the inflows into the European bond funds in Q4, some $19.6bn.

US

Meanwhile, US-domiciled sustainable funds shed nearly $6.2bn, after registering a small net inflow of $459m in the previous quarter, “capping off the roller-coaster ride that was 2022”, said Morningstar.

The year started well with $10.4bn in taken in Q1, but investors withdrew $1.6bn the next quarter and only allocated a “modest” $460m in Q3.

“Although sustainable funds ended in the black, netting more than $3bn for the year, flows into US sustainable funds peaked two years ago in the first quarter of 2021 and have fallen steadily since.

“Much of this was driven by the broader market environment; in 2022, US funds bled more than $37bn, cementing their first calendar year of outflows since Morningstar began tracking data in 1993. Investors generally pulled out of actively managed funds and fixed-income funds amid persistent inflation and rising interest rates, risk of an impending recession, and poor market returns.”

Sustainable fixed income funds fared better than their non-sustainable peers in the final quarter, demonstrating resilience in the face of the above headwinds, but the concerns around greenwashing and prominent US politicians taking an anti-ESG stance, with some state investment funds limiting exposure, meant the losses in Q4 were more severe for sustainable funds than the wider market. During the fourth quarter, sustainable funds shrank by 2.2% compared with an 0.8% shrinkage in the overall US landscape, Morningstar said.

Reaction

Hortense Bioy (pictured left), global director of sustainability research and member of the ESG Clarity EU Committee commented on the findings: “The final quarter of 2022 reveals a divided picture. The rebound in global inflows into sustainable funds was driven by Europe where investor appetite remains strong and supported by a favourable regulatory environment. The US ESG fund market, however, faced headwinds: macroeconomic of course, but also political, with prominent politicians speaking and acting against ESG investing.”

This story first appeared on our sister publication, ESG Clarity.