Tim Love, Gam Investments

Strong earnings and stock re-ratings spurred EM equity market returns for much of the first decade of this century, but investors have favoured developed markets (DM) during the past 10 years.

“It is now time to switch back to EM,” Tim Love, investment director responsible for Gam’s emerging markets equity strategies, told an Asia media roundtable this week.

Love identified four cyclical factors – risk-return benefits, valuations, liquidity, and re-rating potential – to justify his confidence.

First, EM equities are “entering a favourable risk-return quadrant”. EM has given back all of its outperformance achieved versus DM in 2004/08 and 2009/10, according to Love.

Second, the average price-to-book ratio of EM is 0.9 times, compared with 3.0 times at its 2007 peak, which gives EM broad appeal to investors who require reasonable valuations for growth stocks, he said.

Third, liquidity supplied by negative real interest rates in DM should lead to large flows into EM, especially because EM equities have lagged relative EM sovereign bond performance, which should attract cross-over investors.

Love pointed out that while the 37% drop in MSCI EM up to March 23rd 2020 was accompanied by $55bn of foreign outflows, foreign participation in the subsequent 32% recovery has been absent, with a further net $15bn of outflows.

“We also expect cross over flows, as EM equity dividend yields, free cashflow yields and EPS yields are higher than EM sovereign bond yields,” said Love.

Finally, there is re-rating potential for EM equities because of greater EPS resiliency, cash-rich investor under-exposure to the asset class as it increases its representation in global indices, and the higher credit ratings now assigned to leading EM countries (eight of the top 10 EM countries are rated investment grade, compared with just four 15 years ago), said Love.

Moreover, as Gam’s macro strategist, Mike Biggs, told a webinar last November, emerging market currencies are cheap both historically and based on trade-based valuations (such as purchasing power parity), and they should strengthen anyway as the flipside of US dollar weakness, which should continue as long as US interest rates remain low.

Love also noted three secular factors that underpin EM equities.

“There is an explosion of a young affluent middle class, the birth of captive pension funds and domestic consumer orientated reform agendas, and the MSCI re-classification of EM stocks and China A shares,” he said.

PORTFOLIO ALLOCATIONS

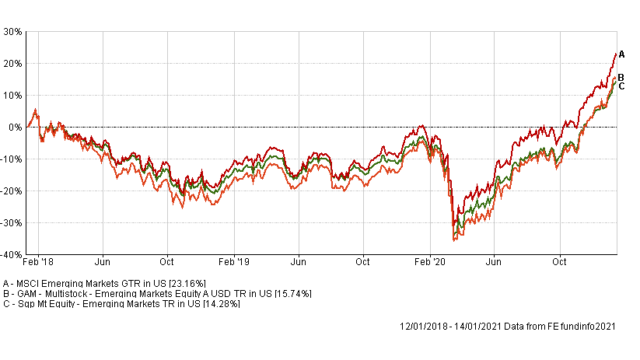

UK-based Love co-manages the $1bn Gam Emerging Markets Equity Fund (available to authorised private investors in Singapore), which has posted a three-year cumulative return of 15.7% (in US dollars), with an annualised volatility of 21.46% compared with 23.16% by the MSCI Emerging Markets index (19.80% volatility) and an average 14.28% by its sector (8.47% volatility), according to FE Fundinfo.

The fund enjoyed a strong return in 2020, up 18.66% in 2020, in line with its benchmark, and outperforming its peers (15.16%), Fundinfo data shows.

Love is overweight Latin America and Eastern Europe, which have been “massive laggards”, and especially favours Brazil, Mexico and some technology stocks in Argentina, Romania because of its low-cost role in manufacturing value chains.

Elsewhere, he likes South Africa, Saudi Arabia (selectively), Vietnam still, despite its already strong performance, and mid- and small-cap stocks in India.

“Northeast Asia [including China] is a very crowded trade, and valuations are extended,” said Love.

His strategy is also overweight consumer discretionary, industrials and materials throughout the EM world, is neutral energy and underweight telcos.

Love remains confident about Samsung Electronics, Taiwan Semiconductor Manufacturing, Alibaba, Reliance and Tencent (so-called START companies), which comprise the top five holdings in his fund, and in the IT sector overall in the region.

“START stocks are approximately 26% of the MSCI EM Index and are still available at reasonable valuations,” said Love.

Gam Emerging Markets Equity Fund vs benchmark and sector average