Although the US equity market continues to breach all-time highs, holding US equity funds for the last three years has proved to be a bumpy ride for investors.

Some top performing active equity funds experienced drawdowns as high as 50% compared to the S&P 500 index drawdown of roughly 25% during the bear market of 2022.

Although some of the best performing funds rebounded sharply during the equity market rally of the past year or so, there are many which have yet to reclaim their former highs.

But a handful of active US strategies* have delivered top-ranked returns while also exhibiting high upside capture and relatively limited downside capture over the past three years, according to data compiled from FE fundinfo.

An upside capture score of over 100% relative to the fund’s benchmark means that the strategy outperformed when the market was rising and a downside capture score of less than 100% meant that they fell less than the market when it was declining.

Below, FSA highlights five actively managed US strategies with top-ranked returns and high upside capture relative to their downside capture over the past three years.

Artisan US Value Equity

This strategy had a top-quartile performance of 46.45% over three years with an upside capture ratio of 131% and a downside capture ratio of 103%.

This value fund focuses on stocks priced with low expectations, in sound financial condition and good free cash flow and return on capital capabilities. Its top three positions are in Meta, Alphabet and US Bancorp.

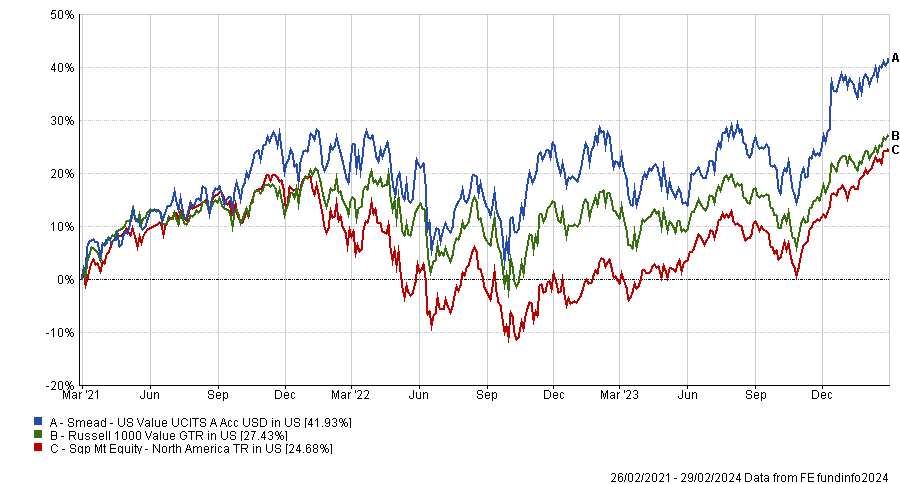

Smead US Value

This strategy also delivered top-quartile returns of 41.93% over a three year period, with an upside capture ratio of 123% versus a downside capture ratio of 102%.

Another value strategy, except this fund aims to buy quality stocks at attractive valuations with a low turnover approach. Its top three positions are in Lennar Corp, DR Horton and Occidental Petroleum Corp.

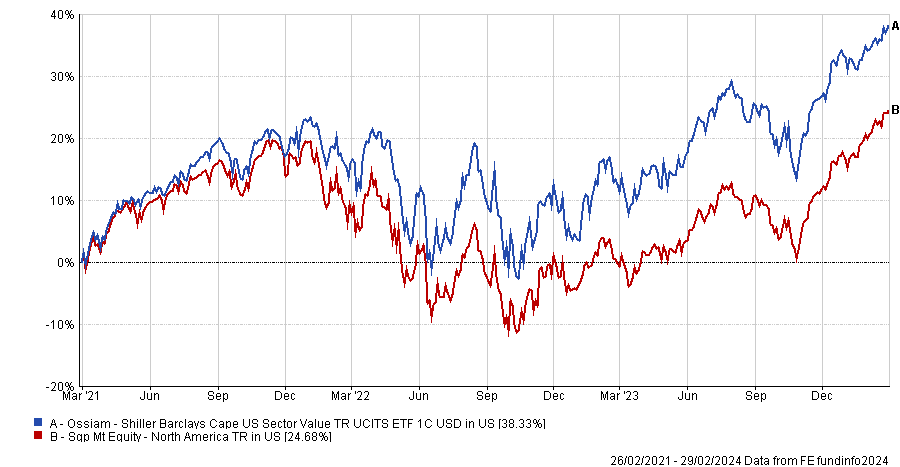

Ossiam Shiller Barclays Cape US Sector Value

This fund returned 38.33% over a three-year period with an upside capture ratio of 120% and a downside capture ratio of 100%.

This value fund aims to mimic the performance of the Shiller Barclays CAPE US Sector Value Index, which is comprised of value stocks based on the CAPE (Cyclically Adjusted Price-to-Earnings) ratio, popularised by Yale University’s professor Robert Shiller. Its top holdings are in Meta, Amazon and Alphabet.

Allianz Choice Best Styles US

This fund returned 37.51% over a three-year period with an upside capture ratio of 118% and a downside capture ratio of 100%.

This core US equity strategy is heavily weighted to certain large-cap US-listed stocks which held up relatively well during the 2022 bear market. Its largest positions are invested in Microsoft, Apple and Amazon.

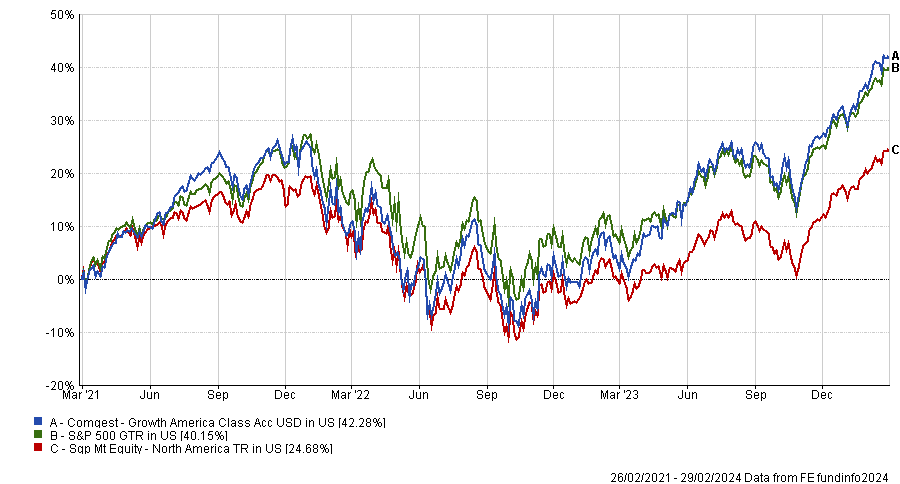

Comgest Growth America

This fund returned 42.28% over a three-year period with an upside capture ratio of 113% and a downside capture ratio of 107%.

The only quality-growth strategy in the list, this fund is heavily tilted towards large-cap growth stocks such as Microsoft, Eli Lilly and Oracle, which were more resilient than the wider benchmark during the 2022 bear market.

*The top-performing funds were measured in US dollar terms. The upside and downside capture ratio figures are based on data from FE fundinfo over the three-year period ending 29 February 2024. The data only includes fund vehicles that fall under the Hong Kong SFC Authorised Mutual or Singapore Mutual equity international sectors in the FE analytics platform. The performance ranking was based on the fund’s Singapore or Hong Kong sector peer group.