Dhananjay Phadnis, Fidelity International

Asia is still at the early stage of its ESG journey compared with Europe, but it is catching up fast. Companies, investors and governments are scaling up their understanding across the board in terms of disclosures as well as offering different fund products, Dhananjay Phadnis, fund manager at Fidelity International, told FSA.

There are three key forces which are driving the strong push towards sustainable investing in Asia, he said.

First, Asian investors, similar to investors from the rest of the world, are increasingly interested in sustainable investments or at least interested in their investments being managed with an awareness of sustainability. ESG AUM in Asia totaled around $25bn in the last quarter, a jump of three times since 2019.

Second, governments in the region are taking the initiative, with China announcing a net zero target by 2060, and push by India to develop renewables, for instance.

“This kind of top-down push has encouraged companies in the supply chain and infrastructure, as well as investors and banks to align with that commitment,” Phadnis said.

Finally, the regulators in key countries, such as Hong Kong, Singapore, Japan and Australia, are insisting on tighter and clearer disclosure requirements, not just for companies but also for asset managers.

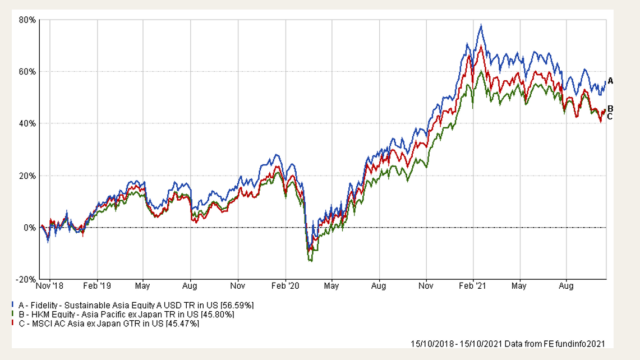

The $3.9bn Fidelity Sustainable Asia Equity Fund managed by Phadnis has posted a three- year cumulative return of 56.59% in US dollars, compared with a 45.47% return by its benchmark MSCI Asia Pacific ex Japan index and a 45.8% return by its sector average, according to FE Fundinfo.

As of 31 August 2021, the top five companies the fund holds are: Taiwan Semiconductor, AIA Group, Samsung Electronics, Tencent and Axis Bank. The main sector exposures are to financials, informational technology, consumer discretionary, communication services and consumer staples. Its major country allocations are to China, India, South Korea, Hong Kong and Taiwan.

Risks and opportunities

“In terms of where we are seeing opportunities, we like the financials, especially insurance companies, where we see significant growth potential in the underpenetrated markets of China and India, and in Asean countries,” said Phadnis. He also sees opportunities among private sector banks, as people begin spending (and borrowing) again as the impact of Covid-19 recedes.

However, there are risks, Phadnis warned.

First, people need to consider whether the Covid-19 virus could mutate again, and that new variants might not be addressed by the current vaccinations.

The second risk is around supply chain shortages. Many companies are still holding and growing their inventories of commodities and components in anticipation of further disruptions, which is exacerbating the shortages.

And finally, geopolitics can be a risk to the globalisation of trade, and undermine the investment and spending plans of companies around the world.

Fidelity Sustainable Asia Equity Fund vs benchmark and sector average