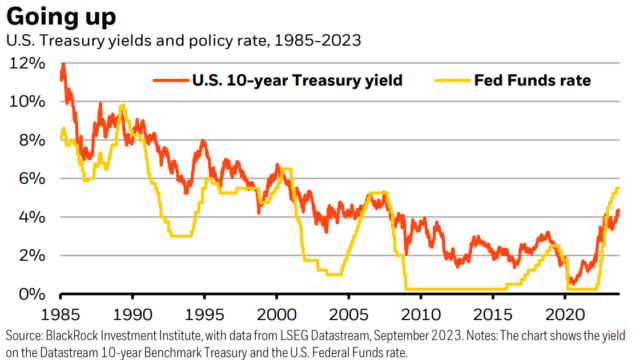

BlackRock, the world’s largest asset manager with over $9trn in assets under management, says that 10-year Treasury yields have more room to rise as markets digest the idea of higher interest rates for longer.

The widely used benchmark rate jumped to as high as 4.54% on Monday as markets started to price in the possibility of the US central bank leaving the door open for more rate hikes down the line.

Jean Boivin, head of BlackRock’s Investment Institute, said in a note on Monday that he expects investors to demand more compensation for the interest rate risk of holding long-term bonds, which will further push up yields.

Although long-term US Treasury yields have already experienced a significant rise following the Federal Open Market Committee (FOMC) meeting, BlackRock’s strategists said: “we’re not yet ready to jump back into long-term US Treasuries”.

“We think term premium – the compensation investors seek to hold long-term bonds – can return and push yields higher still, as can quantitative tightening and the step-up in Treasury issuance.”

As central banks remain steadfast in their tightening of monetary policy, BlackRock thinks that this has finally started to cause economies to slow.

“Rate hikes are weighing on economies,” the strategists said. “The medicine is still working its way through the system”.

Although GDP data suggests that economic activity has remained positive in the US, BlackRock thinks that the economy has already stagnated.

“That seems to have gone under the radar: a stealth stagnation,” the strategists said. “The average of GDP and another official measure of activity, gross domestic income, shows the US economy has flatlined since the end of 2021.”

The weakness in the world’s largest economy isn’t following a normal business cycle slowdown, according to the institute. The US instead faces some more structural issues – such as a shrinking workforce due to an aging population.

As such, the asset manager doesn’t think central banks will be able to cut rates like it has during previous economic slowdowns.

“Central banks need to keep a lid on growth to avoid resurgent inflation once pandemic-era mismatches unwind,” the investment institute said. “That’s why we see them holding tight, not cutting rates like they did in past slowdowns.”

“Our long-held underweight to long-term US Treasuries has served us well as yields climb. Markets have come around to our view on policy rates. Yet there is still little term premium.”

The strategists believe that as markets reassess central bank expectations, investors will start to focus more on the duration risk that the new environment entails.

They are therefore bullish on short-term Treasuries since it has comparable income to high-quality corporate bonds “without the same credit or interest-rate risk”.

The strategists were also bullish on long-term bonds in Europe and the UK due to the 10-year yields being three percentage points higher than the pre-pandemic average, versus roughly two percentage points in the US.