Sticky inflation and higher than expected interest rates mean investors need to start paying more attention to real returns when allocating assets.

This is the view of Allspring’s Eddie Cheng, who told FSA that when rates and inflation are higher for longer, an equity allocation becomes vastly more important for real returns.

“This is because equities are one of the most effective assets to help investors protect their long-term purchasing power,” he said. “In a higher for longer environment, real return matters.”

Indeed, over the decade between 2010 and 2020 when interest rates and inflation remained subdued, headline nominal returns in the UK for example were a good indicator of real returns because they comfortably outpaced inflation.

FTSE v UK CPI between 2010 and 2020

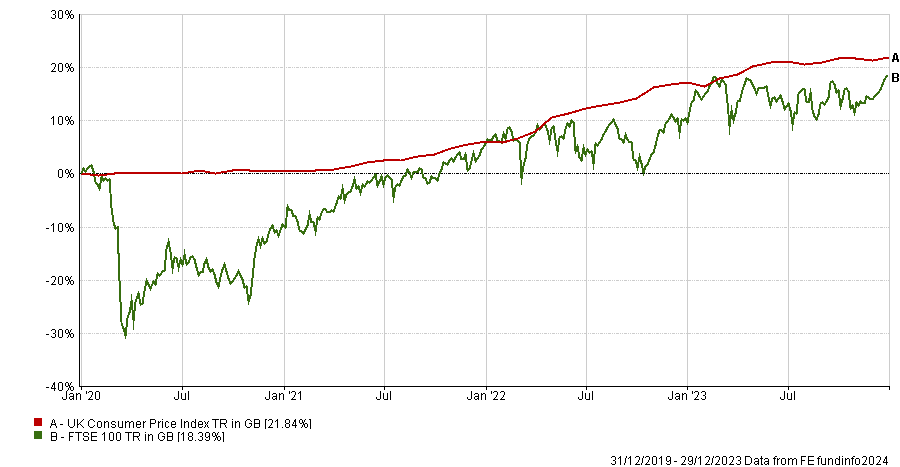

However, after 2020, the disruption caused by Covid-19 and war in Ukraine accelerated inflation and caused nominal returns to no longer be a reliable indicator of returns after accounting for inflation.

Chart of FTSE v UK CPI from 2020 to 2024

The cumulative loss of purchasing power that previously took a decade, sped up in just four years and outpaced the nominal returns of the FTSE 100, for example.

The best way to preserve purchasing power over the long-run is to own dividend-paying equities, according to Cheng (pictured), who manages the Allspring Global Investments’ Global Equity Enhanced Income strategy.

“A high dividend strategy becomes more relevant in a higher for longer environment because you want to invest in a company that can help you to channel as much inflationary cost to the end consumer,” he explained.

“Typically, more mature companies that are dividend payers can do this, rather than growth companies.”

“Growth companies are usually trying to fight for market share, so they aren’t going to raise prices, but mature companies can pass on more of those costs to the end consumer to protect their profit margin.”

Enhancing income with options

However owning high dividend paying stocks is not enough to outpace inflation, as shown by the poor performance of the dividend-heavy FTSE 100 index relative to UK CPI.

The strategy that Cheng manages focuses on investing in companies that pay dividends, but also generates income by selling its equity positions that generate alpha, and enhances it further with with call-writing.

This means that the fund manager sells call options on an index level to collect the option premium as income.

“By selling call options, essentially what you achieve is you sacrifice a small potential of your upside of your equity portfolio in exchange for collecting an income-like option premium,” Cheng explained. “So you enhance your equity income with that option premium.”

Since the strategy sells call options on an equity index rather than on individual stock names, Cheng said it retains alpha upside while selling its potential beta upside.

He also emphasised that the fund is designed to run very close to index-level sector and regional exposure, in order not to miss the returns generated by technology stocks that have driven the market forward in recent years.

Most equity income strategies which run underweight to technology stocks do so because those companies have typically not been dividend payers.

However, this trend has been changing recently with tech giants Amazon, Alphabet and Meta announcing dividends for the first time in their company history.

The Allspring Global Investments’ Global Equity Enhanced Income strategy has an index-like exposure towards the technology sector at 20% versus 23.7% in the benchmark MSCI ACWI Index.

Its top five positions are in US tech companies Microsoft, Nvidia, Apple, Amazon and Alphabet, according to its latest factsheet.

It also has overweight positions in other industries and regions such as energy firm ConocoPhillips and Japanese-listed conglomerate Hitachi at 1.9% and 1.86% respectively.

This allows the strategy to have the regional and sector exposure similar to that of the index which helps it capture broader index-returns that can sometimes be driven by a certain sector, as seen in 2023 with technology stocks or 2022 with energy stocks.

But critically, Cheng emphasised he still runs a concentrated portfolio: “We are running 70 to 80 names in the portfolio, so it’s a relatively high conviction portfolio – but we’re also gaining a broader index exposure,” he explained.