Cracks in China’s property sector have understandably unsettled financial markets. The fading of a multi-year property boom is also dampening a key engine of the economy.

But we don’t think investors should despair. We see the latest turmoil as growing pains in the economy’s transition, a shift that should provide opportunities for longer-term investors particularly in areas like AI, big data and other technologies. And we believe the risk of a broader systemic crisis is contained, with policymakers likely to eventually roll out significant fiscal stimulus to support the property sector and wider economy.

Bumps in the transition to a domestic growth-driven economy

In our view, China’s property sector challenges are part of the economy’s evolution from an export powered model to one more focused on consumption and technology.

The shift, which began after the 2008 global financial crisis, has been fuelled largely by debt. Local government financing vehicles (LGFV) – designed to fund infrastructure and property development – and developers have been among the big borrowers. As the property market has stalled, the economy has also slowed, raising questions about whether the government can meet its 5% economic growth target for 2023.

In the short term, we don’t see a risk of the sector’s challenges significantly hurting the wider economy. Measures such as extending debt maturities and bond refinancings have helped support local government finances. The Beijing government has also required developers to deleverage and taken a more cautious approach to approving infrastructure investments.

So, has Beijing’s response been sufficient? We doubt whether the measures will be enough to turn the property sector around and revive economic growth. A lack of spending – as consumers hoard cash and companies are reluctant to invest – could lead to further deterioration in risk assets.

As cyclical growth momentum deteriorates and credit default risk mounts, we think there is a “pain threshold” at which point Beijing would unveil a more forceful stimulus to boost growth – even if it means raising national debt levels.

This stimulus might take the form of more support of the property sector and proactive infrastructure investments. Other measures may include steps to attract foreign investment, a pragmatic approach to geopolitics and an acceleration in policymaking.

Under such a scenario the economic outlook may improve.

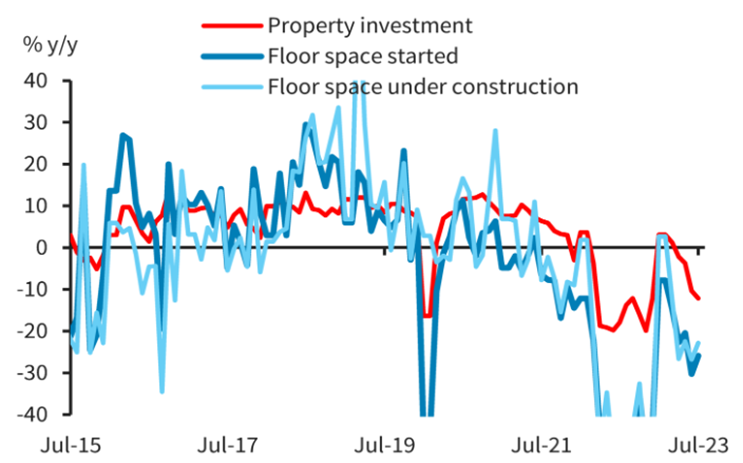

Exhibit 1: Activity in China’s property market has slowed dramatically

Focus on the long-term investment case

In the short term, Chinese financial markets could remain quite volatile. Chinese equity, fixed income and foreign exchange metrics are trading close to 2022 lows. But we think there are positives to consider across the main asset classes, especially at current valuations:

- Look to long-term trends in equities – Stocks rarely perform well when nominal GDP growth languishes below recent trends, as it is now. But given the pullback by some international investors from China equities and the recent market sell-off, there is potential for rallies if positive news emerges. Stock selection will be critical. Certain sectors may perform well depending on where government policy is focused. For example, with the government action against technology companies seemingly over for now, the revenue of internet platforms may improve. The same may be true for sectors linked to AI and big data that are helping establish China as a key global player in these fields.

- Monitor opportunities in government bonds – China’s faltering economy has boosted demand for government bonds as some domestic investors consider alternatives to equities. This demand helped push yields to their lowest levels since the Covid-19 pandemic. We think the yield on 10-year Chinese government bonds could go below the recent 2.5%. But in the event of a stronger government response, bond yields may incrementally grind higher. In such a scenario, we would expect the yield on 10-year Chinese government bonds to range between 2.6% and 2.7% by the end of 2023. Expansionary fiscal policy directed at LGFVs may mean the vehicle’s bonds emerge as an attractive fixed income asset.

- Consider the renminbi’s long-term role – We expect the renminbi to remain under pressure. We think the People’s Bank of China will continue to support the currency —to manage volatility – but will mainly aim to avoid excessive moves which could trigger additional capital outflows. But if the pace of depreciation is well managed, it may be welcomed by policymakers given the potential boost to exports. In the longer term, the currency is set to gradually capture a growing market share in global payments. Policymakers are pushing to internationalise the currency, a process that will take many years.

Exhibit 2: Foreign investors have been exiting Chinese equity positions

Monthly northbound net buying / selling through the Stock Connect trading scheme (in RMB billion)

In the short term, the property sector difficulties may undermine hopes for prosperity in the Year of the Rabbit, but investors should be mindful of another of the rabbit’s other symbol: longevity. And we believe the longer-term outlook for China remains strong.

Greg Hirt is global chief investment officer for multi asset at Allianz Global Investors.