AllianzGI Global CIO Equity Virginie Maisonneuve told a recent media briefing in Hong Kong that she is optimistic on investment opportunities in China.

“We believe the market is very cheap,” she said. “There is clear support from the government in terms of making it a better-quality market with IPOs and improved trading.”

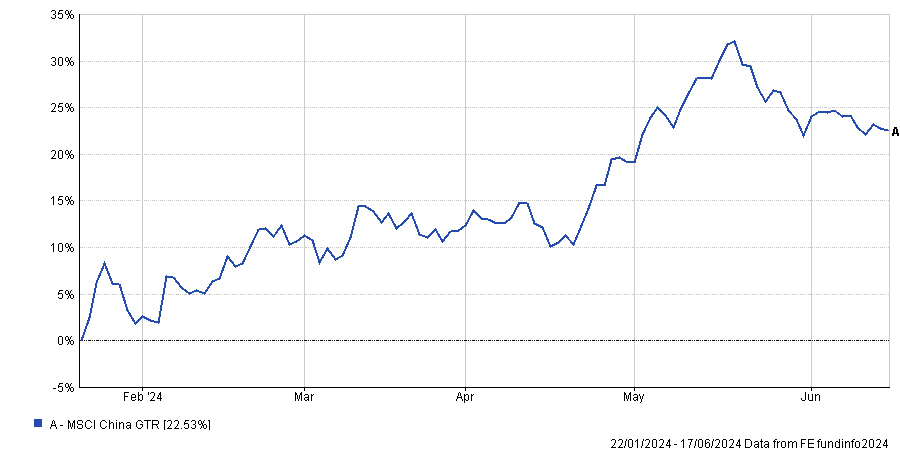

She pointed to how fund managers who are not currently invested in China have already missed out on some of the rebound. Indeed, equities have rallied 22.5% from lows set in late January this year.

Discussing her outlook for the Chinese economy given the drawn-out property market downturn, Maisonneuve emphasised the importance of not just monitoring new policy actions but also interpreting their intention and how the government broadcasts them.

“What we’ve seen in the last few months is definitely the willingness of the government to announce more measures or let more measures come through.”

“What they’re not going to do is guarantee anything, but they’ll give some signals,” she added.

One key signal to watch is if the Chinese government starts to indicate support of the fixed income and equity markets, Maisonneuve said.

She suggested that improving the local fixed income and equity markets may be a natural progression for the Chinese government to do given the country’s saving needs.

“Ultimately, in the framework of ‘common prosperity’ where people have invested so much of their wealth in property at a time when you have a rapid ageing of the population – you need to help people have a good source of savings,” she said.

“Over the long term, fixed income and equities are the right places.”

Maisonneuve thinks that over time people in China will put more of their savings into fixed income and equity products while the property market stabilises.

Looking ahead, given the upcoming US elections, it is widely expected that geopolitical tensions with China will come to the forefront. This may have negative consequences for China in the form of a trade war escalation or increased tariffs.

However, Maisonneuve said that any volatility arising from these events would be a good opportunity to add to compelling opportunities in the region, for fund managers who are still lightly positioned in China.

“How can you not be invested in the second largest economy in the world?” she asked. “One that has a lot of GDP-per-capita catch up to do, and a lot of innovation.”

US debt sustainability

Another topic that is top of mind for Maisonneuve is the sustainability of the US debt burden and the politics around the US election, which are both linked.

Maisonneuve said: “Depending on who’s elected, whether there’s a divided government or not, we might have the need for a bigger deficit”

“An increased deficit this time around is different than when Trump was in power because the deficit is higher.”

“We’ve had two ratings downgrades already, so it’s going to be interesting to see how investors focus their attention on the fiscal needs and the cost of interest rates that you need to attract capital to invest in that additional supply.”

In August 2023, credit rating agency Fitch downgraded the US government’s long-term credit rating from AAA to AA+ due to expected fiscal deterioration over the following three years.

Although it not likely to be a major story until 2025, the impact that US debt sustainability will have on the long-term cost of borrowing needs to be monitored, given the importance of the US interest rate in all asset class valuations.

Maisonneuve said: “Ultimately, if the supply and demand imbalances are more extreme, you know that to attract capital means the long-term cost of capital has to be higher.”