For armchair critics, especially those with a glass of Bordeaux in their hands, the last few weeks have been rather amusing: pundits, pollsters and connoisseurs and have been falling over themselves to get things wrong. Spy was reminded of the rather cynical, but perhaps truthful, insight from Joan Robinson that; “The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists.” Jerome Powell and his band of merry central bankers have just cut interest rates again by 25 bps. Apparently, the Fed “will not allow inflation expectations to drift upward.” If you believe that, Spy has some nice snake oil to sell you.

Some investment opportunities are far harder to master than others, reckons Spy. Life sciences and biotech is a playground that is not for the faint hearted. While rewards can be great, failure rates are high and often binary – a new drug, therapy or technology either works or is a complete failure. A specialist manager, Emerald, has just launched its F/m Emerald Life Sciences Innovation ETF which, “leverages the experience of our life sciences team that has worked together for 17 years. In addition, the five-person portfolio management team on this ETF has an average tenure at Emerald of 25 years and 27 years average industry experience.” If there is a better example of suitability for an active (versus passive) approach to a sector, Spy can’t think of one. The fund has a great strapline too: ‘A cure for the common ETF’. The strategy is trading on the Nasdaq under the ticker LFSC.

Some readers may be aware that the American presidential election took place this week. It was, as usual, a quiet, demure affair, notes Spy. Now that the shouting is all over, a lot of ink will be spent on why Donald T. triumphed in the “greatest political comeback” of all time. It takes a special kind of incompetence to spend $1bn, then lose the presidential race, the Senate and the House, and end up $20m in debt. Take a bow Kamala and the Democrat electoral machine. For markets, they seem to love the ‘sentient mandarin’ coming back to power. The S&P 500 hit yet another all-time high. The dollar jumped. The 10 richest people on the planet got nearly $70bn richer. Perhaps the crowd is happy that, like Selena Gomez, Trump will ‘Shake it up’.

In the middle of Trump’s previous White House tenure, an ETF was launched to explicitly capitalise on Donald’s eccentric policies. The fund, the Point Bridge America First ETF, was designed to track the performance of US companies whose “employees and political action committees are highly supportive of Republican candidates for election to Congress, the Vice Presidency, or the Presidency.” Sensible enough thematic, one would think, with Trump’s brash brand of nationalism. It trades under the ticker, MAGA, naturally. Spy notes that with a touch of irony, however, during Trump’s presidency the fund went nowhere but under President Biden, it reversed trend and has rocketed up 100%. Those investors rushing to back the “the obvious winners” for the next Trump presidency, may find the chart below a touch salutary.

For those investors concerned that their portfolios are too concentrated on the Magnificent Seven, Defiance has a solution for you. The Defiance Large Cap Ex-Magnificent Seven ETF, trading under the XMAG ticker, has been listed on Nasdaq. The fund references the BITA US 500 ex Magnificent 7 Index, which consists of all S&P 500 constituents, generally representing the largest 500 publicly traded securities in the US, while excluding Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla. This was probably not the week to get too excited about this particular strategy as, in reality, the Magnificent Seven continued to have a great week. Microsoft and Alphabet had great results and popped, Nvidia snatched Apple’s “most valuable” crown once again, Meta hit an all-time high, Tesla surged on Trump’s win and Amazon benefits from Powell’s dubious rate cut.

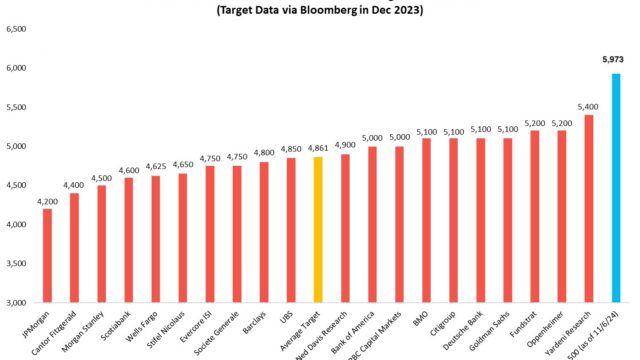

Experts, eh, who needs them? The average prediction for the year-end S&P 500 target was 4,861at the beginning of the year, according to data from Bloomberg. If the current level holds, that is a mere 1,112 points below reality. J.P. Morgan is looking particularly foolish with its 4,200 call. To be fair to JPM, as Yogi Berra (or Nils Bohr), once said, “It’s hard to make predictions, especially about the future.”

Germany is having a torrid time. Its government has just collapsed in acrimony. Volkswagen is shutting local factories and in the past two days, the country has experienced what’s known as a “dark doldrums” period. This happens where no electricity is generated from wind or solar – of which the country has invested heavily. As a result, wholesale electricity prices spiked, at times, to more than €800 per megawatt hour. That happens to be ten times the typical average the Germans pay. No wonder the Greens are getting hammered. Lessons here for the muesli-munching, tofu-eating, sandal-wearing brigade.

Spy’s quote of the week comes from Charles Swindoll, “We are all faced with a series of great opportunities, brilliantly disguised as impossible situations.” Ain’t that the truth!

Until next week…