Analysts, rather than portfolio managers, are the driving force behind T Rowe Price’s $75bn US structured research equity strategy.

This helps the US-headquartered asset manager, which runs over $1trn in assets, “harness the collective wisdom” of their equity research team, according to Alexa Gagliardi, one of four co-managers who help coordinate the analysts.

This is a unique approach since most analysts at investment firms will conduct equity research and make recommendations, but ultimately portfolio managers will make the buy and sell decisions.

For this strategy, roughly 30 analysts from the firm are given capital to manage in proportion to the weight of their coverage in the S&P 500 benchmark, with freedom to buy and sell names in their sector, remaining fully invested at all times.

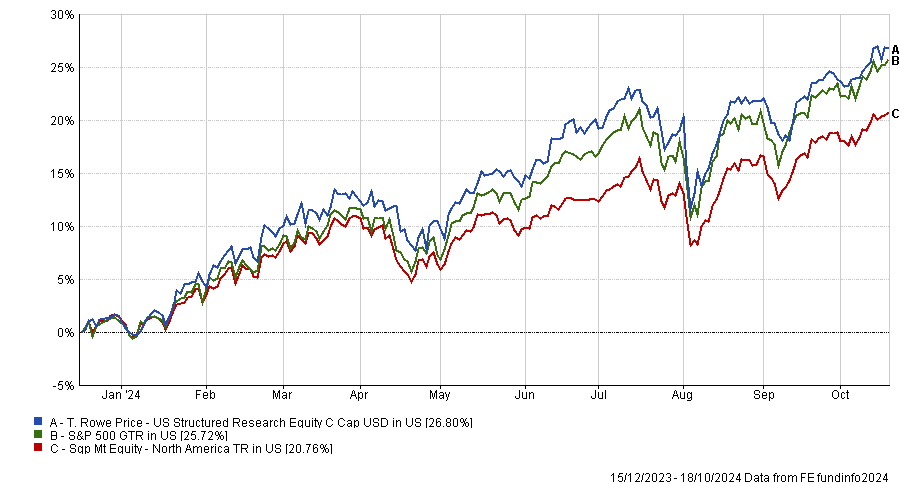

This analyst-driven approach has paid off over the years. According to data from Morningstar, the strategy has outperformed the index and its peers over the past 15 years.

The benefits of this approach really stand out when considering the breadth of performance attribution, Gagliardi told FSA in an interview.

Breadth pays off

She said that over the past year, nine out of eleven sectors delivered alpha. This is despite the fact that US equity markets have been driven by a handful of mega cap stocks.

Under the surface, Gagliardi said the strategy’s analysts have been able to deliver alpha due to the dispersion on a sub-sector level.

“There’s been the rise of generative AI, the rise of GLP-1 weight loss drugs, and one of the fastest rate hiking cycles in history, which led to a lot of dispersion in tech, healthcare, and financials,” she said.

“This is where our analysts with boots on the ground research have been able to develop forward looking insights that allowed them to be positively positioned coming into those trends”.

Nvidia, Eli Lilly and Novo Nordisk have been among the best performing large caps in the S&P 500 index over the past twelve months.

Consistent alpha

Analysts are also encouraged to come up with their own investment framework, and are “responsible for figuring out what makes the companies within their particular area of expertise work or not work,” Gagliardi (pictured) said.

This includes developing their own unique investment style depending on the growth or value characteristics of their sector coverage, which helps mitigate investment style bias at the portfolio level.

The strategy’s focus on maintaining industry-neutral exposure to the S&P 500 index is not only a risk control, but a way to deliver long-term alpha, according to Gagliardi.

“Our peers, who might have higher active share, higher tracking error, and can be a bit flashier, might have better performance numbers in any given calendar year, but our portfolio over the 25- year history has demonstrated the consistency of results to beat not only passive, but also our higher active share peers,” she said.

“That is really compelling because of the consistency of our low tracking error approach that can lead to that positive outcome, where every year a 100 basis point alpha can compound very quickly.”

She added: “We might not be the best performing portfolio in any given year, but we also won’t be the worst, so we don’t need to recover from extreme downturns.”

Reading body language

Gagliardi also noted that some analysts have been covering their sector for many decades – something she said can lead to differentiated insights.

In addition to developing a deeper understanding on what drives a particular company or industry, she said analysts also start to pick up on the body language of a particular executive during meetings others may miss out on.

“You also get to know the management teams and there’s a lot of value in sitting across the table from someone and studying their body language,” she said.

“In our investment meetings we sometimes hear an analyst saying ‘I could tell that he was really beaten down and dejected, or I could tell he was really energized and motivated, and I’ve never seen them behave like that before’.”

“They can get insights from things that aren’t spoken, while someone who might not know that team as well wouldn’t pick up on.”

This could become particularly relevant in an age where more and more investment managers are turning to artificial intelligence to gather insights from earnings calls with public companies.

Current opportunities

Although artificial intelligence was a big driver of markets over the past year or so, the analysts are seeing new opportunities in the insurance space, according to Gagliardi.

Indeed, insurance premiums have been increasing over the past year – which directly impacts the industry’s revenue. Higher rates have also boosted their investment income.

Gagliardi explained: “These insurance companies are benefiting from higher rates as they’re able to reinvest their portfolios as they roll off from maturities at higher investment rates, which has been a tailwind for them, and we expect that to continue.”

The analysts are also still bullish on the potential for GLP-1 drugs, she added.

“We’ve also continued to find opportunity within the healthcare space, primarily the GLP-1 weight loss drugs,” she said.

“Demand continues to outpace supply. We’ve only really begun to scratch the surface from a target addressable market perspective.”

The SICAV fund version of the strategy launched in Singapore in late 2023, and has since delivered a 26.8% return compared with 25.7% from the S&P 500 index.