Emerging markets debt (EMD) has struggled against several headwinds during the past five years, but the environment might be improving for the wide-ranging and diverse asset class.

“After years of outflows, emerging market bonds should attract investors as interest rates fall. The sector offers high yields and longer duration, which are two important factors, especially for institutional investors, as they face reinvestment risk,” said Marcelo Assalin, head of EMD, partner, blended & strategy at William Blair’s emerging markets debt team.

“Already, we are seeing consultants for pension funds and other institutions searching for EMD mandates among asset managers,” he told FSA in an interview.

Outflows from EMD funds rose in 2019 in the wake of the Argentina default, the Covid pandemic a year later accelerated the trend as economic growth slumped, and then US interest hikes to dampen the inflationary impact of Covid government spending completed the hattrick of blows.

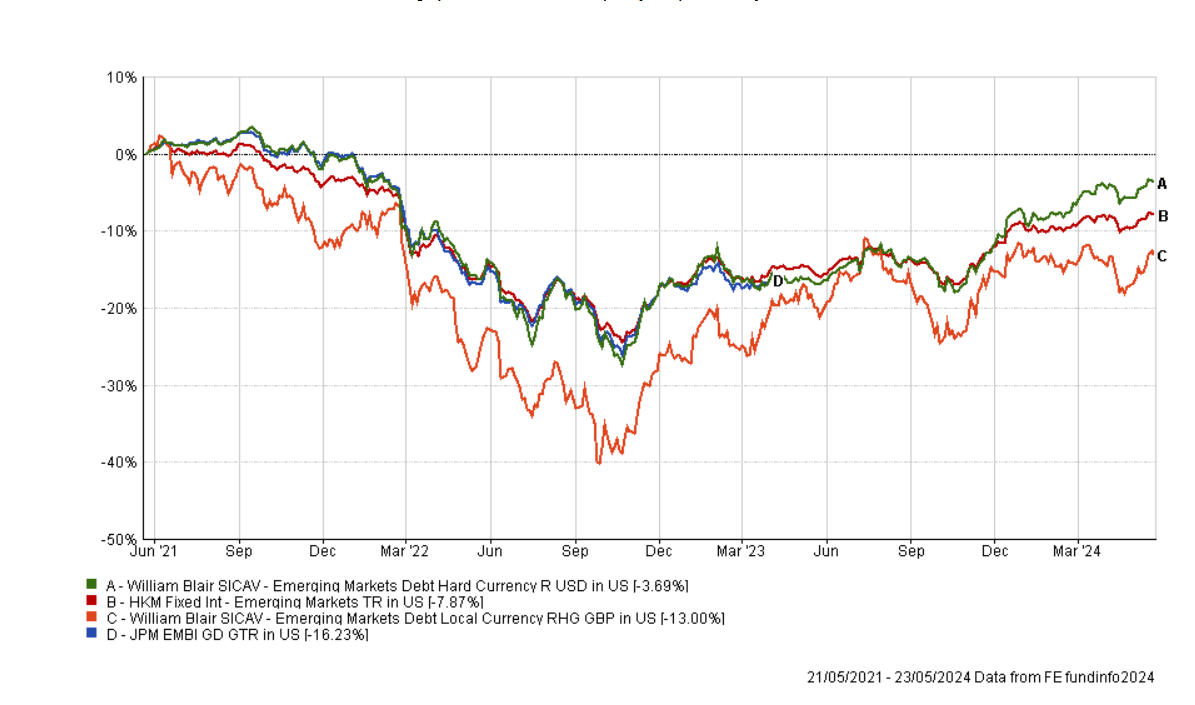

The JPM EMBI Global Diversified index has declined -16.23% during the past three years and the average EMD fund authorised for sale by the Securities and Futures Commission in Hong Kong fell -7.87%, according to FE fundinfo.

William Blair’s EMD Hard Currency flagship performed significantly better (although still negative) with -3.69% return during the same period, FE fundinfo data shows. Incepted in April 2020, the strategy has an average rating of BB+, a yield to maturity of 8.53% and a duration of 6.44 years, according to its 30 April 2024 factsheet.

“Now, the trend is for lower rates which entice investors to look at EMD as a way to counter reinvestment risk if they have remained in cash or bought short duration developed market bonds,” said Assalin (pictured).

Assalin and his team of three other lead portfolio managers, five sovereign debt portfolio managers, three corporate debt managers and two strategy researchers, deploy a top-down approach for the William Blair EMD Hard Currency and EMD Local Currency strategies.

Top-down outlook

They assess macro-economic prospects, their impact on individual countries, coupled with an analysis of the relative valuations of sovereign bond issues.

Assalin’s “best-case” outlook over the next 18-months is for resilient emerging markets’ economic growth of 3.7-3.8%, continued disinflation that will allow interest rates cuts and better liquidity conditions for emerging markets, supportive commodity prices for exporters, and the maintenance of multi- and bi-lateral funding for poorer nations.

“Superior returns from hard-currency emerging market bonds will be driven by interest carry and duration as rates fall,” said Assalin.

As part of his team’s investment process, its investment universe of 70 countries are placed in risk buckets of high, medium and low beta.

High beta overweight positions include Senegal, Ghana and even Argentina and Ukraine. Medium beta overweights include Ivory Coast, Guatemala and Mexico, while Bermuda, Saudi Arabia and Paraguay and low beta overweights.

Prominent underweights to the JPM EMBI Global Diversified index include high beta Mozambique, Nigeria and Kenya, medium beta Bahrain, Turkey and Dominican Republic and low beta China, Uruguay and Indonesia.

The major risks, according to Assalin, are geopolitics and its impact on growth and inflation, and the further acceleration of deglobalizing forces such as the establishment of local supply chains (cutting off revenue for some countries) and more retaliatory trade tariffs among the US, Europe and China.