Indian bonds are becoming a very compelling story for global investors due to some unique tailwinds emerging, according to bond managers.

Asian bonds have not been garnering much interest amongst fixed-income investors recently, given the relatively high yield on offer by US Treasuries and the strength of the dollar over the past year or so.

However, one exception within the Asian fixed-income universe that is emerging as a potential winner is Indian bonds.

The case for allocating to India in recent years is getting stronger, as it is undergoing major tax and central bank reforms and opening to foreign direct investment.

It also has strong per capita income growth and an abundant labour supply is making it attractive at a time where companies are trying to diversify away from China.

While it is still a relatively untapped market for global investors, Indian bonds have been in the spotlight recently after JP Morgan announced its plans to add India to its emerging market government bond index in mid 2024.

Due to institutional benchmarking, this change will result in some significant inflows into the Indian government bond market, according to Invesco’s head of Asia Pacific fixed income, Freddy Wong.

“We are talking about big flows; these are big institutional, quasi-government agents who want to invest,” he said.

Since the 10-year Indian government bond is yielding north of 7%, Wong said that these institutions have no need to go down the credit curve in the search for yield.

Add on the fact that the Indian economy is one of the fastest growing in the world, the local currency bond market is also becoming very attractive for large foreign investors.

India’s latest quarterly GDP growth figure came in at 7.8% and it is expected to post full year growth of 6.3%, according to IMF forecasts.

Meanwhile, last month India’s CPI inflation figure eased to 5%, which is starting to approach India’s central bank target of 4%.

As such, the currency, which was was once a headwind for Indian bond investors, may start to become a tailwind as peak interest rates in the US starts to approach.

A currency tailwind

Wong said: “As long as your country is growing faster than other countries, your currency tends to appreciate. That means you are not just winning on an outward yield standpoint; you are also winning on a risk-adjusted currency standpoint.”

This strength of the Indian rupee is one of the many reasons why Kenneth Akintewe, head of Asian sovereign debt at abrdn, also finds the region very attractive.

“One of the reasons we are comfortable holding significant amounts of risk in the Indian market is because the currency volatility is very, very low,” he said.

He pointed to the rupee’s three-year volatility of roughly 6% and compared it to that of emerging markets ex-Asia’s currency volatility of 15 to 20% and G10 currency volatility of 10 to 12%.

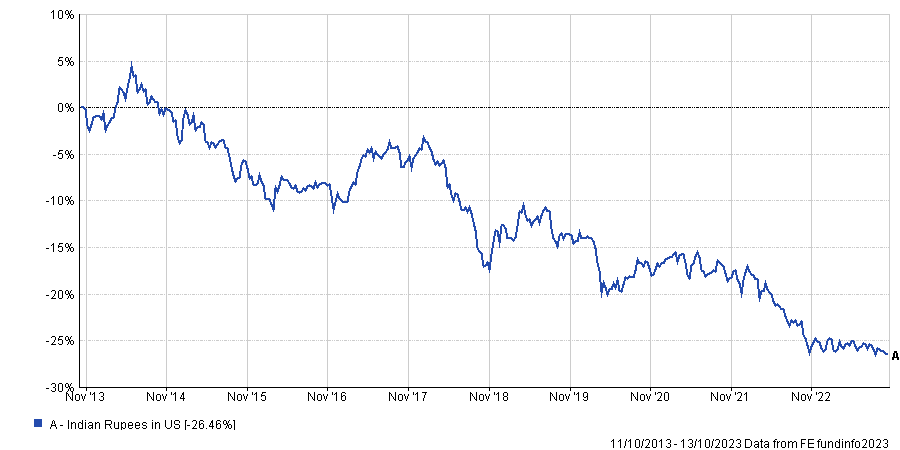

Over the past 10 years, the volatility of the Indian rupee has structurally declined, according to Akintewe. But, the strength of the currency has also been in structural decline, down 26.46% against the US dollar over the past 10 years.

However, for global bond investors who naturally must take on currency risk when considering India, Akintewe said it is one market “where to some extent the central bank has your back”.

He pointed to India’s foreign currency reserves – the fourth highest in the world behind China, Japan and Switzerland – which stood at $595bn at the end of the second quarter of 2023.

Akintewe said: “The Reserve Bank of India actively uses this to defend the currency; it manages the volatility of the currency. It’s not trying to defend a particular level; it intervenes just to make sure that the volatility is not too high.”

“Yes, we will experience currency depreciation, but the history of the market has shown that that currency depreciation over the medium to long term is never sufficient to come anywhere close to wiping out your returns.”

He said that Indian bond investors have still generated 70 to 80% returns over the past decade, despite the currency depreciation, “so imagine what happens in a year where the currency actually appreciates”.

He added: “When you combine that low volatility with the returns that the market generates, this is actually one of the best risk-adjusted investments you could put it into a portfolio.”

“Because of the low correlation of this market with other bond markets and equity markets, as you start putting it into multi asset portfolios or global fixed income portfolios or emerging market bond portfolios, you see the risk characteristics and return characteristics improve, the volatility comes down, and the returns go up.”