Union Bancaire Privee (UBP) is on watch for a global cyclical recovery which would benefit Chinese equities and remains optimistic on US equities despite strong recent performance.

At the start of the year, the Swiss private bank suggested looking beyond China to avoid the structural headwinds the country faced. Indeed, avoiding Chinese equities was somewhat market consensus.

UBP’s view on the region has since changed. Norman Villamin, UBP’s group chief strategist, said in a recent media briefing in Hong Kong that the structural headwinds in China could be overcome by a global cyclical recovery.

“When you get a global cyclical recovery, these structural factors fade, and even these countries that are mired in restructuring have a nice bump in their equity markets,” he said. “That’s the trade we think is unfolding in here in China.”

After a prolonged downturn in the Chinese equity market, it has finally rallied some 20% from its lows in late January.

A further catalyst for the market could be if the Chinese government adjusts its policy due to being behind on its GDP and inflation targets so far this year.

This is according to Carlos Casanova, UBP’s senior economist for Asia, who said: “If that calibration entails more policy support, more liquidity, multiple cuts, etc, that’s the other catalyst for Chinese equities heading into the second half.”

“We think that policy announcements are probably enough to catalyse a bit of a recovery in the market – whether or not that’s sustainable is based on earnings.”

But any policy support from the Chinese government is “all necessary, but in itself perhaps insufficient” Villamin added.

“What we’ve seen historically is you need domestic and the global cycle also needs to turn,” he explained. “That’s what we’ve started to see already. We’ve got easing in parts of Europe and if the US begins, then you have both of these drivers.”

US equities still strong despite slowing tech earnings

Many investors have grown cautious on US equity markets due to how the narrow performance has been, led by the large-cap technology names on the back of strong earnings and enthusiasm for artificial intelligence.

“Undoubtedly, tech stocks are not cheap,” Villamin said. He explained that the reason tech stocks have driven the market is because that has been where earnings growth has been.

“Tech at its peak in the first quarter of the year were growing earnings about 40% year on year; the rest of the market was basically flat,” he said.

“What we should see as we go into year-end is tech earnings growth should start to slow probably towards high teens and non-tech earnings growth should accelerate from zero, we think to mid double digits or so.”

This is why he expects the gap between US tech performance and non-tech will start to close.

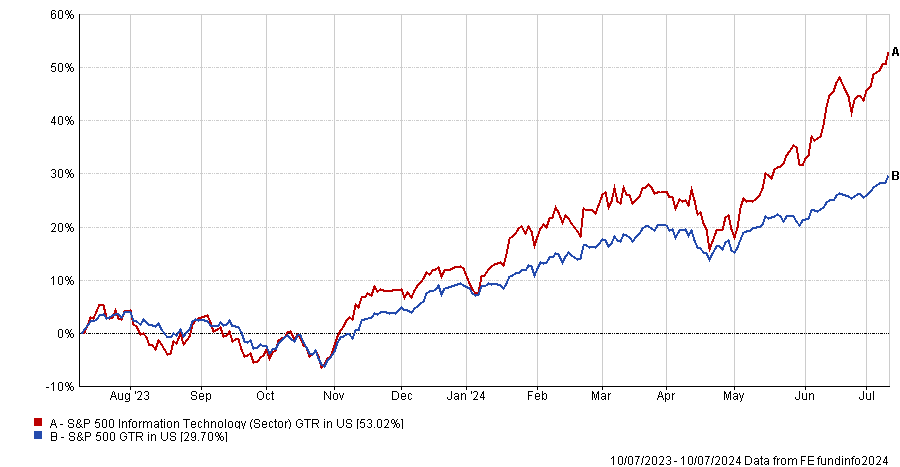

Over the past 12 months, the S&P 500 Information Technology index has almost doubled the gains of the wider index.

“I think for investors what that means is you’re going to get a much broader set of opportunities to choose from,” Villamin said.

“Does this mean I got to dump all my tech, tech is expensive? Not really. Over the last decade for the most part when the big tech stocks in the US trade below 30 times, your returns for the next 12 months had historically been very good.”

“I don’t need P/E multiples in tech to go up here, because these are companies that are generating 15% to 20% earnings growth regularly, so I can buy and hold these things and compound at high teens types of returns.”

For long-term investors, the strategist said that the non-tech stocks in the US provide for a tactical opportunity as the economic cycle picks up, whereas tech stocks could still provide an “anchor” to portfolios going forward.