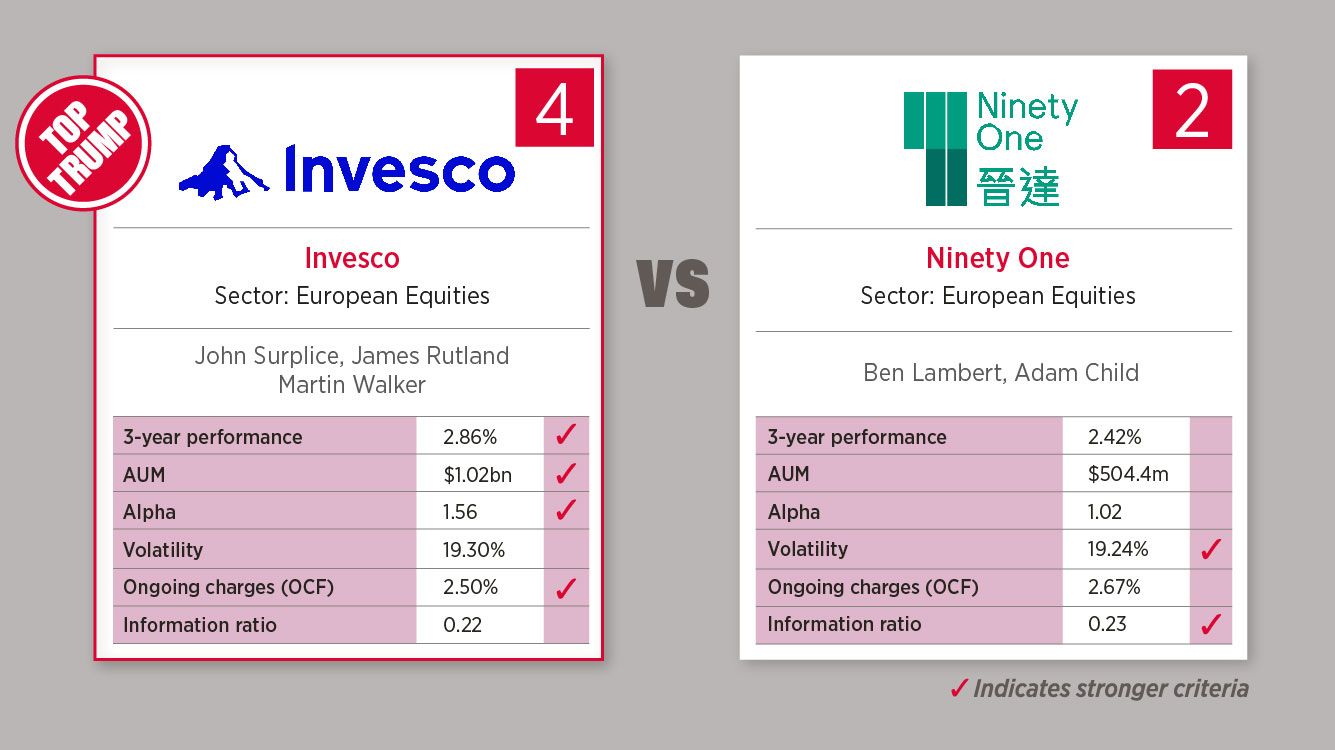

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the Invesco Pan European Equity fund defeats the Ninety One European Equity fund 4‐2.

Invesco Pan European Equity fund

The fund aims to provide long-term capital growth by investing in a portfolio of equity or

equity related instruments of European companies with an emphasis on larger companies.

Top 10 holdings:

- Total (3%)

- Deutsche Telekom (2.8%)

- Airbus (2.8%)

- UniCredit (2.8%)

- Smurfit WestRock (2.6%)

- UPM-Kymmene (2.4%)

- Banco Santander (2.4%)

- Sanofi (2.3%)

- AstraZeneca (2.3%)

- Cie de Saint-Gobain (2.3%)

Ninety One European Equity fund

The fund aims to achieve long-term capital growth primarily through investment in companies either listed and/or domiciled in Europe, or established outside of Europe but carrying out a significant portion of their business activities in Europe.

Top 10 holdings:

- Sap (5.4%)

- Novo Nordisk (4%)

- Barclays (3.7%)

- Schneider Electric (3.3%)

- Deutsche Telekom (3.3%)

- Asml Holding (3.1%)

- Astrazeneca (2.9%)

- London Stock Exchange Group (2.9%)

- Unilever (2.8%)

- Enel (2.7%)