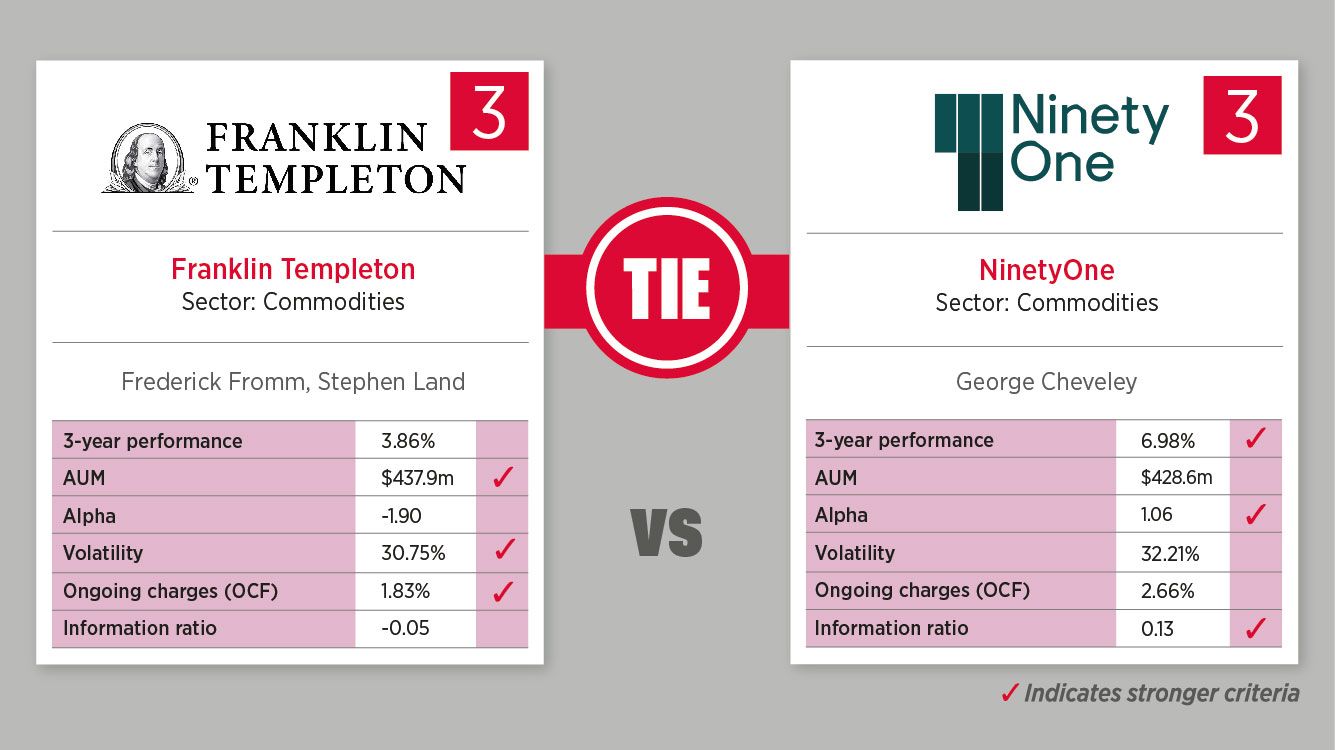

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the Franklin Gold and Precious Metals fund and the Ninety One Global Gold fund tie 3-3.

Franklin Gold and Precious Metals fund

The fund pursues an actively managed investment strategy and invests mainly in equity and equity-related securities issued by companies of any size and in any country, including emerging markets, that are involved in the mining, processing or trading of gold and other precious metals.

Top 10 holdings:

- Newmont Corp (5.79%)

- G Mining Ventures Corp (4.52%)

- Agnico Eagle Mines (4.31%)

- Alamos Gold (4.31%)

- Perseus Mining (3.52%)

- Barrick Gold Corp (3.13%)

- Artemis Gold (2.61%)

- Torex Gold Resources (2.48%)

- Endeavour Mining (2.37%)

- Pantoro (2.3%)

Ninety One Global Gold fund

The fund aims to achieve long-term capital growth primarily through investment in equities issued by companies around the globe involved in gold mining. The fund may also invest, up to one-third, in companies around the globe that are involved in mining for other precious metals and other minerals and metals.

Top 10 holdings:

- Barrick Gold Corp (8.6%)

- Agnico Eagle Mines (7.7%)

- Northern Star Resources (7.3%)

- Evolution Mining (7.2%)

- Gold Fields (5%)

- Centamin (4.9%)

- OceanaGold Corp (4.5%)

- Alamos Gold (4.5%)

- Hecla Mining Co (4.3%)

- Royal Gold (4.3%)