Spy was due to meet an industry colleague for a drink last night, but Super Typhoon Yagi put paid to that. Instead it was a night in front of modern cowboy drama Yellowstone on Netflix. In one scene, a character says, “I hope I never meet the first man who first decided to ride a bull.” Kevin Costner’s John Duttone replies, “I don’t know, Carl, the first man might be worth meeting. It’s the second man I wonder about!” That witty insight left Spy musing on those people who fall for an investment scam or get rich quick scheme, not just once but a second time. Every bank and financial institution is constantly telling us not to give out our pin codes or OTPs to strangers on the phone and yet people still seem to fall for it all the time.

Do you want your China investment strategy driven by machine learning? KraneShares thinks you do, observes Spy. The American ETF player has just introduced the KraneShares China Alpha Index ETF, trading in New York, with the ticker KCAI. The strategy which “utilises a proprietary machine learning approach to systematically identify and optimise alpha opportunities in China A-Shares, aiming to deliver excess returns” above the CSI 300 index. China’s stock market is notoriously volatile, driven by excitable retail investors whose whims seems quite unfathomable at times. All Spy can say is that this machine had better have the ability to learn lightning fast, if it is going to deliver any alpha whatsoever in that rocky landscape.

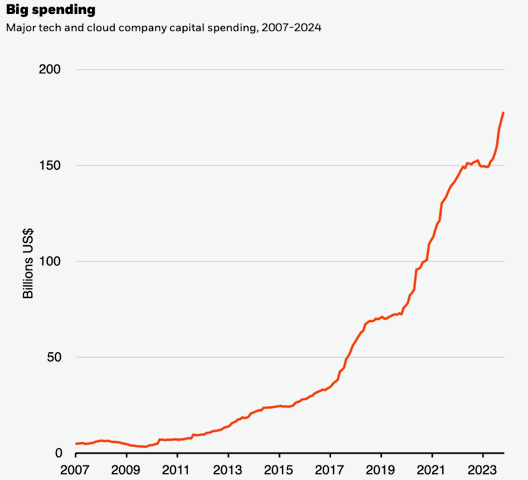

BlackRock’s strategists have been musing about the increasingly noisy drumbeat of concern about potential returns from AI investments and urge a little patience. As they put it, “Yet it’s possible that shareholders may not see further AI investment as the best use of corporate balance sheets. We see a disconnect between the short-term lens of some investors and the long-term visions of tech and cloud service providers. That divergence has spurred jitters among investors – but we think patience is needed…Some tech companies are already reporting increasing revenues from the roll out of AI-related products.” The capital investment landscape is certainly dramatic; look at this chart of Microsoft, Amazon, Meta and Alphabet’s tech and cloud company capital spending in the last few years. The return better be worth it, because these companies are risking a lot.

Speaking of AI, Spy remembers the old adage: if it is on the cover of Time, the peak is already in. Time has just released its Time 100 AI issue. The front cover is peppered with the good and the great driving the industry forward. You can see the full list here. If nothing else it will make you sound more knowledgeable at your next cocktail party.

Do happier employees lead to companies that provide better financial returns. Irrational Capital, an investment manager set up in 2017, believes there is a positive correlation and has launched a few funds to prove it. Spy is fairly convinced that the underlying thesis is correct: happier staff should produce better financial outcomes for a firm. But the question is: over what timeframe? With some companies’ roster of benefits sounding like a community club-cum-sports centre, do staff actually spend much time building their firms’ profits? Or are they too busy doing a charity bike ride, taking a yoga class or sitting on the couch with a wellness officer? When does the actual work get done, wonders Spy?

Do wealth managers add any value? A magnificent rant from the entrepreneur and CEO of Native, Moiz Ali. “To date, I can say that: A) They have provided virtually no value in growing my net worth. They promise access to exclusive investment opportunities, but the investments aren’t nearly as good or as exclusive as you’d think. Elliott Management has $71bn under management. How exclusive do you think it is? Every wealth manager pitched me “exclusive access” to Elliott. It’s the fucking Vanguard of private wealth managers. Forerunner Ventures? They raised $1bn dollars. Nothing you couldn’t get access to if you really wanted/tried. But to get funds you can’t get access to, they can’t either. Sequoia? Not a chance in hell. B) They are structured against success.” Spy has no doubt many wealth managers do add value, but the frustration is real here because there is more than a grain of truth in it.

Schroders, with £774bn ($1017.65bn) under management, will appoint its current CFO, Richard Oldfield, as its next CEO, according to the Financial Times. Spy has no doubt that Mr. Oldfield is a very smart guy. However, in his experience, when the bean counters are in charge the first thing that happens at firms is that costs start getting cut, but, unfortunately, often at the expense of creativity and investment.

What percentage of China’s population is now over 60? It is 21.1% according to the Ministry of Civil Affairs. That equates to 296.97 million people and is the first time the number has risen above 20%. Any Chinese investment thesis that does not take into account that rather scary demographic profile is surely doomed to failure.

Spy’s quote of the week comes from that venerable font of knowledge, Bruce Lee. “Adapt what is useful, reject what is useless, and add what is specifically your own.” Perhaps if you are not into karate, try Marlene Dietrich instead, “Darling, the legs aren’t so beautiful, I just know what to do with them.”

Until next week…