And so the great debate begins: have we seen peak inflation? One half decent print of the CPI out of the US and economists are scrambling over themselves to revise their forecasts for rates, election results, housing and a whole lot more. “Supply chains are getting much more fluid, that is for sure”, a local wealth manager said to Spy. “But that doesn’t mean the consumer will spend more. It is all about earnings from here and, on that front, I am not as optimistic. Flattish inflation is one thing, you still need to make money.” Nailed it.

Spy can barely go a few hours without somebody talking about private markets. With good reason it would seem. This short YouTube video of Jenny Johnson, CEO of Franklin Templeton, talking about buying alternative investment companies puts it all in perspective. She explains succinctly that there are now half the number of public companies than there were in 2000 and we now have five times as many private equity-backed businesses that stay off market, and for much longer. The key point being, while the companies are off market, a lot of the capital appreciation is taking place and public market investors are missing out. Therefore, TINA springs to mind – there is no alternative.

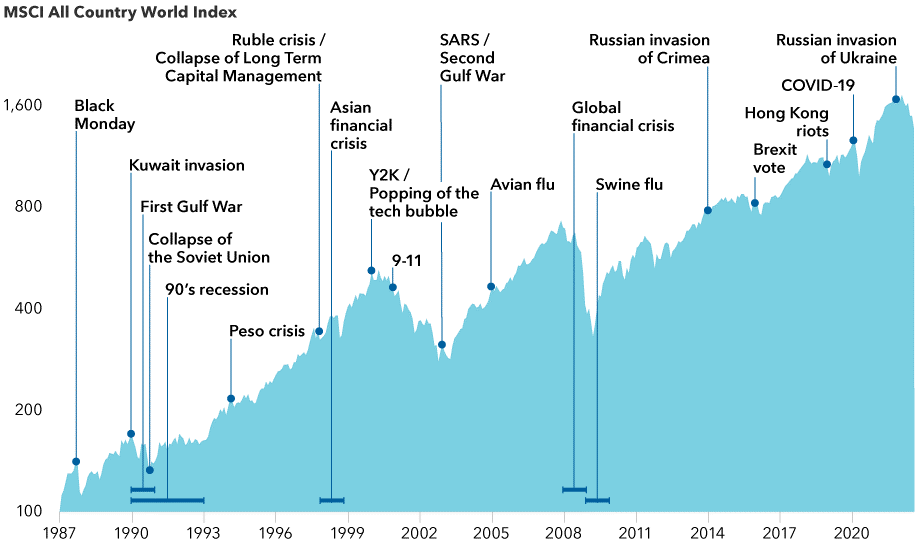

A great thought leadership piece from Capital Group this week. A few of their managers are discussing what they have learned about bear markets. Lisa Thompson, a portfolio manager, writes, “When cycles shift, market leadership changes. So, in today’s rising rate environment, I am focused on opportunities to invest in lower priced companies that generate strong cash flow. I think of this theme as the Revenge of the Nerds. I am generally staying away from the cool kids of the last decade — glitzy tech and media companies — and looking for opportunities among the unpopular kids in those industries hurt by the low cost of capital, poor capital allocation and adverse regulations.” This came with a great chart too.

Whilst people gloomily went off for their summer holidays, Mister Market decided to have a decent rally. In fact, the S&P 500 is now at the highest point it has been in three months. The big question everyone is asking: is this a bear trap or the real deal? Spy has heard some portfolio managers describe this as the moment of “maximum danger”. Apple, Microsoft, Alphabet, Amazon and Tesla alone have added at least $1.3tn since the beginning of July. Will that gain last or will it evaporate as fast as it did in the first six months of the year? If you were hoping Spy would have some wisdom, you are much mistaken. He is as confounded as the rest of the market. Tech funds have enjoyed the rally, though. J.P. Morgan’s US Technology Fund is up 19% in the last month. T. Rowe Price ‘s Global Technology is up even more at a whopping 24%.

“What a difference a day makes, twenty-four little hours” sang Dinah Washington (and many other artists since). Whilst it is not a day, five years in fact, but certainly the tune has changed. In 2017, BlackRock commented on Bitcoin, “Bitcoin is the index of money laundering” Fast forward to 2022, and the company reports rather warmly “We are seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets.” In fairness to BlackRock, he who is so stubborn they never change their mind when the facts change, is by far the greater fool, in Spy’s humble opinion.

Another asset manager comping to this party? Abrdn. This week, Stephen Bird, Abrdn’s CEO, went on record about digital assets, “You can expect more from me very shortly on this.” The race is most certainly on.

For consumers, Amazon’s secret weapon is often considered to be its Prime service. For Spy, it is AWS. Consider this: AWS’s revenue in 2021, $62 billion, was higher than the revenue of 448 other companies in the S&P 500. You, and just about everybody else, is reading something on a website or in an app that is stored in the AWS cloud every few minutes, of every day. And that isn’t changing any time soon.

Good stat from Cerulli Associates this week. ETF assets under management in Asia, excluding Japan, over the last five years, have risen by 217% to reach $422 billion by the end of 2021. This is a stellar compound annual growth rate of 33.5%. Asia took a little longer to jump on the ETF bandwagon but is playing catch up, fast.

Talking of ETFs, Direxion has launched the Daily Electric and Autonomous Vehicles Bull 2X leveraged ETF, for those who truly believe and want to place a racier bet on the sector. The ETF only invests in about 25 stocks, therefore it is super concentrated. The fund includes charging station manufacturers such as ChargePoint and Blink, companies involved in software development,m electric vehicle manufacturers such as Tesla, Lucid, and NIO and those firms manufacturing of various EV components.

The song and dance about breaking up HSBC continues. If HSBC thought it had done enough to stave off the calls for a split, Ping An, its largest shareholder, seems to have different ideas. Get out the popcorn.

Until next week…