While Thailand equity markets did not escape global correction in February, Thai investors saw it as a buying opportunity, fund flows data from Morningstar show.

While Thailand equity markets did not escape global correction in February, Thai investors saw it as a buying opportunity, fund flows data from Morningstar show.

Kasikorn AM’s Benjarong Techamuanvivit gives FSA an update on both Thai regulations and where she sees product demand.

Foreign investment funds continue to be popular in Thailand, with assets growing 15% annually to THB 1.17trn ($37bn) in 2017, according to Bank of Thailand’s 2017 financial stability report.

Amundi Asset Management is considering setting up wholly foreign-owned enterprise (WFOE) in China and plans to launch more Hong Kong-domiciled funds, according to Zhong Xiaofeng, the firm’s CEO for North Asia.

Partnering with domestic fund managers to launch feeder funds remains the best strategy for foreign asset managers looking at the Thailand and Malaysian markets, according to analysts from Boston-headquartered Cerulli Associates.

Thai investors were optimistic about the local economy in 2017, adding to their equity holdings while investors in China and Hong Kong took money out of equities.

Two mutual funds in Thailand and one in Hong Kong were among the 10 best-selling newly-launched products in Asia-Pacific in 2017, according to a Broadridge Financial report.

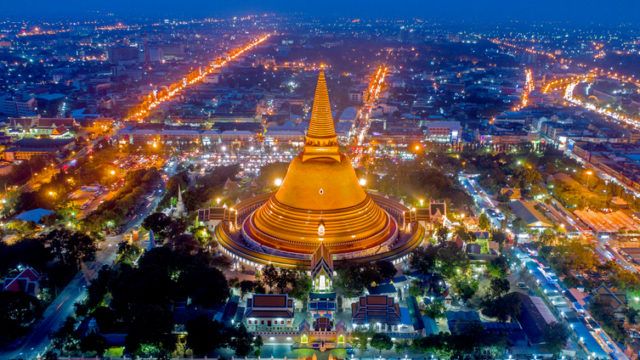

Infrastructure investments in Thailand and Indonesia are expected to boost demand for commercial financing and to benefit local banking sectors, according to Eric Mok, a senior executive director at Franklin Templeton Investments.

In a step toward ESG funds, Thailand’s asset managers are launching a series of domestic equity funds focused on companies with high corporate governance scores.

T Rowe Price has partnered with Thailand’s Land and Houses Fund Management (LH Fund) to launch a global income fund for domestic investors.

Part of the Mark Allen Group.