When investing in emerging markets (EM) debt with an ESG perspective, T Rowe Price recommends identifying companies that are seeking to make a “positive impact”, rather than adopting conventional “backward-looking” analysis that relies on third party sources.

“We utilize sovereign research and analysis to inform macro views that underpin our corporate positioning,” Samy Muaddi, portfolio manager of the T Rowe Price Emerging Markets Corporate Bond Fund, told FSA.

“An EM country with better sovereign ESG characteristics, and a more robust regulatory environment, will typically provide a better backdrop for corporate investing and potentially encourage better corporate ESG practices,” he said.

The US-based asset manager prefers utilities that are moving away from fossil-fuel generation towards renewables, technology, media, and telecom companies, as well as industrial companies that have a clear path towards reducing greenhouse gases emissions.

“From an ESG perspective, we avoid certain segments of the financial sector where we have questions about their business models,” said Muaddi.

“Specifically, we believe certain ‘usury lenders’, which prey on the unbanked in the economy, inhibit social mobility and are vulnerable to future regulation unless they change their business models.”

The Luxembourg-domiciled $260m Emerging Markets Corporate Bond Fund was launched in 2011 and is available to Singapore retail investors.

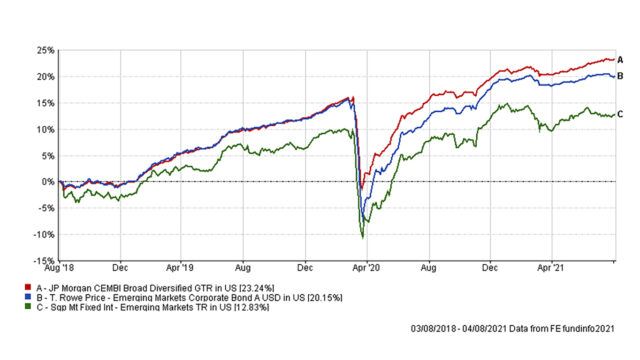

The fund has posted a 20.15% cumulative return over three years, versus the sector average return of 12.83%, but it has underperformed its JP Morgan CEMBI Broad Diversified Index benchmark (23.24%) over the same period, according to FE Fundinfo.

In terms of country diversification, its biggest exposure is China and Mexico — 10.4% and 10.1% respectively — and the fund also has allocations to India (6.7%), Columbia (5.7%), and the United Arab Emirates (5.3%).

Tracking trends

When integrating ESG factors in investment decisions, Muaddi suggests that investors focus on the inherent and evolving characteristics of each industry.

While the extraction industries are more prone to having riskier ESG characteristics, Chinese real estate companies are geared to more sustainable business trends and have shown good progress in integrating some ESG factors, he said.

Yet, although energy utilities and mining companies account for a relatively large share in the EM, companies which improve on their practice are expected to benefit from regulatory support and are likely to have lower capital costs.

Muaddi also looks at governance trends at the country level, which can have a profound positive or negative impact on populations and businesses. For instance, improvements in areas such as property rights, education, institution-building, free speech, rule of law, and wealth equality can all be signs of progress.

Investors should also look out for rapidly changing regulations, which drive shifts in the way companies conduct their business and the extent and quality of their ESG disclosure.

“Particularly when it comes to environmental regulation, the landscape will be very different going forward. For decades, companies have borne little to no cost for the externalities of pollution or use of natural capital,” said Muaddi.

T Rowe Price Emerging Markets Corporate Bond Fund vs sector average and benchmark