Elizabeth Soon, Pinebridge

Pinebridge remains sanguine on the Indian equity markets, which has shown resilience this year on the back of improving fundamentals at the macro as well as micro level, Elizabeth Soon, head of Asia Ex-Japan Equities, told FSA.

At the macro level, India’s external vulnerability to a possible rise in global interest rates has been reduced significantly, while at the micro level there are improvements in corporate balance sheets.

“We are also seeing many ‘new age’ start-ups looking to raise capital from the public markets. This is keeping the primary market extremely robust with IPOs in demand resulting in lower cost of equity for companies,” she said.

There is a high probability of adding value by focusing research on individual companies and their prospects, according to Soon. The strength of the business model, the people running the business, and the valuations to be paid are the three most important criteria that she is looking at, and without being constrained by market capitalization or sector allocations.

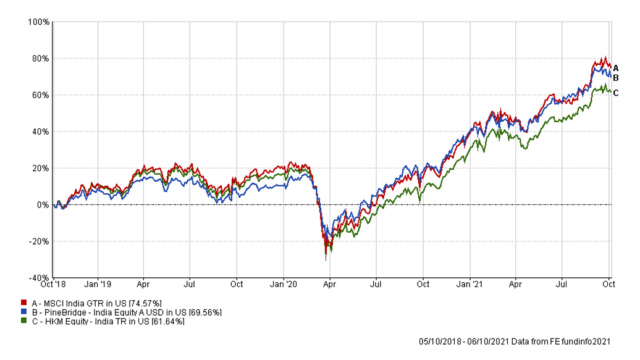

Soon manages the $968m Pinebridge India Equity Fund, which has posted a 69.56% three-year cumulative return in US dollars, compared with 74.57% by its MSCI India Index benchmark and 61.64% by its sector average, according to FE Fundinfo.

The fund invests primarily in equity and equity-related securities of companies listed on stock exchanges in India or closely related to the economic development and growth of India.

As at 31 August of 2021, the fund’s top five holdings are: Divi’s Laboratories, Bajaj Finance Ltd, Infosys Ltd, Shree Cement, Tata Consultancy Services. Top five sectors it holds are: information technology, financials, health care, materials, and consumer discretionary.

Corporate change

“India is at a very interesting juncture. Because of disruption across industries, Pinebridge sees many investment opportunities,” Huzaifa Husain, head of India equities, told FSA.

What he calls “force vectors”, such as digitisation, direct-to-consumer sales, environmental imperatives, geopolitical rewiring of supply chains, and new demand for health and houses are driving the economy and boosting corporate prospects.

For instance, India’s strategy of investing in public digital software is transforming the way the government interfaces with its citizens. This is spurring a lot of innovation where companies are building conveniences on top of these public rails, according to Husain.

“By using digital identity credentials, a person can open a deposit account in a bank of which they are not a customer using a payment app of another company, which itself is using the underlying public infrastructure that allows movement of money between various banks,” he explained.

These linkages impact the traditional advantages of legacy companies, such as a physical presence, brand value, distribution strength, customer database, and others, which will likely be rapidly eroded.

Companies that can swiftly scale up by combining their software skills, the available public infrastructure, their marketing prowess, and a low-friction customer transaction interface should see rapid growth, said Husain.

“We believe vigilance and patience are essential when investing in India. That’s why our approach is to carefully select companies that can see opportunities in the shifting landscape and navigate their way through the transformation,” Soon added.

Pinebridge India Equity Fund vs benchmark and sector average