Although markets have already priced-in a deluge of rate cuts from the US central bank, the opportunity for bond investors has not completely passed.

This is according to Mary-Therese Barton, Pictet Asset Management’s chief investment officer of fixed income, who said the income component of the asset class will drive higher returns in the long-run.

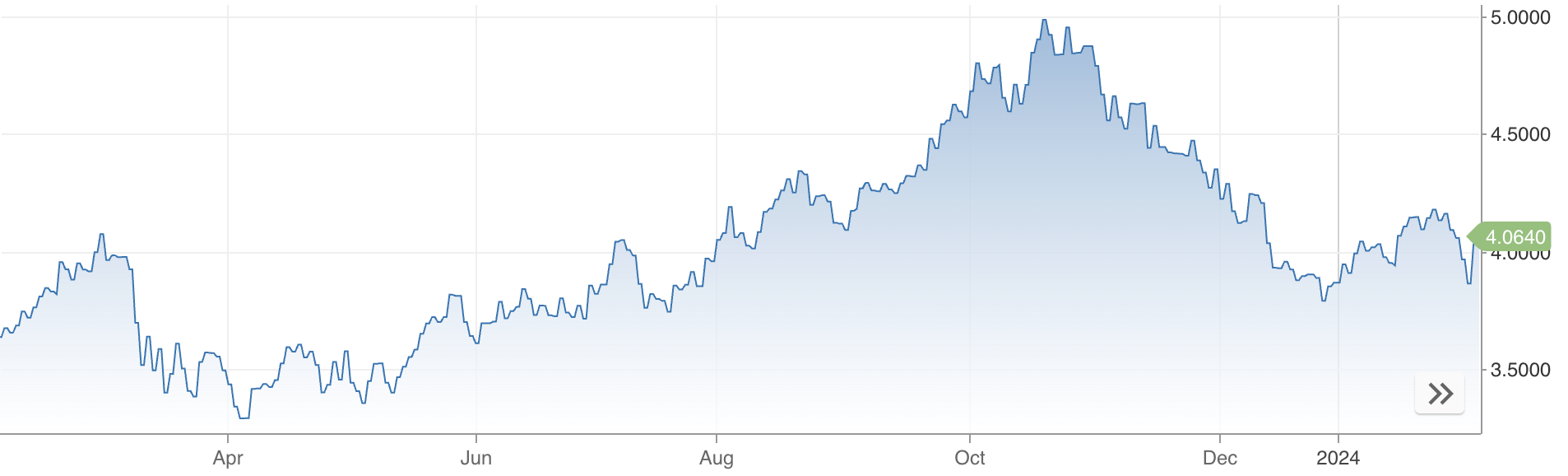

In mid-October the US 10-year treasury yield dropped from its peak at 5% and trades roughly at the 4% level as the market anticipates rate cuts from the Fed.

Although more rate cuts are expected further down the line, Barton believes that the natural neutral monetary policy rate will be structurally higher than what the market expects due to higher inflation expectations, higher real rates and a higher term premium.

“We think an environment of higher neutral rates for longer means that you can go back to basics of fixed income,” she said. “It’s the return of income.”

“People say is it time for fixed income do we need to come in now? Well yes, it will be time but there’s no need to rush into it,” she continued.

“We think we’re going to see more volatility in markets going forward, which means in duration, you’re going to have to be more tactical in how you position in portfolios.”

“But ultimately over the longer term, those elevated income levels are going to be attractive in terms of your portfolio construction.”

Barton also said that elevated rate levels will mean that credit selection will become more important in both the corporate space and even in the sovereign space where debt levels and issuance have come more into focus.

“It isn’t a race to allocate”

Over the next two years, the market is pricing in 200bps of rate cuts which in Barton’s view, seems overdone given the consensus for a soft-landing scenario.

As such, she is closely monitoring the growth and inflation data which could undo some of the rate cuts currently priced-in by the market.

“The market consensus is more of a ‘goldilocks’ environment, but as the data comes in hotter, that’s where we can start to see more of those interest rate cuts taken out,” she said.

So if expectations for rate cut have gone too far, does that limit the future capital appreciation potential offered by bonds? Yes, but higher yields make the asset class attractive from an income perspective, according to the CIO.

“If we’re expecting less room for duration to rally, then that’s going to be less space for capital appreciation from the duration component,” Barton said.

“But what that does provide is where the yield levels remain relatively high, I think that becomes an attractive level for long term asset allocation.”

She thinks it makes a strong case for moving up the yield curve into selective high yield and emerging markets.

“It isn’t a race to allocate,” she added. “It’s a long-term decision to allocate because you’re allocating for the income and the potential for capital appreciation from idiosyncratic stories within those indices, thematic stories, sector stories.”

She said the upcoming environment is going to be exciting for active bond investors due to the dispersion that she expects to see in the high yield and emerging markets.

This dispersion will even be present in the developed market rate space due to different trends in the economic, fundamental and political trajectories of the UK, US and the EU, for example.

She added: “As we reassess this higher volatility environment in fixed income, there is a lot of potential for generating alpha and active management in the highly liquid developed market space.”