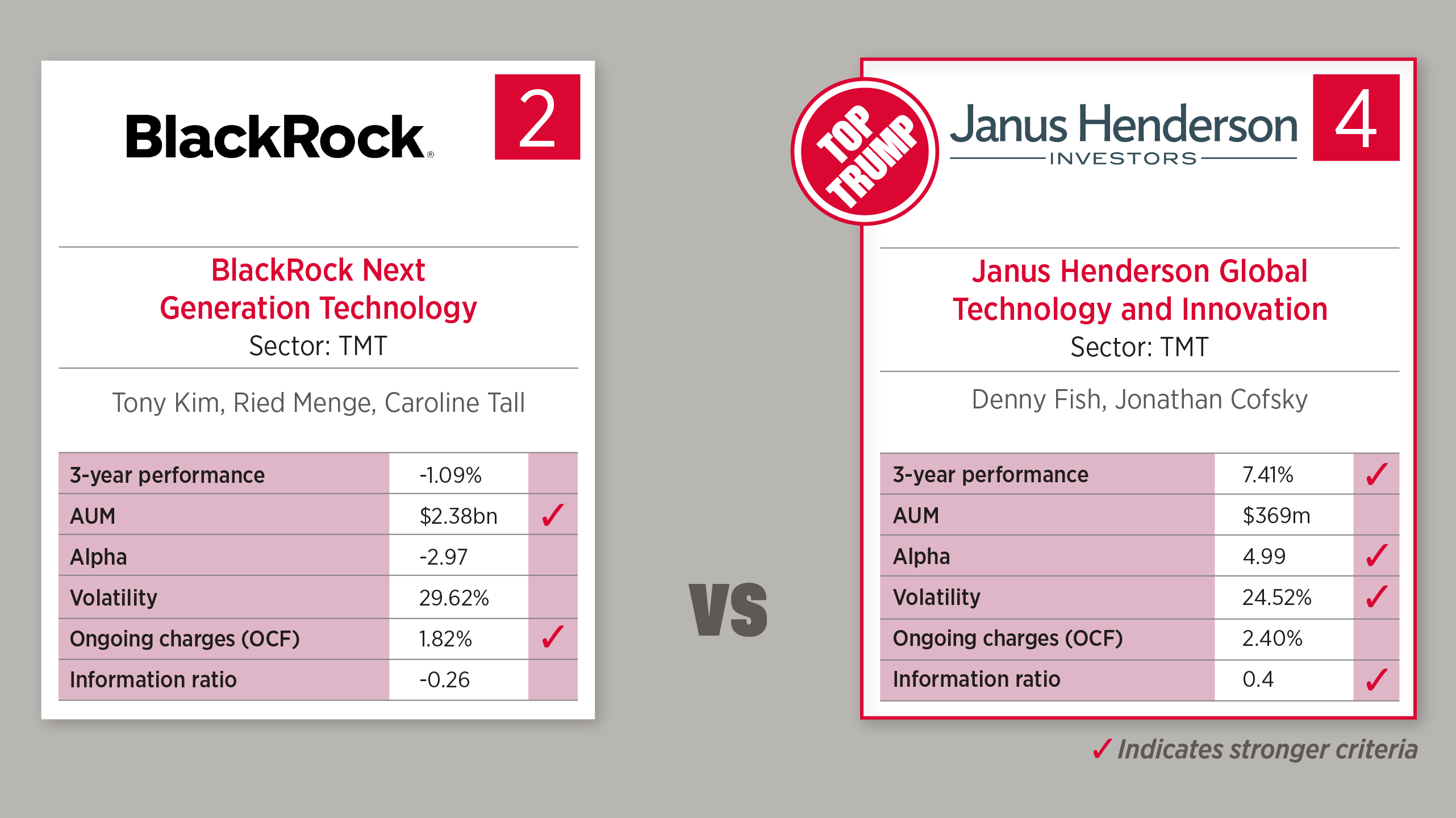

Based on the popular 80s card game, each week we select an asset class and use FE Fundinfo data to compare two funds based on their 3-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide who is the Top Trump.

This week the Janus Henderson Global Technology and Innovation fund defeats the BlackRock Next Generation Technology fund 4:2.

BlackRock Next Generation Technology fund

The fund invests at least 70% of its total assets in the equity securities (eg. shares) of companies globally whose predominant economic activity comprises the research, development, production and/or distribution of new and emerging technology.

Sector breakdown:

- Semiconductors and semiconductor equipment (34.96%)

- Software (19.42%)

- Electronic equipment, instruments and components (8.67%)

- Entertainment (4.37%)

- Technology, hardware, storage and peripherals (4.23%)

- Financial services (4%)

- IT services (3.07%)

- Automobiles (3.04%)

- Hotels, restaurants and leisure (2.82%)

- Broadline retail (2.75%)

- Professional services (2.41%)

- Other (10.27%)

Geographic breakdown:

- USA (54.28%)

- Taiwan (8.67%)

- Netherlands (8.32%)

- Japan (5.73%)

- UK (4.81%)

- Australia (3.56%)

- Korea (3.45%)

- China (3.13%)

- France (1.76%)

- Germany (1.56%)

Janus Henderson Global Technology and Innovation fund

The fund invests at least 80% of its assets in a concentrated portfolio of shares selected for their growth potential. The fund may invest in companies of any size, which are technology-related or will benefit significantly from technology, in any country.

Top holdings:

- Microsoft Corp (9.46%)

- Apple (7.53%)

- ASML Holding (6.52%)

- Workday (4.72%)

- Nvidia Corp (4.7%)

- Mastercard (4.07%)

- Advanced Micro Devices (3.62%)

- Taiwan Semiconductor Manufacturing Co (3.62%)

- Lam Research Corp (3.57%)

- Alphabet (3.34%)

Country breakdown:

- USA (82.68%)

- Netherlands (7.1%)

- Taiwan (3.75%)

- Canada (3.03%)

- Brazil (1.11%)

- Israel (0.84%)