Rising interest rates has been a drag on real estate investor returns over the past few years, but this trend could be set to reverse.

Real estate has been battered by rising interest rates as it is highly sensitive to the cost of borrowing for construction, transactions, and valuations.

However, Tim Gibson, co-head of global property equities at Janus Henderson, believes the sector is finally at an inflection point.

“If rates rising are bad for listed property, then the opposite must also hold true,” he said at the FSA Investment Forum in Thailand.

“We’ve seen historically that we don’t even need rates to be cut, we just need the Fed to stop raising rates,” he added.

He highlighted how the confluence of a high dividend yield, decent earnings growth and a multiple re-rating could make for strong total returns in the real estate sector.

“If we look at where listed-real estate is today, we’ve got a dividend yield of 5%, we’ve got earnings growth of another 5%, the cherry on top is the multiple re-rating,” he said.

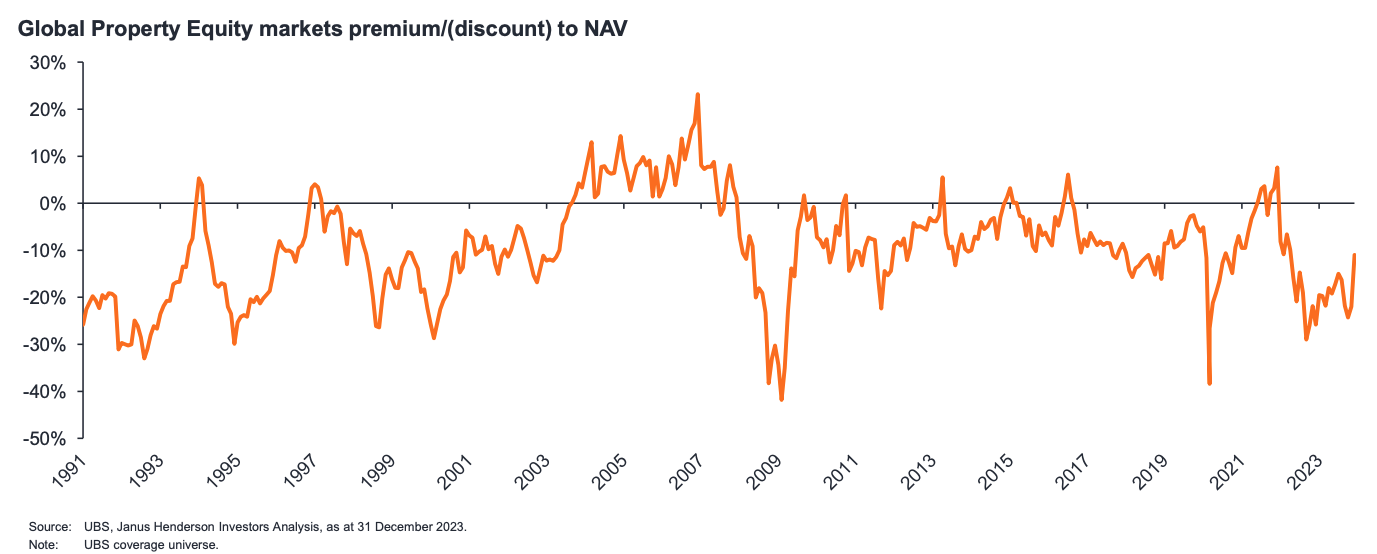

He also pointed to the valuations of public real estate versus private real estate, where public real estate is trading at a notable discount to their net asset values (NAV).

“We are two years into this downward cycle, so for our companies, they have already taken write-downs to the value of their real estate – so it’s a discount to what is fast becoming a bottom of the cycle NAV.”

This is where the value proposition is for public real estate versus private real estate, according to Gibson – who implied that the NAV could be set to rise alongside a discount narrowing.

While private property markets are expected to bottom in 2024, he believes public REITs have already bottomed.

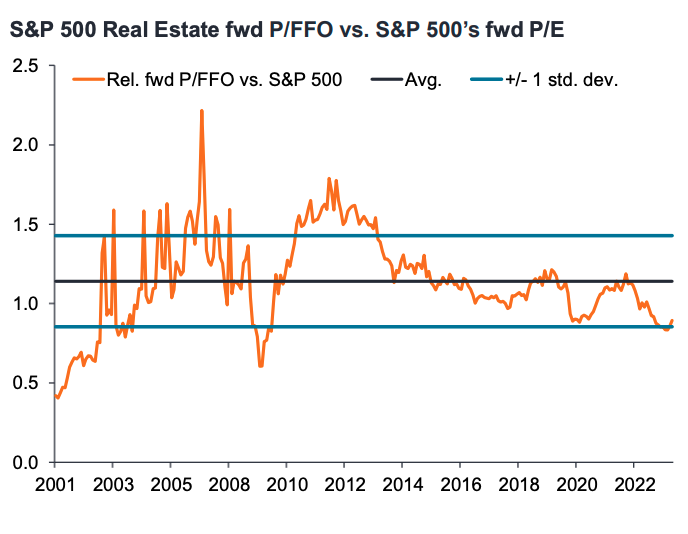

He also flagged how the real estate sector is trading at its widest discount to the broader market since the global financial crisis.

He said: “We should be expecting a continued positive re-rating of the real-estate sector now that a lot of the left-tail negative risk has been taken off the table.”

One tail risk for real estate is if the Fed hikes interest rates again to combat sticky inflation, but recent commentary from the US central bank seems to have made this outcome more unlikely.

Gibson stressed that the timing of any impending rate cuts don’t matter, rather that the direction of travel for interest rates is more important.

However, he warned investors need to be active in the sector, with different sectors faced with different drivers of return and expectations than a few years ago.

For example, short-duration real estate assets were in favour during rising rates, but with falling rates longer duration real estate assets are expected to be in vogue, he said.

In terms of investment themes, he favours sectors such as data centres, life science lab space and logistics assets.