Whenever market participants come up with acronyms for leading stocks, they almost always underperform afterwards.

This is according to Richard Clode, portfolio manager of the $4.3bn Janus Henderson Global Technology Leaders Fund.

“My view is as soon as we come up with a nice marketing story or acronym – whether it is BRICS, FANG, Granola, Mag Seven – you can pretty much guarantee that you will never find a period that they will outperform ever again,” he said.

Indeed, there has been a notable divergence in performance of the so-called Magnificent Seven stocks: Nvidia, Meta, Amazon, Microsoft, Alphabet, Apple and Tesla year-to-date.

So far Nvidia is up 82% and Meta is up 52%, whereas others such as Apple and Tesla are down 8% and 33% respectively.

Clode said this divergence in performance should not be particularly surprising because of how different the companies are.

“They have completely different AI positioning. They have completely different valuations. Some have exposures to China, some don’t; some have different regulatory risks, so why would they perform together?” he said.

“Picking stocks is hard, it always has been. So this kind of narrative of: ‘oh yeah, so easy to just buy those seven over there’ – has never worked for any extended period of time and I don’t expect that to work going forward.”

Continuing divergence

Clode also argued that the rapid pace of AI development and higher interest rates will mean that this divergence will likely continue.

“The winners of the past aren’t necessarily going to be the winners in the future. We saw that in the PC to mobile transition,” he said. “Money is not free anymore and when money is not free, you have winners and losers.”

“You’ve got to be able to fund your business – you can’t just get free money from debt markets; those days are over. So as a result, the winners will disproportionately do better than the losers.”

While the fund that Clode manages still has exposure to the Magnificent Seven, it is significantly underweight the recent laggards.

Apple, for example, is no longer in the fund’s top-10 for the first time in a decade.

Apple was up 49% during 2023 but much of this performance had “nothing to do with fundamentals,” according to Clode.

He pointed to last year’s large inflows into technology ETFs on the back of AI optimism, noting the large weighting Apple holds in the various indices. The MSCI World IT index for example, had as much as 20% of its portfolio allocated to Apple at some points during 2023.

He also noted how strong balance sheets were a massive factor in the market last year. Apple had one of the strongest balance sheets in the public equity space with $162bn cash on hand in late 2023.

Investors flocked to companies with strong balance sheets in 2023 for relative safety amid high interest rates and growing fears of an upcoming a recession.

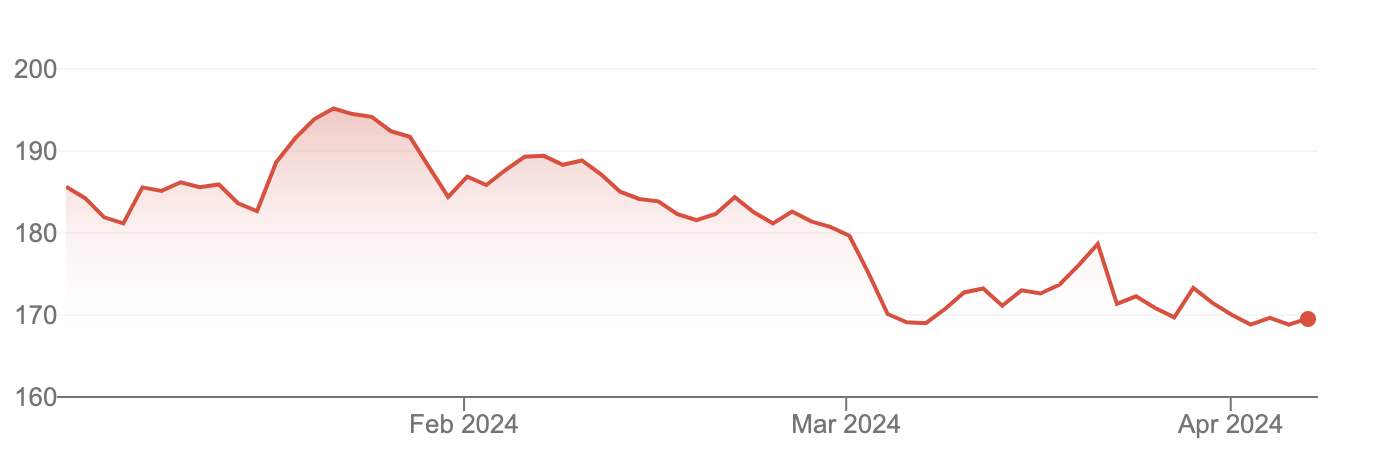

However, this year, Apple’s share price has been struggling following disappointing sales for its latest iPhones in China and growing concerns over the lack of a clear AI strategy.

Performance of Apple year-to-date

Clode flagged Apple’s exposure to the Chinese consumer market – which itself is suffering from a prolonged real-estate downturn and increasing competition from local smartphone maker Huawei.

He said: “It hasn’t articulated its generative AI strategy, but maybe that will change at WWDC in June. It doesn’t have the GPUs it wants, and it’s had to get in the queue for Nvidia. It has a bit more regulatory risk than people expect. So, for all those reasons, we’ve really cut back exposure.”

Indeed, just last week the US Justice Department filed an antitrust lawsuit against Apple, accusing the firm of illegally monopolising the smartphone market.

The company is also facing growing scrutiny on how it should utilise its massive balance sheet following the cancellation of its Apple car endeavour after pouring roughly $10bn into the project.

On the flipside, Clode said one stock from the Magnificent Seven he believes is more underappreciated is Amazon.

Amazon’s cloud computing division AWS saw growth decelerate in 2023, with 13% sales growth in its latest quarterly earnings report, far below the 40% growth rate seen at the end of 2021.

However, Clode believes the growth will come back as the company will be well positioned for AI applications deployed in the cloud.

He is also optimistic on the company’s retail business, which expanded massively during the pandemic and became a drag on the wider business.

He said that business is now “rationalising very fast” and that there is “material upside potential in the retail margins you’re going see as they optimise their efficiency”.

“It’s also on a fairly reasonable valuation, which is not something you’d normally associate with Amazon as a stock,” he added.

Over the past year, the Janus Henderson Global Technology Leaders fund is up 47% compared with the sector average of 25%.