More than seven in 10 investors prefer personal advisers when seeking wealth management advice, according to a recent study by Navigator Investment Services and EY.

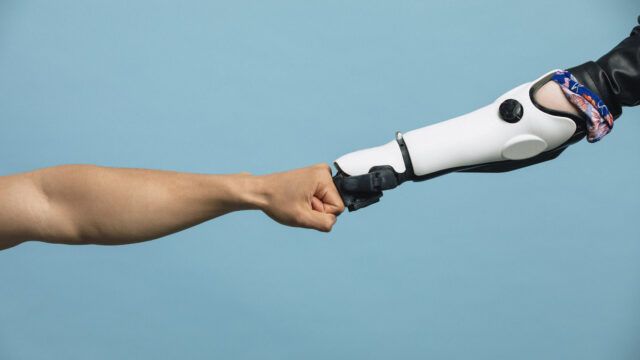

“While the rate of digital adoption has been increasing, the desire for a greater human touch continues to grow in tandem. Our report validates the value of advisory services as a highly trusted source of advice that will not be easily replaced by self-directed, digital investment options,” said Akhil Doegar, chief executive officer at Navigator.

Among the 72% of investors who prefer to retain a human touch when it comes to advisory services, 35% responded that they favour adviser-led relationships, while 37% would look for a combination of both digital and physical services.

The appetite for purely digital-led relationships has also been declining at the higher end of the wealth pyramid, with only 6% of the surveyed ultra-high-net-worth investors preferring digital-led relationships.

“The preference for an adviser-led relationship in these segments can be attributed to their complex and bespoke wealth planning needs, stemming from larger sums managed, whether inherited or self-earned,” the report added.

Navigator noted that the results correlate with a 2022 CFA Institute study, which found that 66% of retail investors consider their primary financial adviser as their most trusted source for wealth management advice, while only 9% see online research and 7% see friends and family as their most trusted source for advice.

Navigator and EY launched the advisory report, entitled titled “Advancing the Art of Advisory: Is Advisory Still Relevant?”, which examines key trends in the global wealth management industry.

When selecting a wealth management provider, 34% of the surveyed investors said the top criteria is “trust that their advisers will act in their best interests”, followed by the ability to achieve high returns (21%) and their commitment to ethical conduct (15%).

The report also showed that investors are more likely to engage advisory services during major life events, such as starting a new business (61%), buying a home (60%) or inheriting money (59%).