Jimmy Choong, HSBC Global Asset Management

The HSBC Asia Multi-Asset High Income Fund was available to retail investors in Hong Kong from Monday.

The initial public offering period will end on 15 January 2021 and the fund will begin trading on the same day, according to Alison Brown, head of sales for wholesale business at HSBC Global Asset Management (HSBC GAM).

“In an ongoing low interest rate environment, investors are eager to seek alternative sources of income while maintaining exposure to growth opportunities, particularly as the world transitions to a post-pandemic recovery. Risk management is a key component in the investment process,” she told a media briefing yesterday.

The product is a unit trust domiciled in Hong Kong, and could potentially be offered to mainland Chinese investors through the Mutual Recognition of Funds scheme in a year’s time provided it meets all other eligibility criteria, she said.

The annual management fee is 1.25%, and dividends will be paid monthly (although payments are not guaranteed). Its base currency is US dollars, and share classes are also available in Hong Kong, Australian and Canadian dollars, the euro, pound sterling and renminbi.

Yield enhancement

The fund, which is benchmark agnostic, aims to capture higher income opportunities in Asia by using a multi asset approach with additional yield enhancement techniques.

These include adding higher yielding asset classes, tilting equity to higher dividend stocks and writing covered calls (to collect the option premia) on equities.

“Asia ex-Japan is the only region globally to have experienced positive GDP growth in 2020. As we step into a year of restoration, we believe Asia remains a fast-growing region with good macroeconomic fundamentals,” said Hong Kong-based Jimmy Choong, associate director for multi-asset at HSBC Global AM, who is the manager of the fund.

“Asian equities are currently trading at discount compared to the major developed markets, giving a higher capital growth potential,’’ he added.

“Meanwhile, with policy rates globally reaching all-time lows, Asia high yield bonds offer competitive yields and shorter duration compared to peers. In addition to yield, Asia credit also has the benefit of lower default rates, helping make the case for investing in Asia credit stronger.”

According to HSBC Global AM data, the current average spread for Asian high yield credit has narrowed to 679 basis points (bps) from the widest level of 1579 bps during the sell-off in late March, but still attractive compared with 369bps two years ago, and much wider than the current 386 bps for the ICE BofA US High Yield Index and 365bps for the ICE BofA European Ccy High Yield Index.

Meanwhile, default rates in Asia are running at between 4% and 5%, compared with single-digits, according to Blackrock research.

Portfolio allocation

A model portfolio has 51.7% allocated to Asian high yield bonds, 38.7% to the manager’s “enhanced income strategy”, which includes high dividend paying Asian equities, as well as writing covered calls on equities) and a 9.6% to Asian property, including Reits.

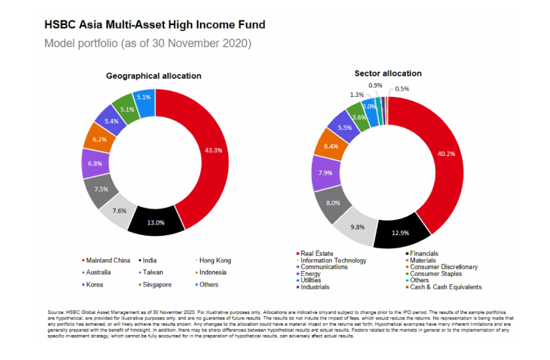

Geographically, the biggest weighting is China (43.3%), followed by India (13.0%) and Hong Kong (7.6%). The largest sector exposure is to property (40.29%) and industrials (12.9%), and there is a 9.8% allocation to the low dividend paying information technology sector, so that investors have some exposure to high growth companies.

“The fund will follow the same investment process used across HSBC’s global multi asset platform, but it will be enhanced to increase the natural yield of the fund and adopt a more aggressive, higher risk stance than its peers,” said Choong.

Several asset managers, including Blackrock, have promoted their Asian fixed income funds in recent months, emphasising the higher yields available compared with US and European bonds, as well as lower corporate default rates in the region.

Last month, Pictet Asset Management received a green light from the Securities and Futures Commission to offer the Pictet Asian Bond Income Fund to Hong Kong retail investors, which will invest across a “blend of Asian investment grade and high yield corporate bonds that targets income optimisation while avoiding concentrated credit risks,” a spokeswoman told FSA at the time.

It will be Pictet AM’s second Hong Kong-domiciled fund, four years after the firm launched the Pictet Strategic Income Fund, a multi-asset product that has garnered assets of $143m, according to FE Fundinfo.