European equities have not fared as badly as might have been expected during 2022 given the war in Ukraine, elevated inflation, rate hikes and an economy that is structurally growing slower than the US.

Since Russia invaded Ukraine in February, the war has weighed heavily on economic growth in Europe, particularly due to the continent’s dependence on Russian gas.

Coupled with the strong US dollar, the surge in commodity prices has meant that “the most important losers were in developed markets, for example the euro,” said Xueming Song, currency strategist at DWS in an earlier interview with FSA.

Despite considerable risk facing the economy in 2023, some may see it as an interesting asset class to consider if they expect that the European Central Bank will pause rate hikes sooner and at a lower level than the US Federal Reserve.

Against this backdrop, FSA asked Isaac Poole, chief investment officer at Oreana Financial Services, to select two European equity funds for comparison. He chose the T. Rowe Price European Equity Fund and the MFS Meridian European Research Fund.

| MFS Meridian | T Rowe Price | |

| Size | $2.27bn | $88m |

| Inception | 2006 | 2017 |

| Managers | Team | Tobias Mueller |

| Three-year cumulative return | 2.54% | 1.86% |

| Three-year annualised return | 2.74% | 2.32% |

| Three-year annualised alpha | 0.88 | 0.45 |

| Three-year annualised volatility | 23.83% | 23.66% |

| Three-year information ratio | 0.12 | 0.07 |

| Morningstar star rating | ***** | **** |

| Morningstar analyst rating | Silver | Neutral |

| FE Crown fund rating | *** | ** |

| OCF (retail share class) | 0.82% | 0.75% |

Investment approach

While both funds have a tilt towards quality stocks, the T. Rowe Price fund has a clearer growth bias in its portfolio.

When choosing names to invest in, the manager tends to look for companies that stand to benefit from structural or idiosyncratic changes, or areas where views that go against the consensus can be put to play.

Apart from looking at sustainability of returns, management, financial models and the company’s position in industry, the manager also attaches great importance to companies that are able to generate an internal rate of return of 10% or greater, noted Poole.

“There is a focus on larger-cap stocks as well as a growth bias, reflecting the portfolio manager’s background, although there can be allocations to mid-cap stocks as well,” he said.

“Out of a universe of 300-400 stocks, and a watchlist of about 100, the portfolio is typically comprised of around 50-80 positions.”

When compared with the MSCI Europe benchmark, the fund is underweight the consumer staples and energy sectors and overweight industrials and business services, financials and communication services.

“The key difference however is the portfolio construction and positioning process, with MFS Meridian using a team of experienced research analysts to vet and select ideas, while T. Rowe has a single manager – although ably supported by a strong pool of research analysts.”

Isaac Poole, Oreana Financial Services

The investment team for the MFS Meridian fund looks for companies with better than average growth, quality management and good returns.

“The research analysts are critical to the process and they provide broad bottom-up research from meeting with companies, sell-side research and then assessing valuations, taking into consideration business risks within each analysts’ own models,” said Poole.

He also noted that there are some sector constraints and new positions cannot be more than 5% of total assets, while historically the fund has been investing in large-cap companies with no clear value or growth bias.

Compared with the benchmark, the MFS Meridian fund is overweight the UK, the top country its assets under management are allocated to.

The portfolio is also overweight financials, consumer staples and consumer discretionary among its top six allocations.

Poole believes both funds have a strong, time-tested process that is an important part of the attraction of these funds.

“The key difference however is the portfolio construction and positioning process, with MFS Meridian using a team of experienced research analysts to vet and select ideas, while T. Rowe has a single manager – although ably supported by a strong pool of research analysts.”

Fund characteristics

Sector allocation:

| MFS Meridian | T Rowe Price | ||

| Financials | 18.4% | Financials | 18.4% |

| Consumer staples | 13.8% | Industrials & business services | 17.4% |

| Industrials | 12.9% | Health care | 17.1% |

| Health care | 12.6% | Consumer discretionary | 9.5% |

| Consumer discretionary | 10.5% | Materials | 9.0% |

| Materials | 7.8% | Information technology | 7.0% |

| Energy | 6.5% | Consumer staples | 5.7% |

| Utilities | 5.2% | Communication services | 5.4% |

| Information technology | 5.0% | Energy | 3.6% |

| Communication services | 4.5% | Utilities | 3.3% |

| Real estate | 1.0% | Real estate | 1.3% |

| Equity warrants | 0.1% | ||

| Cash & cash equivalents | 1.7% |

Country allocation:

| MFS Meridian | T Rowe Price | ||

| United Kingdom | 26.7% | United Kingdom | 18.1% |

| France | 19.0% | Switzerland | 14.4% |

| Switzerland | 15.8% | Germany | 12.4% |

| Germany | 10.2% | France | 11.0% |

| Netherlands | 6.8% | Italy | 9.1% |

| Netherlands | 8.7% | ||

| Sweden | 7.9% | ||

| Spain | 6.2% | ||

| Finland | 4.0% | ||

| Portugal | 1.8% | ||

| Austria | 1.6% | ||

| Norway | 1.5% | ||

| Denmark | 1.2% |

Top 5 holdings:

| Aberdeen Standard | weighting | Blackrock | weighting |

| Nestle SA | Roche Holding | 3.9% | |

| Roche Holding | ASML Holding | 3.8% | |

| LVMH Moet Hennessy Louis Vuitton | AstraZeneca | 3.7% | |

| Linde PLC | LVMH Moet Hennessy Louis Vuitton | 3.5% | |

| Novartis AG | Siemens | 2.9% |

Performance

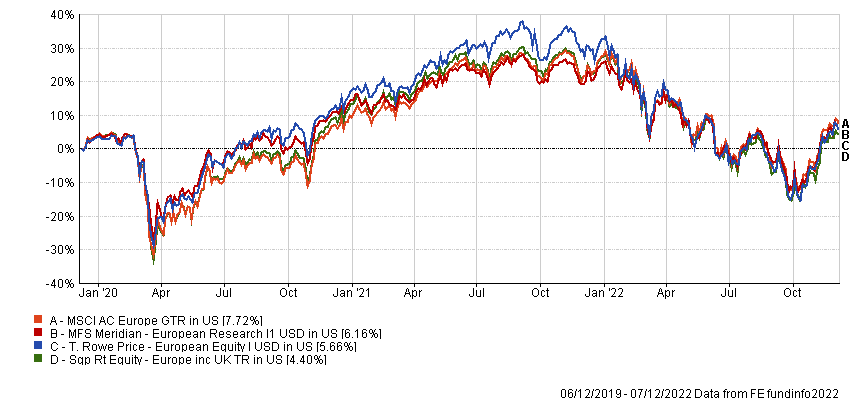

2022 has been a difficult year for equities and Europe has been no different, yet both funds have demonstrated long-term resilience by outperforming the sector average return.

Over a three-year period, the Europe inc UK sector posted a return of 4.4,% while the MFS Meridian fund and the T. Rowe Price fund generated returns of 6.16% and 5.66% respectively.

Looking at the performance year to date, the MFS Meridian fund posted a return of -15.57%, but still outperformed both the MSCI Europe benchmark at -15.69% and the sector average of -18.12%.

Yet, the T. Rowe Price fund returned -20.25% since the beginning of 2022.

Commenting on the performance of the MFS Meridian fund, Poole noted that it has a long-term track record of good returns, clearly reflective of the bottom-up stock selection process and the focus on quality stocks.

“The fund has sometimes underperformed in sharp rallies, but that is balanced by resilience during difficult quarters,” said Poole.

Although returns have underwhelmed in 2021 with a heavier tilt on consumer cyclical stocks, the overall risk-adjusted returns on offer look sustainable and reflective of the process, he added.

On the other hand, the T. Rowe Price fund has been struggled relative to the index as the fund has a zero weighting to energy.

“Given the short-term tenure as manager, the focus needs to be on recent performance, which makes it difficult to make meaningful comparisons, but over a shorter period the drawdown in 2021 was a difficult period,” said Poole.

“2022 has been similarly challenging but it is too early to draw major conclusions on how this relates to the manager’s process.”

Isaac Poole, Oreana Financial Services

The fees for both funds are reasonably well priced, noted Poole, with the MFS Meridian fund at 0.82% and the T. Rowe Price fund at 0.74% per annum.

Although both funds struggled through 2021 and in early 2022, Poole believes the challenge for T. Rowe Price is to stick to the process and show it can provide outcomes through challenging and good markets with its new management.

Discrete calendar year performance

| Fund/Sector | YTD* | 2021 | 2020 | 2019 | 2018 | 2017 |

| MFS Meridian | -15.57% | -13.07% | 10.54% | 10.69% | 22.39% | -8.74% |

| T Rowe Price | -20.25% | -19.01% | 8.97% | 16.64% | 20.11% | -8.49% |

| Mixed assets – international | -18.12% | -15.77% | 14.14% | 8.97% | 14.95% | -13.07% |

Manager review

Tobias Mueller became the sole manager of the T. Rowe Price fund in October 2020, though the transition period started from July that year.

He took over from former manager Dean Tenerelli, who had managed the strategy since 2005 and left T. Rowe Price.

“Mueller has a good history managing and researching European equities and has a long 11-year tenure with T. Rowe Price,” said Poole.

“He has a clear process that is still being transitioned to the strategy, but is fortunate to be able to draw on a big and capable, analyst, research and manager team.”

Mueller is backed by 20 European specialists plus sector specialists and other internal resources within the asset manager.

He can also draw on the firm’s 150-plus sector and regional specialists and the other international equity portfolio managers as necessary for investment ideas and feedback, according to Morningstar, and also makes use of an internal fund advisory committee, which is made up of more experienced portfolio managers and analysts.

In contrast, the MFS Meridian fund adopts a team-based approach with a group of 12 analysts selecting stocks using their own bottom-up framework.

The London-based team is led by Christopher Jennings and David Shindler, who have been at the firm since 2004 and 2006, respectively.

A weekly investment meeting votes on new positions, with lower conviction positions moving out to make space.

“The investment management process is great for durability of the fund – it helps with culture, teamwork and repeatability in the face of turnover,” noted Poole.

Despite a larger team, around half of the analysts have joined since 2018.

“A single investment manager has the benefit of not managing by committee – they must take the responsibility of making decisions themselves,”

Isaac Poole, Oreana Financial services

“We have seen instances where a group framework can work well. This appears to be the case for MFS in this instance – although considerable turnover remains a risk.”

Morningstar analysts also noted that the existing team has a fairly short joint tenure on the strategy but the company has done a good job in handling the transitions and its strong research framework combined with its global research footprint has helped less experienced analysts in ramping up their expertise quickly.

Conclusion

The two funds are ranked positively by both Morningstar and FE Fundinfo.

Morningstar gives the MFS Merdian fund five stars with an analyst rating of silver and called it “a strong and reliable option” for investors due to its above-average sustainable growth, high-quality returns and sound management.

On the other hand, the T. Rowe Price fund is awarded four stars by Morningstar with an analyst rating of neutral as its fund manager, who took over as the sole manager, is yet to prove his investment process.

“With the departure of long-term manager Dean Tenerelli in 2020, Tobias Mueller took over as sole manager on T. Rowe Price European Equity. While we believe this strategy has good potential, the manager’s process has been in practice for a relatively short time. We therefore exercise caution and continue to watch it develop.”

FE Fundinfo, which bases its assessment on a fund’s three-year history of delivering alpha, minimising relative volatility and producing consistent returns, gives the MFS Merdian fund three crowns and only two crowns to the T. Rowe Price fund.

When comparing both funds, Poole believes both could be a core European holding within a broader portfolio, but also agreed that “there is an onus on T. Rowe to continue to show outcomes are in line with expectations and the process is well established” given the fund manager Mueller is relatively new to the role.

“Impressively, he has stuck to his process and the challenge is now to show that it can deliver through different market cycles.”

“MFS Meridian adopts a research analyst-based approach and while performance has underwhelmed relative to its impressive historical outcomes, it clearly has the capability to withstand those problems.”