In addition to high interest rates and inflation, the latest banking crisis has heaped further pressure on equities markets in 2023.

While many investors prefer to invest in larger companies that demonstrate enough pricing power and solid cash flow, brave investors have their eye on small-cap companies due to cheaper valuations.

“Small-cap companies are always in the eye of the storm, but they also lead recoveries in markets,” said Darius McDermott, managing director of Chelsea Financial Services, speaking to FSA.

For instance, the Russell 2000 index returned 109% from April 2020 to March 2021 as the global economy was recovering after being hit hard by the coronavirus pandemic, while the S&P 500 only gained 64% over the same period of time, according to FE fundinfo data.

In addition, the market consensus is that the US may be able to avoid a significant recession, which makes American companies better positioned for a rebound.

Against this background, FSA asked McDermott to select two US small/mid cap funds for comparison. He chose the T Rowe Price US Smaller Companies Equity fund and the FTGF Royce US Smaller Companies fund.

| Franklin Templeton | T Rowe Price | |

| Size | $76.9m | $2.34bn |

| Inception | 2004 | 2013 |

| Managers | Lauren Romeo | Curt Organt |

| Three-year cumulative return | 22.05% | 16.32% |

| Three-year annualised return | 19.77% | 14.00% |

| Three-year annualised alpha | 2.63 | 0.97 |

| Three-year annualised volatility | 24.61% | 21.49% |

| Three-year information ratio | 0.50 | -0.10 |

| Morningstar star rating | ** | ***** |

| Morningstar analyst rating | Neutral | Gold |

| FE Crown fund rating | *** | *** |

| OCF (retail share class) | 2.03% | 1.06% |

Investment approach

The fund manager for the T Rowe Price US Smaller Companies Equity fund holds a flexible approach and looks for both growth and value opportunities in the small and mid-cap space to build a diverse portfolio of the best ideas from the vast analyst resources at his disposal.

“The T Rowe fund is a ‘best ideas’ strategy that levers off the huge amount of in-house research, as well as that of industry contacts and external brokers, building a portfolio of the strongest ideas from across a range of sectors in the US across the small and mid-cap space,” said McDermott.

“This means that the manager will buy a diverse set of stocks that have both value and growth characteristics, but which are likely to be the winners over the next five plus years.”

Working together with around 40 analysts, the fund has a heavy emphasis on free cash flow generation with sound or improving financial leverage.

During the stock picking process, the fund manager also aims to identify management teams whose goals are aligned with shareholders, have a solid plan for the business and have a track record of delivering in the past.

“These stocks won’t be those that are structurally challenged, but those that are under pressure for cyclical reasons,” said McDermott.

“They will be firms that still have an enduring competitive advantage, but are cheap due to an external factor, such as industry-related reasons.”

“These stocks won’t be those that are structurally challenged, but those that are under pressure for cyclical reasons. They will be firms that still have an enduring competitive advantage, but are cheap due to an external factor, such as industry-related reasons.”

Darius Mcdermott, Chelsea Financial services

The portfolio consists of 150 to 200 stocks and is diversified across different sectors.

Around one-fifth of the portfolio’s assets under management are invested in the industrials and business services sector, followed by 17.2% in information technology and 14.1% in healthcare.

Meanwhile, the investment objective of Franklin Templeton Royce US Smaller Companies Fund has a higher conviction and consists of around 60 stocks currently.

“[The fund manager] looks for companies with high returns on invested capital, but with the ability to compound value by reinvesting current earnings back into businesses at high rates of return for long-periods of time – the target being to buy companies when the stock is out of favour due to cyclical or internal company issues to improve long-term returns,” McDermott said.

“The target is to buy companies when the stock is out of favour due to cyclical or internal company issues to improve long-term returns,”

Darius Mcdermott, Chelsea Financial services

The fund aims to capture long-term growth of capital by identifying companies with sustainable franchises and focuses on those with low debt, the ability to generate excess cash flow and attractive prospects that are selling at prices the team believes are attractive.

It primarily invests in smaller companies in the US with a market cap up to $5bn.

At the same time, the fund avoids investing in companies with too much debt so as to avoid short-term headwinds.

To achieve that, the investment team not only meets with the management team but also with the company’s customers and competitors during its investment process.

The fund has a bias towards high-quality companies with a strong overweight towards the industrials (31.5%) and IT sectors (15.6%).

Its largest holdings include real estate business Kennedy-Wilson Holdings, communications business Ziff Davis and IT firm MSK Instruments, according to the fund factsheet.

Fund characteristics

Sector allocation:

| Franklin Templeton | T Rowe Price | ||

| Industrials | 31.5% | Industrials and Business Services | 21.2% |

| Information Technology | 15.6% | Information Technology | 17.2% |

| Consumer Discretionary | 13.0% | Health Care | 14.1% |

| Health Care | 11.2% | Financials | 11.0% |

| Financials | 10.0% | Materials | 9.8% |

| Industrials | 6.6% | Consumer Discretionary | 9.3% |

| Materials | 5.5% | Real Estate | 6.6% |

| Real Estate | 3.9% | Energy | 4.1% |

| Communication Services | 3.1% | Consumer Staples | 2.9% |

| Consumer Staples | 2.0% | Utilities | 2.3% |

| Cash | 4.2% | Communication Services | 0.2% |

Top 5 holdings:

| Franklin Templeton | weighting | T Rowe Price | weighting |

| Ziff Davis | 3.1% | Teledyne Technologies | 1.8% |

| Kennedy-Wilson Holdings | 3.0% | Arthur J Gallagher | 1.6% |

| MKS Instruments | 2.9% | Ingersoll-Rand | 1.5% |

| White Mountains Insurance | 2.9% | Reliance Steel & Aluminum | 1.5% |

| Bio-Techne | 2.9% | Manhattan Associates | 2.7% |

Performance

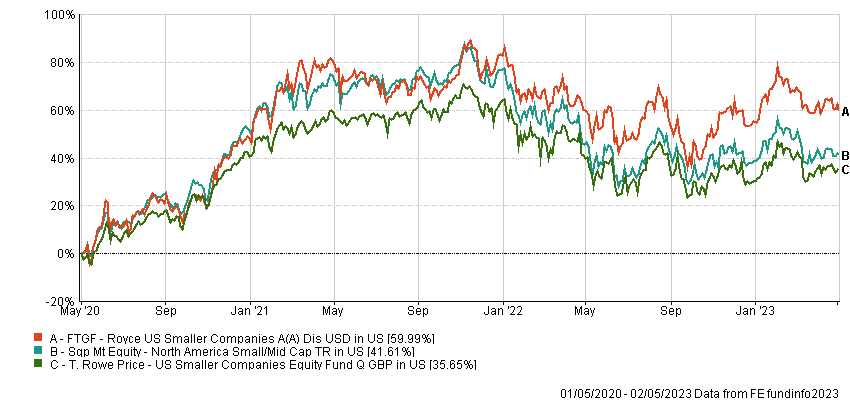

Both funds have posted stellar performances over the last three years despite market volatility and recorded double-digit, three-year cumulative returns.

According to FE fundinfo data, the T Rowe Price fund generated almost 36% in terms of three-year cumulative return, while the Franklin Templeton fund posted a return of almost 60% for the same period.

Meanwhile, the North America small/mid cap sector average was about 42% over the same period of time.

“The Franklin Templeton fund definitely has more of a value-driven approach, although it does have reasonable exposure to growth sectors like technology in the portfolio,” said McDermott.

That is why it did not produce some of the strong returns that its peers saw in 2020 and only returned over 9% that year.

Nevertheless, it did have an exceptionally strong end to 2020 and all of 2021, as the vaccine rally put value firmly back on the table as an investment style.

Although the T Rowe Price fund has generated less return in comparison, it demonstrated a lower volatility regardless of market environment.

“The T Rowe fund is very diverse, it has exposure to mid and small names and is also style agnostic – mitigating any of those concerns,” McDermott noted.

The strongest performance has come in growth markets in both 2019 and 2020, with the fund up 37.9% and 27.9% respectively. By contrast, it struggled last year, falling 21%.

Discrete calendar year performance

| Fund/Sector | YTD* | 2022 | 2021 | 2020 | 2019 | 2018 |

| Franklin Templeton | 3.48% | -15.45% | 23.47% | 9.97% | 27.53% | -13.70 |

| T Rowe Price | 1.40% | -21.85% | 16.95% | 25.09% | 27.62% | -11.41% |

| North America small/mid cap | 4.78% | -21.04% | 16.84% | 28.52% | 38.52% | -6.22% |

Manager review

The T Rowe Price fund is managed by Curt Organt, who has been with the asset manager for almost all of his investment career.

He took over the fund from Ryan Burgess in early 2019 and was an industrials analyst working specifically in the smaller companies team before that.

He has also worked at DAP Products as a financial and marketing analyst.

He has around 40 analysts under his team covering different factors for different types of stocks.

On the other hand, Lauren Romeo manages the Franklin Templeton fund.

She boasts almost three decades’ worth of investment industry experience and joined Royce Investment Partners in 2004.

She has previously worked at Dalton Greiner, Hartman & Maher as a portfolio manager and was an analyst at both Legg Mason Funds Management and T Rowe Price.

“T Rowe Price and Franklin Templeton are two of the largest asset managers in the world – and both are known for their huge depth in terms of analyst support,” McDermott noted.

Conclusion

Based on historical returns, the Franklin Templeton fund was rated two stars by Morningstar, while the T Rowe Price fund was awarded five stars.

T Rowe Price was also evaluated as the better fund in terms of analyst rating by receiving a gold rating, while the Franklin Templeton fund got a neutral rating by Morningstar.

FE Fundinfo, which bases its assessment on a fund’s three-year history of delivering alpha, minimising relative volatility and producing consistent returns, gave both funds a three crown rating.

Echoing the Morningstar ratings, McDermott also sees the T Rowe Price fund as the safer choice.

“A more balanced core portfolio, with value names in addition to the usual growth focus has borne fruit, with considerable performance coming from stock selection,” he said.

Nevertheless, the Franklin Templeton fund has produced strong returns when value is in favour, he noted.

“If you feel value is the place to be in the near future – this fund could be a big string to your investing bow,” he concluded.