The FSA Spy market buzz – 28 March 2025

JP Morgan Asset Management gets enhanced; Thailand wants some leverage; Natxis is surveying the world; A billionaire here, another there; Business social media lunacy; Andrew Carnegie’s wisdom and more.

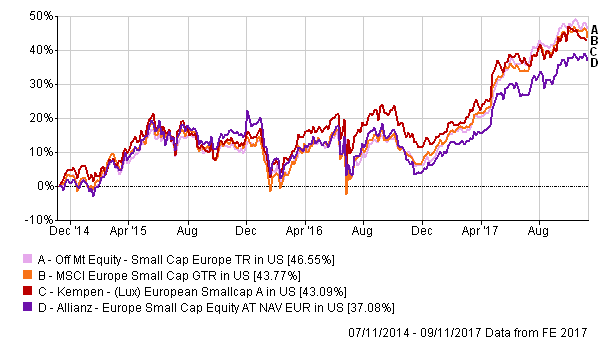

Pictured: Three-year performance of the two funds, the MSCI Europe Small Cap Index and the fund category average.

“The quality approach has been struggling, especially in 2016, when quality has been out of favour” said Van Genderen. At the same time, “small caps have been performing quite well compared to large caps,” he added.

In evaluating the performance of the Kempen fund, one has to take into account the recent incorporation of the ESG criteria and changes in the fund’s management team since 2010.

The Kempen fund performed better than the Allianz fund on a three-year basis. It also had a higher alpha, a lower beta, a higher Sharpe ratio and lower volatility. By all these measures, it did better than the Allianz fund, even though that amounted to outperforming its benchmark MSCI Europe Small Cap Index by only a fraction of a percent.

On a one-year basis, both funds delivered similar returns while underperforming their benchmarks.

“The [Allianz] fund’s short-term performance has deteriorated significantly over the past five full calendar years,” wrote Van Genderen in an April 2017 fund report. “The main reason lies in weak stock selection results.”

Names such as Betsson, a Swedish online gambling company or Bellway, a UK property developer, were among the biggest detractors in the Allianz fund in 2016, according to data from Morningstar.

Van Genderen said the incorporation of the ESG criteria into the Kempen fund investment process has in a sense made it a different product, similar to the firm’s Sustainable European Small Cap Fund, which is managed by the same team.

“[T]he long-term track record is no longer fully relevant given the turnover in the team and the change in process [to include ESG],” wrote Van Genderen.

However, the performance of the sustainable fund can be used for reference.

“The sustainable fund has not been performing very well, also based on a disappointing stock selection,” he said.

| Allianz | Kempen | MSCI Europe Small Cap Index | |

| 3-year return (cumulative) | 38.38% | 45.15% | 45.02% |

| 1-year return | 27.56% | 27.43% | 34.05% |

| 3-year Alpha | -1.91 | 1.37 | |

| 3-year Beta | 1.04 | 0.90 | |

| 3-year Sharpe Ratio | 0.51 | 0.69 | |

| 3-year Volatility | 15.41 | 14.00 | 14.16 |

Data: FE, 31 October 2017, returns in US dollars. Ratios are annualised

Your Questions Answered by Federated Hermes Impact Opportunities

Your Questions Answered by Federated Hermes Impact Opportunities

Accessing India’s tech future

Accessing India’s tech future

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Healthcare’s innovation shifts into high gear

Healthcare’s innovation shifts into high gear

Conditions in the high yield market

Conditions in the high yield market

Impact opportunities: investing to limit biodiversity loss

Impact opportunities: investing to limit biodiversity loss

How ETFs offer an active way to drive sustainable returns

How ETFs offer an active way to drive sustainable returns

Ninety One: Finding opportunities in times of change

Ninety One: Finding opportunities in times of change

Dynamism is the name of the game for this global macro strategy

Dynamism is the name of the game for this global macro strategy

The future of mobility

The future of mobility

JP Morgan Asset Management gets enhanced; Thailand wants some leverage; Natxis is surveying the world; A billionaire here, another there; Business social media lunacy; Andrew Carnegie’s wisdom and more.

Part of the Mark Allen Group.