The FSA Spy market buzz – 30 May 2025

Korean AI-driven investing, The wisdom of Nvidia, Goldman Sachs and active good news, The sheer size of the top ten, Ferris Bueller and Trump’s tariffs, A trillion here - a trillion there, and much more.

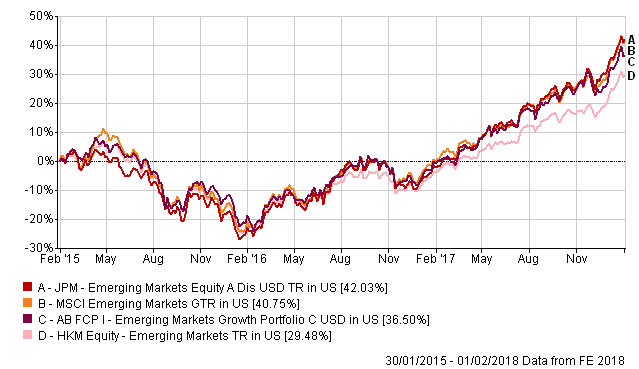

Because of the more aggressive approach, the JP Morgan fund tends to perform better than the AB fund when markets rise, but in a downturn, the AB fund would show a better performance.

In particular, the AB fund outperformed the JP Morgan fund each calendar year from 2012 to 2015, while the funds’ fortunes reversed in 2016 and 2017.

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

| AB |

-56.88 |

72.15 |

13.65 |

-25.01 |

19.14 |

1.48 |

1.49 |

-11.27 |

6.53 |

36.14 |

| JP Morgan |

–52.74 |

70.02 |

17.90 |

-18.99 |

17.34 |

-5.21 |

-1.39 |

-16.31 |

13.57 |

41.82 |

| MSCI EM |

-53.18 |

79.02 |

19.20 |

-18.17 |

18.63 |

-2.27 |

-1.82 |

-14.60 |

11.60 |

37.75 |

The key factor in performance attribution for the JP Morgan fund is the stock selection, according to Ng. In particular, the stock selection in China was the top positive contributor to the fund’s outperformance in 2017.

Over the past three years, the AB fund showed a higher alpha, a lower beta and a lower volatility than the JP Morgan fund.

|

AB |

JP Morgan |

MSCI Emerging Markets |

|

| 3-year return (cumulative) |

36.28% |

42.85% |

40.6% |

| 1-year return |

37.45% |

45.98% |

40.71% |

| 3-year Alpha |

2.0 |

1.96 |

|

| 3-year Beta |

1.03 |

1.14 |

|

| 3-year Sharpe Ratio |

0.52 |

0.54 |

0.55 |

| 3-year Volatility |

15.81 |

17.04 |

16.81 |

How can a sustainable approach also ensure you don’t compromise performance?

How can a sustainable approach also ensure you don’t compromise performance?

Nuveen broadens income sources via private capital and real assets

Nuveen broadens income sources via private capital and real assets

Taking a thematic approach to harness disruption

Taking a thematic approach to harness disruption

From “FAANG” to “MAMAA” to “Magnificent 7” – what’s in a name?

From “FAANG” to “MAMAA” to “Magnificent 7” – what’s in a name?

Who’s afraid of higher interest rates?

Who’s afraid of higher interest rates?

Unmasking the dividend opportunity

Unmasking the dividend opportunity

Tap into Japan’s post-pandemic growth trends

Tap into Japan’s post-pandemic growth trends

How ETFs offer an active way to drive sustainable returns

How ETFs offer an active way to drive sustainable returns

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Your Questions Answered by Federated Hermes Impact Opportunities

Your Questions Answered by Federated Hermes Impact Opportunities

Korean AI-driven investing, The wisdom of Nvidia, Goldman Sachs and active good news, The sheer size of the top ten, Ferris Bueller and Trump’s tariffs, A trillion here - a trillion there, and much more.

Part of the Mark Allen Group.