A standout performer during the pandemic, Chinese technology stocks, which had underpinned the strong returns of many Chinese equity funds, took a tumble throughout August and September as the Chinese government turned its attention to removing spheres of “western” influence in its economy, the global fund data company said.

Chief among these was a “tech crackdown”’, with popular companies such as Tencent and NetEase being affected by regulatory changes, which have largely been seen as an attempt by the government to exercise control over the technology industry and online platforms in particular.

All of this goes to show that for investment managers, factoring in political risks is an extremely complicated business and something beyond their control.

“At FE Investments, we focus on controlling risk and maximising diversification, rather than predicting the markets and have largely tried to avoid Chinese equity funds because of this inherent risk,” Charles Younes, research manager at FE Investments, said in a report.

Invesco fund focus

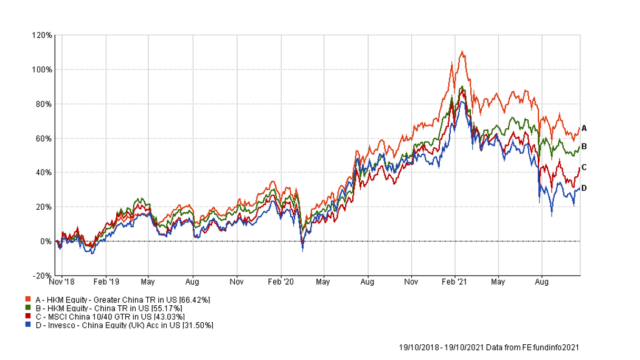

Nonetheless, the Invesco China Equity fund which is on FE fundinfo’s “Approved List” has not gone unscathed.

“We like this fund, as up until now it has been a fairly safe bet. Its mostly defensive strategy has protected investors from much of the downside seen in the Chinese markets over the past two years,” Younes said.

It has done this with clever stock picking, where, until recently technology stocks were considered safe, he said. The Chinese government, keen to promote its own domestic technology firms, such as Alibaba, Weibo and Tencent to compete with the likes of Facebook, Twitter and Amazon, enjoyed relative market freedoms and government support.

“But how quickly things can change. For the most part over the past 18 months, the fund’s own maximum drawdown periods have been significantly less impactful than the wider sector, yet the difference between the first and the second quarter of 2021 is stark,” Younes pointed out.

The maximum drawdown comparison between fund and sector has completely rotated as the fund has borne the brunt of the political changes sweeping through China in the second quarter of the year.

Unfortunately for the fund managers, Lorraine Kuo and Mike Shiao, their stock picking has been in previously “safe” companies that are now right at the heart of the storm. The holdings in Tencent and online retailer Meituan have been significantly impacted by the antitrust regulations.

The latter too has been particularly affected by a further tightening of “Edtech” service providers, having launched a livestreaming service for education businesses towards the end of last year. Education, seen by the government as one of the key sectors of its economy, has been deeply affected.

“Nonetheless, despite the sharp downturn in performance, we have seen nothing that has changed our opinion of the running of the fund and its management,” Younes stressed.

Consistent strategy

The fund managers are not deviating from their underlying strategy, which is to have a preference for private enterprises over state-owned ones. These companies drive them away from financials and energy, giving them a strong bias towards technology, consumer-related sectors and healthcare in the portfolio.

This, of course, is the same strategy which insulated investors from market downturns seen within the sector just a few months ago. Indeed, when investors take a longer-term approach to investing, political risk becomes inherent.

As we move towards the end of 2021, another year which has been impacted by volatility, the only certainty is that markets will fluctuate once again. Already there is talk within Chinese markets that other sectors such as real estate will enter significant periods of slowdown and the Invesco China Equity fund has avoided some of these risky stocks in risky areas, Younes concluded.

Invesco China Equity Fund vs benchmark and sector average