Each month we feature the allocation in one of the three portfolios offered by FE Advisory Asia: Cautious, Balanced and Growth. Data is included to show how well the portfolio has done compared to the previous month and year-to-date so that readers can get a sense of performance.

Additionally, Luke Ng, senior VP of research at FE Advisory Asia, provides a concise analysis on macro events and their impact on the portfolio.

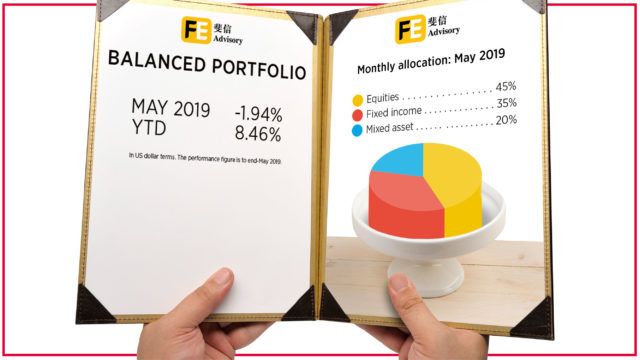

A breakdown of the balanced portfolio at the end of May 2019*. Performance figures are in the menu image above.

Luke Ng, FE Advisory Asia

How did the market perform in May?

May saw an equity market sell-off across the board with no major markets immune, bringing an abrupt halt to the recovery seen year-to-date. This was driven by a depressed outlook for global growth and was exacerbated by a sudden deterioration in US-China trade talks. Whilst the US announced that they would be increasing tariffs on $200bn worth of Chinese goods to 25% from 10%, China retaliated by hiking tariffs on $60bn worth of US imports. China was not the only one to experience Donald Trump’s ire, with the President slapping 5% tariffs on all Mexican imports due to what he perceives as their inaction to curb illegal immigration. In addition, India and Turkey lost their preferential trading status with the US.

Industries that are particularly sensitive to the trade environment such as autos and semiconductors were hit particularly hard, whilst more defensive sectors such as utilities and consumer staples held up better. Unsurprisingly, government bonds, which are seen as a safe haven asset, rallied as money flooded out of equities in response to the heightened uncertainty.

Emerging markets underperformed developed markets for the month due to concerns about trade and supply chain disruption, with Chinese stocks in particular struggling.

How did the Balanced portfolio perform?

The FE balanced portfolio fell 1.88% in May in US dollar terms. Fund selections among our equity sleeve contributed positively, thanks primarily to our holdings investing in Europe and Japan, which significantly outperformed their respective markets throughout the downturn. Our exposure in emerging markets also added value as it fared better than the MSCI Emerging Market Index, which dropped over 7% in the month. Nevertheless, the US equity exposure we held had underperformed in May after a strong run at the beginning of the year. Within the fixed income sleeve, the Fidelity US Dollar Bond Fund benefited amid deteriorating investment sentiment. The fund was the best performing holding in our portfolio in the month.

How did we rebalance the Balanced portfolio?

We have maintained a slight overweight in the risk budget of our portfolio, despite the fact that the underlying equity exposure has been slightly reduced. This resulted from our decision to take profit from some of our equity exposure and top up the Fidelity US Dollar Bond Fund. The halt of the Fed rate hike cycle was also a relief for longer duration high-grade instruments. Thus, we have taken the decision to replace a low duration focused strategy in the portfolio with Pimco GIS Global Bond so that we can wind back up the overall portfolio duration from a short bias positioning.

In addition, we have also replaced our emerging market equity exposure with an alternative strategy investing into the same universe. We believe the latter is able to fare better under the current market condition.

FE Advisory Asia portfolio performance

| Jan 2019 | Feb 2019 | Mar 2019 | Apr 2019 | May 2019 | June 2019 | YTD | |

| Cautious | 3.25% | 1.19% | 1.00% | 1.23% | -1.54 | 5.41% | |

| Balanced | 5.51% | 1.42% | 1.30% | 1.81% | -1.94 | 8.46% | |

| Growth | 7.36% | 2.27% | 1.75% | 2.74% | -3.95 | 10.48% |

Source: FE Advisory Asia. Growth rates in US dollar terms. Data as of 31 May 2019.

Full-year 2018 performance for the FE Advisory portfolios can be viewed here.