Rong Ren Goh, Eastspring Investments

Eastspring Investment has said that its $74.5m Asia Sustainable Bond Fund is now available for sale to Hong Kong retail investors.

“Interest in ESG investment [products] has been growing rapidly in this market, alongside the government’s push to make Hong Kong a regional hub for green finance,” said Joyce Chan, general manager and head of intermediary sales of Eastspring Investments.

The Luxembourg-domiciled fund primarily consists of investment grade and non-rated bonds, with about 40% of the portfolio allocated to bonds that are rated at BBB and A, and another 41% to unrated bonds.

“The Asia Sustainable Bond Strategy invests in a mix of green, social and sustainability bonds and other debt securities issued by Asian governments, quasi-governments, companies or supranationals, which are aligned with ESG principles,” the fund factsheet states.

According to the fund factsheet, it has the most exposure to the real estate investment trust (Reit) sector with 13%, followed by financial institutions (11%) and home construction companies (11%).

Geographically, Singapore constitutes the largest portion in terms of market allocation with 34%, followed by China and India market with 27% and 10% respectively.

“We view that Singapore Reits offer a good combination of relatively strong ESG profile and credit fundamentals given their reasonable gearing ratios and stable accretive fee income,” Chan said.

“In Singapore, there is a strong industry and regulatory drive to build a low carbon, energy-efficient city-state. Singapore Reits actively invest in green building certifications for their properties, and are generally focused on reducing building energy consumption. Operating in a sector where regulatory standards are very high, ESG sector risk is assessed to be relatively low.”

The Asia Sustainable Bond Strategy was incepted in Singapore in December 2019 and was authorised on 27 July by the SFC, according to the regulator’s website. The strategy is co-managed by Rong Ren Goh and Yong Hong Tan of the firm’s fixed income team.

It is guided by a proprietary ESG evaluation framework which focuses on identifying the ESG risks of an issuer and its preparedness to mitigate such risks over time.

“The principle behind this is that issuers well prepared to deal with these risks are better placed to build sustainable businesses in the longer term, and reduces the likelihood of being unable to repay their debts,” said Goh.

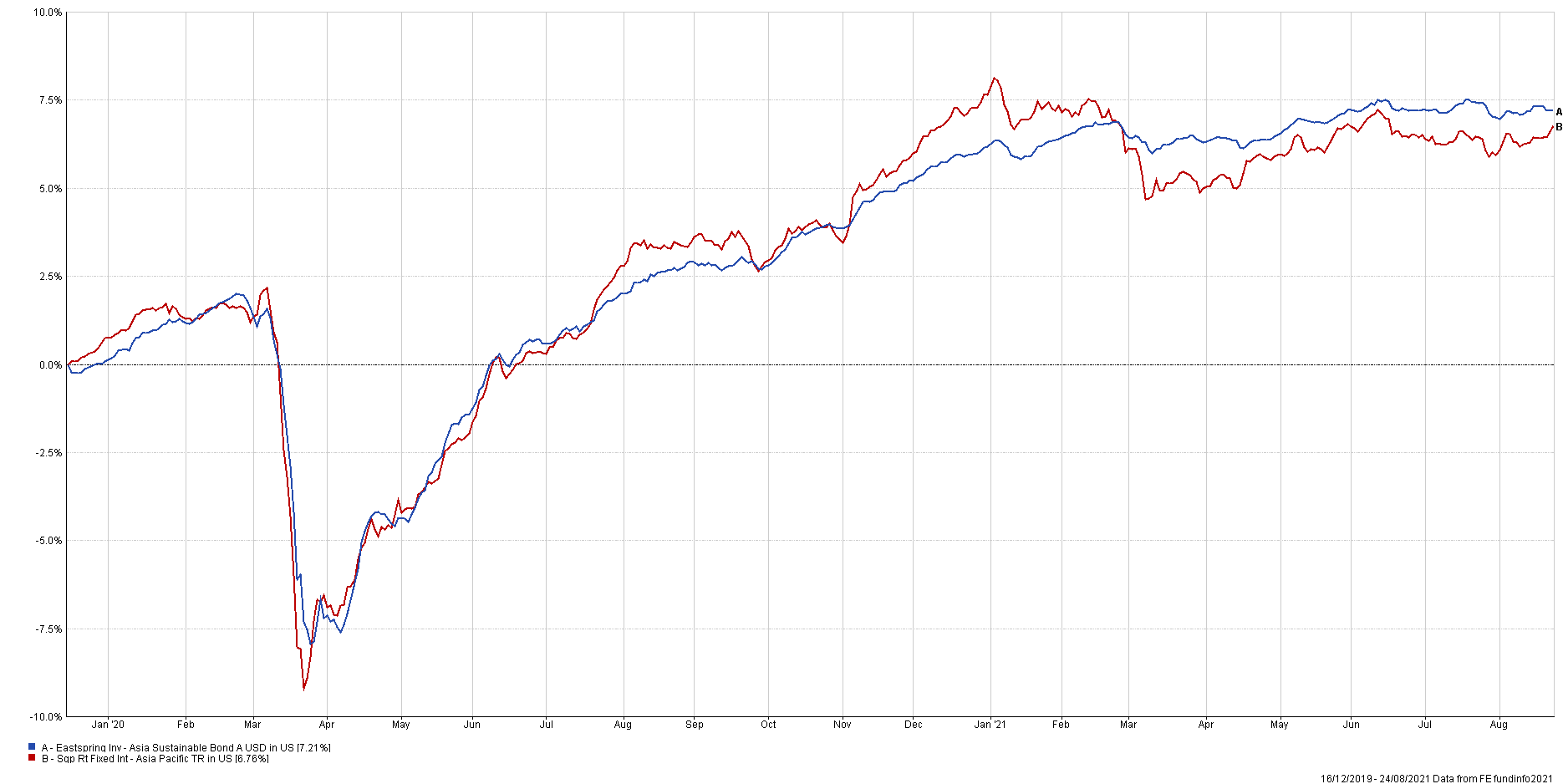

Since its inception in 2019, the fund has posted a 7.21% cumulative return, versus the sector average return of 6.76%, according to FE Fundinfo.

Singapore-based Eastspring Investments is the asset management arm of Prudential plc, and has assets under management of $254bn as of the end of June. Including the Asia Sustainable Bond Fund, Eastspring Investments offers 24 SFC-approved mutual funds in Hong Kong, according to the regulator’s website.

Eastspring Asia Sustainable Bond Fund vs sector average