By Dina Ting, head of global index portfolio management at Franklin Templeton

Amid the technology sector’s summer rebound, we encountered some chatter about a new nickname (Wall Street loves nicknames) that may or may not stick — China’s prominent 10. Like the magnificent seven, the “prom 10” is what Goldman Sachs analysts are calling China’s own power bloc of giant, public-owned enterprises that appear well-positioned to help drive growth and innovation. The corporations span sectors and industries including e-commerce, gaming, media, biotechnology, smartphones and electric vehicles.

What makes the promient 10 notable isn’t just their scale or sector reach — but their relatively modest market share. Together, they represent just 17% of China’s total market capitalisation, versus far higher concentrations in markets such as the US or Germany. The group’s alignment with national policy priorities, including artificial intelligence (AI), consumer technology and global competitiveness, positions them at the forefront of China’s next phase of modernisation.

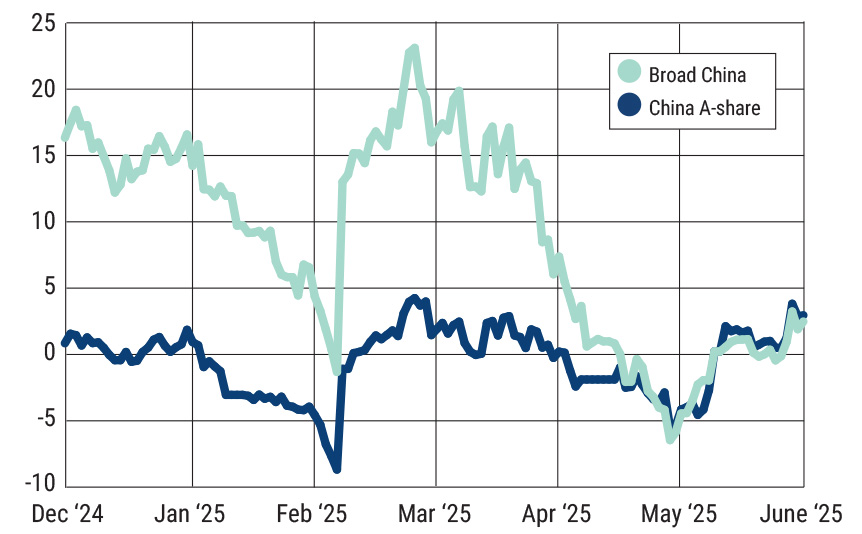

After three straight years of losses (2021–2023), the FTSE China RIC Capped Index is showing signs of a fragile recovery, now up more than 18% in US dollar terms year-to-date through June 26, 2025. This is being led by gains in the communications, financials, tech and healthcare sectors that are prompting investors to shift from China caution to curiosity.

Markets were buoyed recently after the confirmation of a US-China trade framework deal to allow rare-earth exports from China and an easing of US tech restrictions. Of course, a volatile trade environment and US-China tech decoupling may continue to pose challenges for Beijing. Consider, however, that even with World Bank global growth expectations now at 2.3% — a 20-year low outside of major crises — China’s growth forecast remains stable at 4.5%.

Funding talent

A key driver of China’s progress is its deepening investment in talent and education, particularly in AI and other strategic fields. China’s Ministry of Education has launched a broad campaign to integrate AI education across not just its top-tier universities but also vocational institutions and secondary schools, which stands in contrast to the US’s unusually strained relationship now between the federal government and higher education institutions. University AI programmes in the US are reportedly experiencing more restrictive federal funding conditions this year and, in several cases, are facing abruptly frozen or cancelled National Science Foundation funding for researchers.

According to Stanford University’s 2025 AI Index Report, there has also been a noteworthy reduction in the performance gap between the top AI models of the US and China — a mere 0.3%. While the US maintains its lead in quantity, Chinese models have rapidly closed the quality gap: In 2023, China’s top models lagged the US by nearly 20 percentage points in several benchmark tests. Just one year later, this gap has narrowed substantially.

The progress, analysts say, stems from a coordinated national strategy, accelerated investment in AI education and deep integration between state-backed firms and research institutions that are enabling faster commercialisation of AI across sectors. In one quirky example, a leading mobile payments and lifestyle app in China has deployed a tool that can help users detect hair loss!

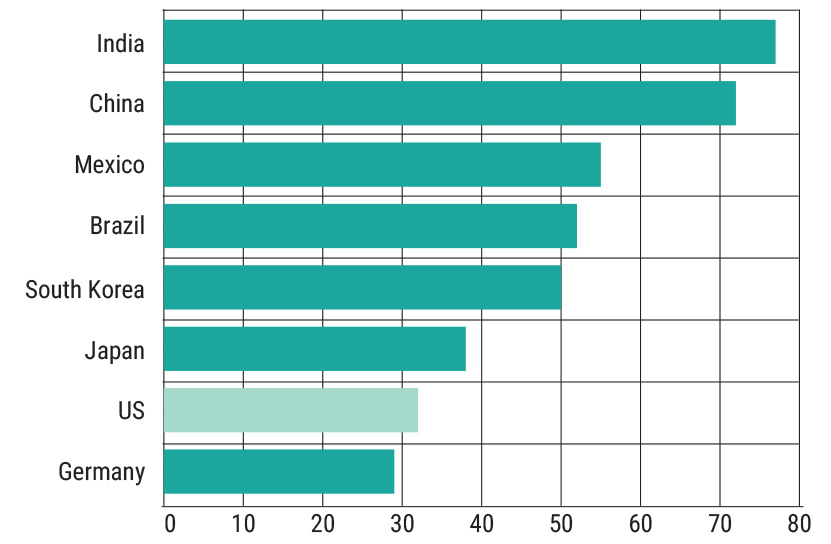

China’s capital expenditure on AI is set to reach upwards of nearly $99bn this year, reflecting a surge of 48% over 2024. More than half of this funding is expected to come from government sources. Meanwhile, public sentiment is notably more AI-positive in China. Edelman’s 2025 Trust Barometer found that 72% of Chinese respondents say they trust AI, compared to only 32% in the US — a confidence gap that underscores differences in regulatory environments, infrastructure and cultural adoption.

Percentage of adults who say they trust AI technology

Market valuations

Beyond the AI realm, we believe Chinese equity valuations are still reasonable. China’s market (as measured by the MSCI China Index) currently trades at 12.5x forward earnings — below its 10-year average (13.9x) and at a steep discount: 53% to India (as measured by the MSCI India Index), 31% to Taiwan (as measured by the MSCI Taiwan Index) and 18% to the broader emerging market index (as measured by the MSCI Emerging Markets Index).

This relative undervaluation, paired with an uptick in initial public offering (IPO) activity and tech leadership, makes a strong case for re-engaging with broad China exposures. Hong Kong’s capital markets, long subdued by regulatory uncertainty and sentiment shocks, have also staged a comeback. This indicates to us a resurgence of private sector confidence and a revival in investor demand.

We believe broad China exposures, including both A-Shares and offshore-listed securities, provide a comprehensive opportunity to participate. Given Beijing’s recent progress in US trade negotiations, China’s equity market may finally be transitioning to a more compelling value opportunity, in our analysis.

Diversified exposures have outperformed A-shares yields (YTD)

Volatility is still part of the equation, but for investors with a long-term view and appetite for near-term swings, we believe current entry points may offer potential upside. After years on the sidelines, diversification through Chinese equities may again earn its place in global portfolios.

This article first appeared in our sister publication, Portfolio Adviser.