A buoyant domestic economy should support US equities, while incremental yield can be earned with Asia high yield bonds and selective carry currencies.

A buoyant domestic economy should support US equities, while incremental yield can be earned with Asia high yield bonds and selective carry currencies.

The expected July interest rate cut in the US is unlikely, according to Boston-based Ken Taubes, chief investment officer for Amundi.

Portfolio manager Eric Moffett prefers stable companies to high growth businesses in Asia.

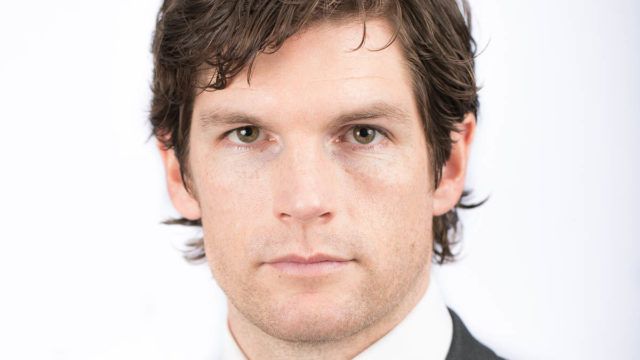

The risk that Morgan Stanley IM has been repositioning for is the trade dispute, said Andrew Harmstone, head of the global risk control team, who explains the firm’s approach to risk control.

The US-based fund manager is wary about moving down the credit curve to gain incremental yield and expects declining interest rates to sustain fund performance.

Australian bonds offer investors relatively high yields from defensive credits, according to Aberdeen Standard.

In Xingtai Capital’s highly concentrated China fund, the top ten account for 60% of the portfolio, which holds only 20-30 positions.

James Tomlins, manager of the firm’s Global High Yield ESG Bond Fund, uses three steps when applying ESG to high yield.

Any definition should be principles-based, permitting the investor flexibility to decide if the green bond is actually green, according to Mitch Reznick, Hermes IM.

The 2.5 year fixed-term bond fund aims for a 3.5%-4% yield and will be marketed to retail investors in Hong Kong and Singapore.

Part of the Mark Allen Group.