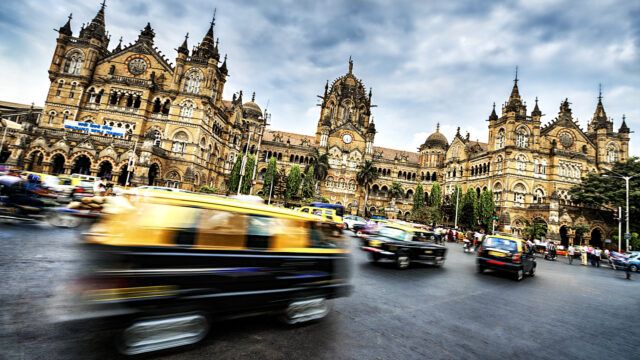

PGIM’s Matt Shafer explains how the firm is gaining market share having begun its push into intermediaries in Asia in 2021.

PGIM’s Matt Shafer explains how the firm is gaining market share having begun its push into intermediaries in Asia in 2021.

China holds the keys to fight its deflationary forces, rebalance its economy and create more sustainable growth domestically, according to Fidelity International’s George Efstathopoulos.

Eastspring conceded that recent earnings trends were concerning, but are positive about the world’s most populous country.

AI is the tech theme of the decade, according to the UBS Global Wealth Management Chief Investment Office.

J.P. Morgan strategists expect gold prices to move towards $3000 per ounce in 2025.

The core transformation is towards a forward-looking, value-driven approach.

Long duration bonds are not much better than they were three years ago before the 2022 bond bear market, warns Muzinich’s Tajtana.

Active managers should not be blaming the ‘Magnificent 7’ for underperforming, Clode says.

Most analysts do not expect AI to have an impact on company profitability this year despite increased spending.

There will be more rate cuts outside of the US which should support financial assets, according to the firm’s Asia CIO.

Part of the Mark Allen Group.