Eurozone and Japanese equities will likely outperform their peers next year, said the Swiss wealth manager.

Eurozone and Japanese equities will likely outperform their peers next year, said the Swiss wealth manager.

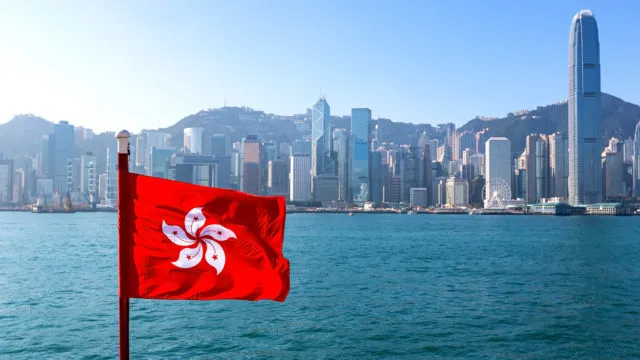

Wealth management firm Lioner International Group opened its Hong Kong office, with a focus on Greater China market.

Rising inflation in the post-pandemic world means that beta alone can’t deliver the returns investors want, according to JP Morgan Asset Management .

Asian equities will bounce back as countries in the region reopen, said the asset manager.

Investors should gain exposure as both China equities and fixed income are undervalued, said Blackrock.

An EY survey finds the alternative funds industry has deftly navigated pandemic-related disruption and is now gaining new momentum.

Even during a period of volatility, equites are still the best asset class, according to Fidelity International.

Asia’s “top-down” economies also help make “policy changes more effective”, said the asset manager.

The energy sector will remain robust in the short-term, fuelled by global demand, according to fixed income experts.

Family Office Association Hong Kong (FOAHK) hopes to attract more overseas family offices to the territory in 2022.

Part of the Mark Allen Group.