The new fund is the asset manager’s first fixed income ETF.

The new fund is the asset manager’s first fixed income ETF.

The US asset manager sees the recent sell-off as a good opportunity to generate income by adding back some credit and interest rate exposure in more resilient parts of the yield curve.

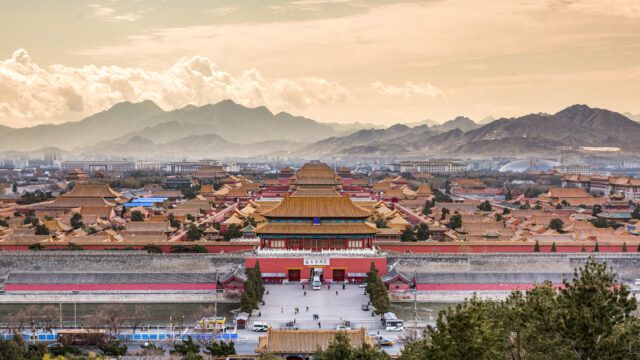

The search for diversification should lead global investors to boost their allocation to China bonds, according to State Street Global Advisors (SSGA).

High yield debt seems to be better placed to navigate a recession than in the past, according to T Rowe Price.

Credit investors have waited many years for today’s more attractive yield levels. But slowing growth and recessionary fears may lead to them missing new opportunities, says AllianceBernstein (AB).

The strategic case for China government bonds has been reinforced despite tough market conditions, according to Fidelity International.

The current economic environment is constructive towards both equities and fixed income, believes JP Morgan Asset Management (JPMAM).

Investors like Pimco which believe central banks will ultimately get control of inflation in the coming years are starting to get paid more.

The real sustainability of green bond issuance in the property sector needs to be assessed carefully, according to BNY Mellon Investment Management (BNY Mellon IM).

The sell-off in bonds in 2022 has created a compelling case to pick up certain assets at attractive prices, with wider spreads potentially cushioning further rate rises, according to M&G Investments.

Part of the Mark Allen Group.