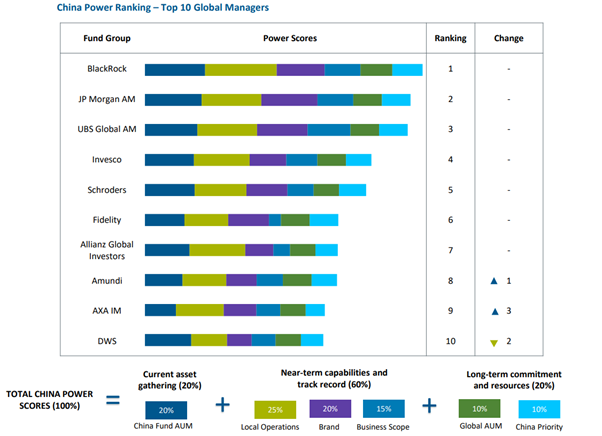

Broadridge Financial Solutions has announced its half-yearly China “power ranking”, with BlackRock continuing to top the list.

Despite declines in assets under management due to market underperformance, global asset managers overall saw an improvement in their scores due to their strong footprints in China.

For the third time in a row, BlackRock ranked first thanks to growth across both its wholly-owned fund management company (FMC) and majority-controlled wealth management subsidiary (WMS).

JP Morgan Asset Management and UBS Global Asset Management also maintained their rankings of second and third respectively despite lower overall scores attributed to large declines in their inbound and outbound China AUM.

Yoon Ng, principal of distribution insight at Broadridge, noted that asset managers received higher scores compared with previous studies in general, but that the drivers were different.

“Unlike in 2021, where scores were mainly boosted by asset growth, in 2022, we saw higher scores in ‘local operational strength’ and ‘brand perception’ among the top 10 asset managers,” said Ng.

The Broadridge China Power Ranking takes into account six key criteria. They are fund AUM, the extent of business scope, local operational strength, brand perception, global investment strength and assigning China as a strategic priority.

Scores across the six criteria are weighted and tallied to determine the foreign manager that is best positioned in the market.

Seeking entry points

As the options for entering the onshore China market continue to expand, the study found that all top 10 global managers are pursuing or at least seriously considering setting up either FMCs or WMSs, or in some cases both.

BlackRock is currently the only global manager that has established both a wholly owned FMC and a majority-controlled WMS.

Although, Schroders, Amundi, Allianz Global Investors and UBS are all reportedly seeking to set up fully owned FMCs, while DWS is looking to set up a WMS joint venture with Postal Savings Bank of China.

“It is surprising to us because the general perception is that WMSs have lower profit margins than FMCs,” said Ng.

“During the first half of 2022, the majority of WMSs saw large increases in both revenue and profit and they garnered higher net income and better profitability than many FMCs, thanks mainly to their much lower operating and distribution costs due to comparatively smaller headcounts.”

Yet, Ng expects FMCs to generate better profit when bull market conditions return with more blockbuster fund launches.

In addition to providing better control over product development and distribution, Broadridge noted that foreign asset managers are also setting up more entities due to regulatory concerns.

“It is good to have options in China because regulations may tighten in one product segment versus another. We have seen this happen many times when it comes to the Chinese banking sector,” Ng added.

Broadridge Financial Solutions is a global fintech firm that provides trading and communications infrastructure to banks, broker-dealers and asset and wealth managers among others.

![Despite headwinds, ESG continues to perform iStock-1186178292_1920x1080[38]](https://s34456.pcdn.co/wp-content/uploads/2021/08/iStock-1186178292_1920x108038-156x111.png)