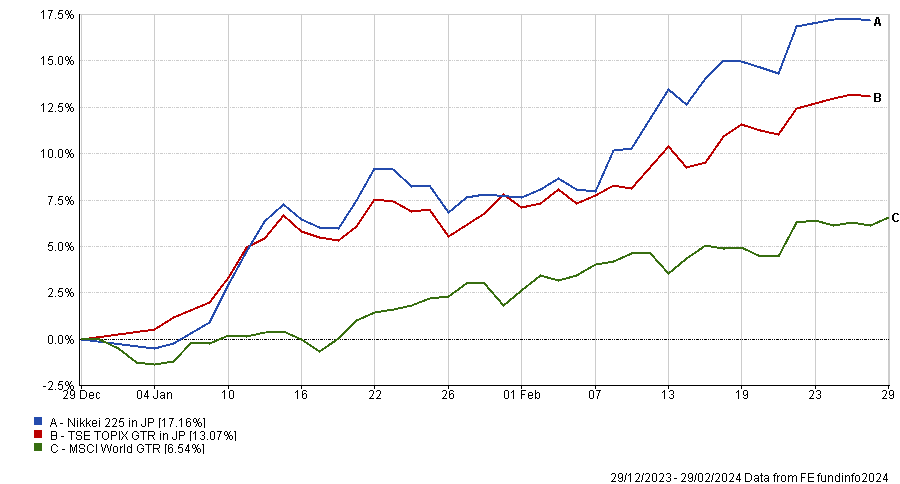

After the Nikkei 225 index breached all-time highs, some investment veterans might be hesitant to jump in after several false starts over the past three decades.

But strong momentum on corporate governance reforms, a possible end to deflation and potentially more inflows on the horizon all bode well for the Japanese equity market, according to asset managers.

The BlackRock Investment Institute for example, believes that rally in Japanese stocks still “has room to run”.

“We stay overweight Japanese stocks and think they can best their all-time highs,” its strategists said in a recent note.

They expect the return of mild inflation and company-level developments to drive the next leg of the rally.

“The corporate earnings growth we expected since 2023 is playing out,” they said. “Yet we don’t see markets fully pricing in positive signs like corporate reforms.”

However, the investment giant warned that March will be a “pivotal” month for the Japanese markets because the annual union wage negotiations take place at the same time as the BoJ’s next policy meeting.

Will the BoJ derail the rally?

Some investors are worried that the BoJ will tighten monetary policy too much and risk reverting to a deflationary spiral which plagued its economy for more than three decades.

But BlackRock’s strategists don’t see the BoJ disrupting the optimistic outlook as they believe it will likely stay cautious on policy in order to prevent a return to deflation.

Jeremy Osborne, head of Japan equity investment directing at Fidelity, also believes that the chances of Japan returning to deflation are low.

He said: “There are risks around inflation and the impact of rising interest rates on market valuations, but we expect any increase in rates will be gradual.”

This is why Fidelity thinks Japanese equities “offer compelling value” to investors who are underexposed to the market.

Osborne said: “Although we have seen renewed buying since March 2023, global active funds remain net underweight in Japan, albeit less so than they were during the Covid-19 period.”

Japanese households are also underweight equities relative to investors in the US and Europe, he added.

“Domestic stocks account for only 11% of their financial assets, but this is likely to rise as households shift from cash deposits to inflationary assets such as stocks, driven by inflation and the expansion of the Nippon Individual Savings Account,” he said.

The “significant structural underweights” in investor portfolios suggests there is ample room for inflows into Japan, he argued.

“If the corporate sector, guided by more shareholder-friendly policymaking, can continue to build on its success in recent years in boosting returns, then we expect inflows will persist,” he said.

Reasons for caution

However, there are still reasons to be cautious on Japan, argues Sophia Li, portfolio manager at FSSA Investment Managers.

She flagged the fact that much of the recent inflow into Japan has been driven by fund flow shifting from China to Japan ETFs, where China investors have been buying the Nikkei 225 ETF at close to a 10% premium.

“Global investors are trying to find a place to reallocate assets from China to Japan and other markets,” she said.

“Foreigner money is ‘tourist’ and may flow back to China as long as there is any sentiment improvement.”

Another potential risk Li flagged is the abnormal weighting of the Japanese indices towards large-cap cyclical companies with high foreign exchange rate sensitivity.

She said: “If the global economy enters a recession in 2024 and if the US interest rate comes down faster than expected, index-heavy companies such as trading companies/banks/auto OEMs will deliver disappointing earnings, exacerbated by JPY appreciation.”

Li believes that the large-cap universe is “too crowded” and prefers the “hidden gems” in Japan which have top global market share in niche industries that are “unknown to global investors” and still trading at attractive valuations.

Is it another bubble?

Some investors may be wondering whether this is the start of another bubble as was the case in the late 1980s.

But Emily Badger, portfolio manager at Man Group, believes the contrast between valuations during the late 80s bubble era and today “couldn’t be any more stark”.

“In 1989, the market boom led to Japan accounting for 37% of global stocks by market cap,” she said. “The Nikkei 225, was trading at 60 times its earnings over the trailing 12 months and it had an above 8 times price to book ratio.”

But despite recent new highs in the index, she said the Nikkei 225 trades at around 16 times its price to earnings ratio, twice its price to book ratio and over a third of the companies in the index are priced below their book value.

However, she did highlight the fact that the Nikkei 225 has the larger capitalisation names and that investors should look at the Topix index for a more reflective representation of wider corporate Japan.

“A Topix record would signal that a robust broad-based recovery is well and truly underway,” she said. “And that may finally confine Japan’s lost eras to the history books.”